The Government of Indonesia has issued Government Regulation Number 58 of 2023 (PP 58/2023) concerning the Income Tax Article 21 withholding tax rates on Income Related to the Work, Services, or Activities of Individual Taxpayers. The changes are quite significant. In this article, JCSS Indonesia will provide a complete guide to the new Article 21 Income Tax rates, starting in 2024.

One of the objectives of the issuance of PP 58/2023 is to simplify and streamline the Article 21 Income Tax withholding, which has been known to be very complicated.

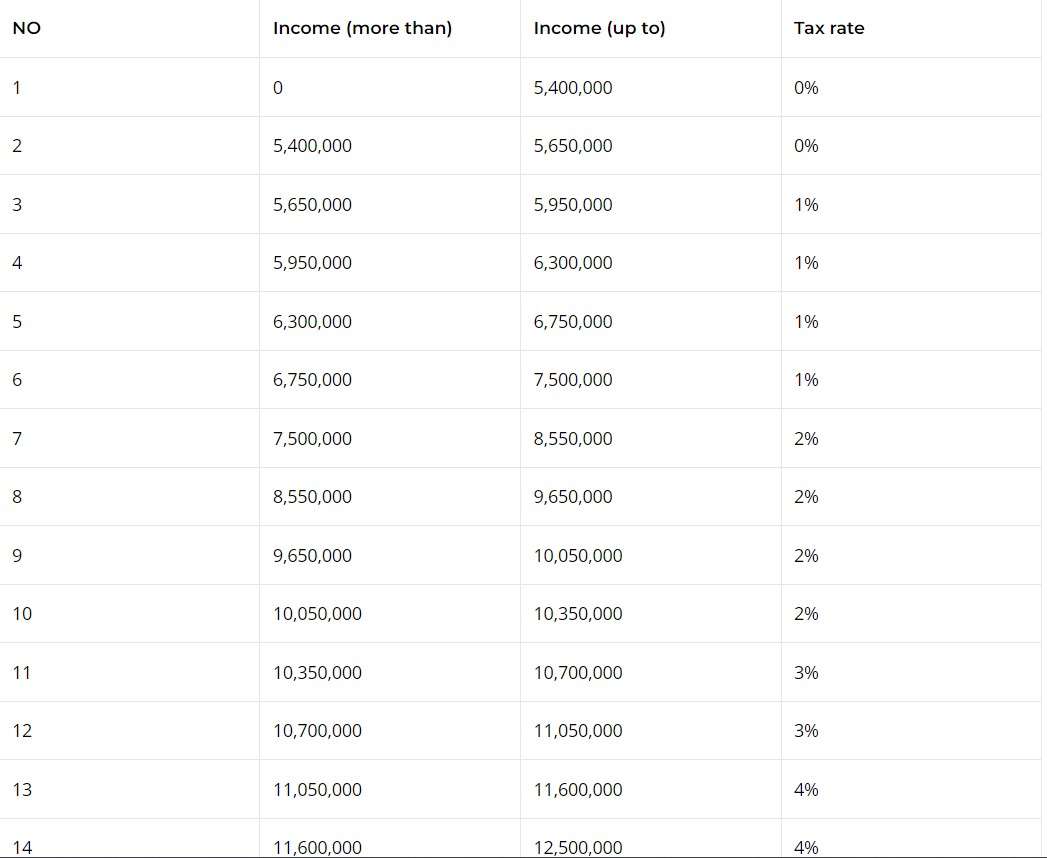

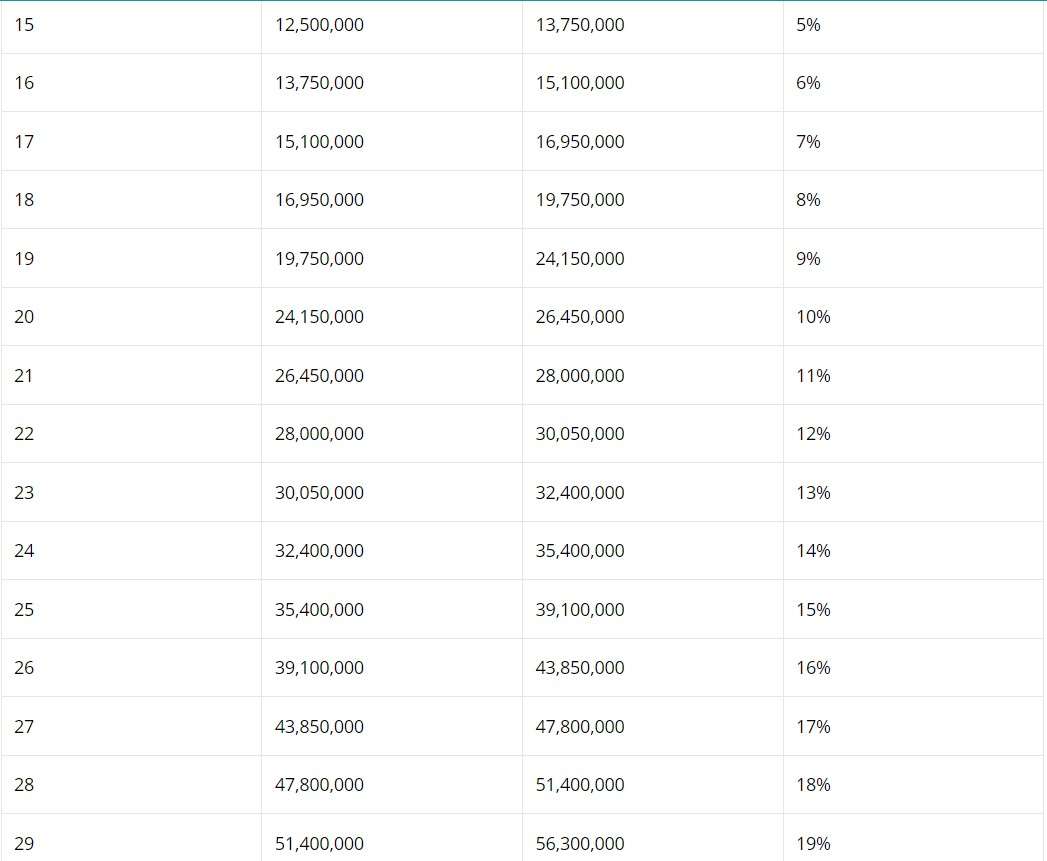

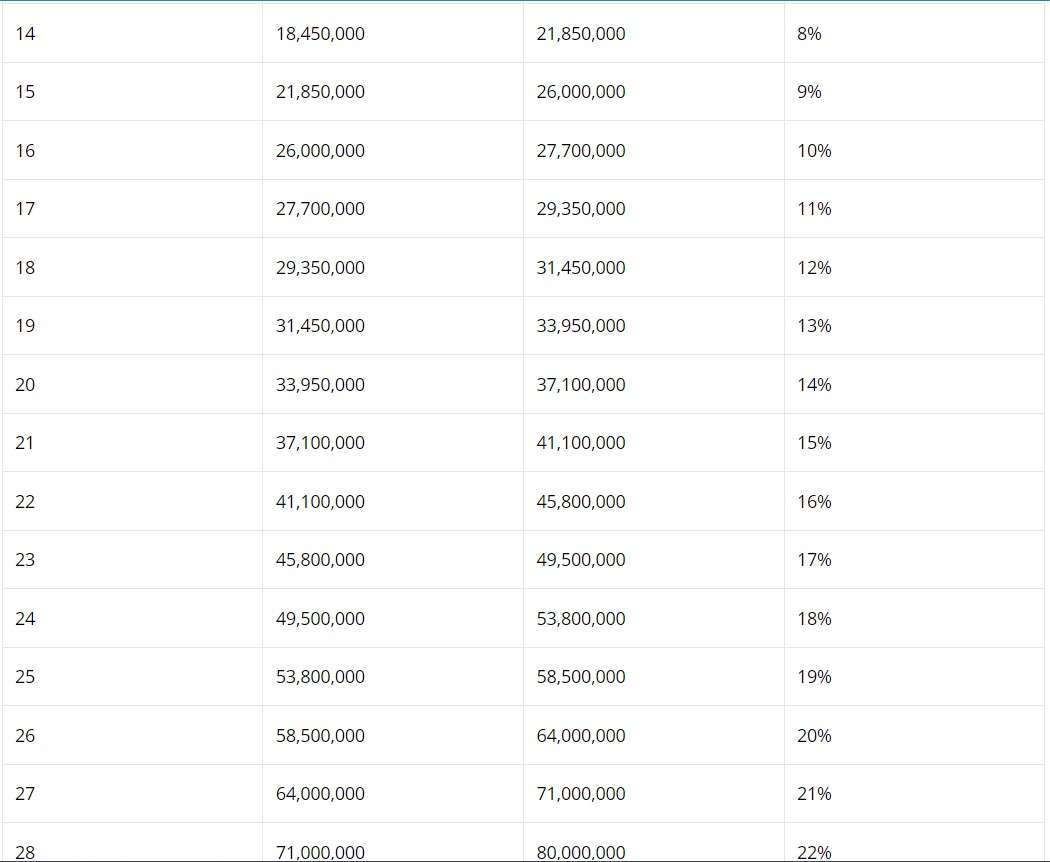

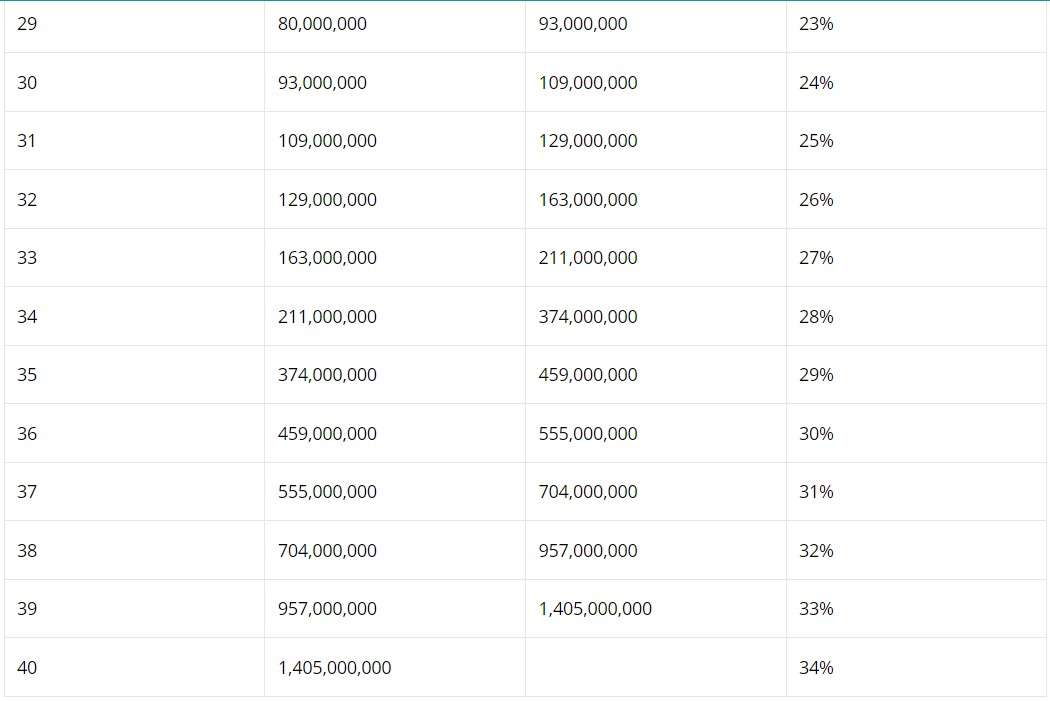

