Countries around the world have created tax systems that individuals, companies, and investors must adhere to. This taxation system is intended to generate revenue for the government of each country.

Taxes typically imposed in most countries include:

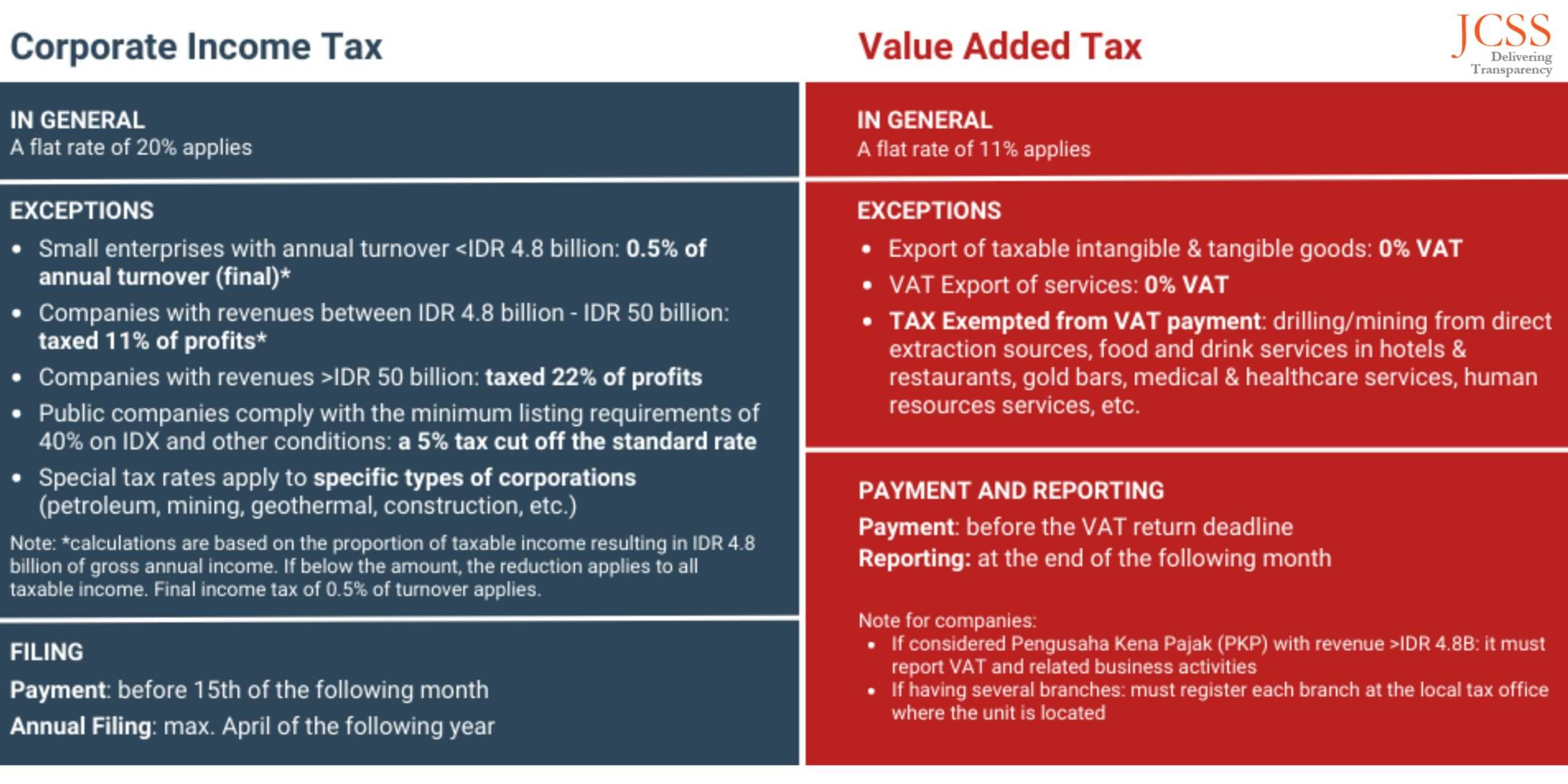

Indonesia’s tax system contains a wide variety of taxes imposed on individuals, goods, and companies. One such tax is Value Added Tax (VAT).

Value Added Tax (VAT) is a consumption tax imposed at every stage of production of both goods and services up to the sale of the final product. The usual VAT rate in Indonesia is 10% and is imposed on most goods and services in Indonesia.

NOTE: It is planned that VAT in Indonesia will be increased to 11% in April 2022 and to 12% in 2025.

Business owners in Indonesia should be fully aware of the VAT system as it affects their business activities across the country. There are 3 components to VAT:

VAT collection is based on the accrual principle which states that VAT must be collected at the time of delivery of taxable goods and services. Freight refers to the transfer of ownership and risk of goods and occurs when service delivery revenue can be reliably measured.

Revenue or receivables are recognized at the time of the transaction even though payment has not been received. The recognition of income or receivables is recognized by the issuance of a commercial invoice, which becomes the source document of this recognition and the basis for its recording.

VAT application in Indonesia must be completed every month. Payment must be made and filing must be made on or before the last day of the month following taxable submission.

According to the Directorate General of Taxes, the basis for imposing taxes may include the following:

VAT refunds can also be claimed in Indonesia. The decision on VAT restitution is entirely the responsibility of the Directorate General of Taxes. The decision is usually dependent on a VAT audit conducted within 12 months of receipt of the refund request.

The application can also be approved if no decision is made by the DGT. After application, the company is then required to submit supporting documents within one month to the Directorate General of Taxes.

NOTE: The company has the right to file a return application at the end of the year in comparison with other taxpayers.

The introduction of Value Added Tax in Indonesia has brought many benefits to the country. Some of the advantages are:

Taxes are one of the main contributors to government revenues and VAT is one of the main contributors to Indonesia’s economic growth. The revenues generated through VAT over the years have been channeled to the growth of various sectors of the economy such as agriculture, manufacturing, health, and technology, among others.

Indonesia’s large population leads to high levels of consumption which in turn contributes to a stable income base due to VAT levied on products.

VAT has also greatly reduced barriers to both imports and exports of goods and services. This in turn has fueled international trade in Indonesia and led to the creation of stronger incentives for businesses to control costs.

VAT also greatly reduces barriers to import and export of goods and services. This in turn has fueled international trade in Indonesia and led to the creation of stronger incentives for businesses to control costs.

Some goods are not affected by Value Added Tax in Indonesia. One of these items is:

Gold Bullion Ore Securities – copper, silver, tin, gold &; iron

Geothermal energy Crude oil Natural gas

Gravel Sand Rice

Soybean Corn Salt

Coal Sago F&B served at the hotel &; restaurant.

-> Gold bullion Ore Securities – copper, silver, tin, gold &; iron

-> Geothermal energy Crude oil Natural gas

-> Gravel Sand Rice

-> Soybean Corn Salt

-> Coal Sago F&B served at hotel & restaurant

One of the services that is not affected by Value Added Tax is:

x Education

x Medical &; Health

x Public transportation

x Letter

x Arts & Entertainment

x Insurance

x Workforce

x Broadcast (not advertising)

x Food & Catering

x Public phones

VAT rates in Indonesia are explained in detail as follows:

– 10% for most cases

– 5% or 15% depending on government

regulations – 0% for exports of intangible and tangible

taxable goods – 0% for exports of services

VAT is calculated by applying your VAT rate on the tax base in Jakarta or other cities in Indonesia. The interested parties agree on the basis for imposing taxes on the value of transactions.

Several events must also be used as the basis for imposing taxes, which are as follows:

– Market value of transactions between parties

– Cost of goods sold – Tax for domestic purposes or as a gift

– Auction price of delivery of Taxable Goods– Agreed

delivery price of Taxable

Goods– Imported films worth Rp 12 million

each– 20% of the total cost of land

– Retail selling price of imported or shipping

tobacco products– Package delivery service (10% of actual bill)

– Tour agency and tourism services Delivery without commission (10% of actual bill)– Gold jewelry delivery (20% of selling price)– Freight forwarding (10% of actual bill)

– Products and Services Not Subject to VAT in Indonesia– Here are Non-VAT Taxable Goods in Jakarta and throughout Indonesia

:

Drilling or mining from direct extraction of the source. Examples are natural gas, crude oil, coal, geothermal energy, gravel and sand, iron ore, copper ore, gold ore, tin ore, silver ore, etc.

Food and beverage service in hotels and restaurants, both dine-in and takeaway

Gold bullion, securities, and cash

Staples such as salt, rice, salt, soybeans, corn, and sago

Non-taxable services under VAT in Indonesia are as follows:

– Medical and health

services– Mail services– Social services such as funerals

– Religious

services– Insurance

services– Arts and entertainment

services– Education

services– Public transport services, hotel

services– Labor

services– Food and catering services– Public

telephone services

– Broadcasting services that are not relevant to advertising

Companies that are considered Taxable Entrepreneurs, or PKP, must report VAT and related business activities every month.

Companies that have several branches must register each with the Tax Service Office or KPP. VAT obligations are settled by input-output mechanisms (input tax and output tax).

VAT refunds are valid in Jakarta and other cities in Indonesia. The company can apply for a refund at the end of the financial year. The Directorate General of Taxes (DGT) decides on VAT restitution. This is primarily contingent on a VAT audit within 12 months of receiving a refund request.

An application is considered approved also if no decision is taken. The company must then submit supporting documents to DGT within one month.

At JCSS Indonesia we believe in providing the most professional and efficient tax services to our customers, including VAT reporting and refund in Jakarta and throughout Indonesia.

Our experts with in-depth knowledge of tax law in Indonesia will assist you in dealing with all taxation-related situations.

To find out more about how JCSS Indonesia can help your company navigate the complex taxation system in Indonesia, contact us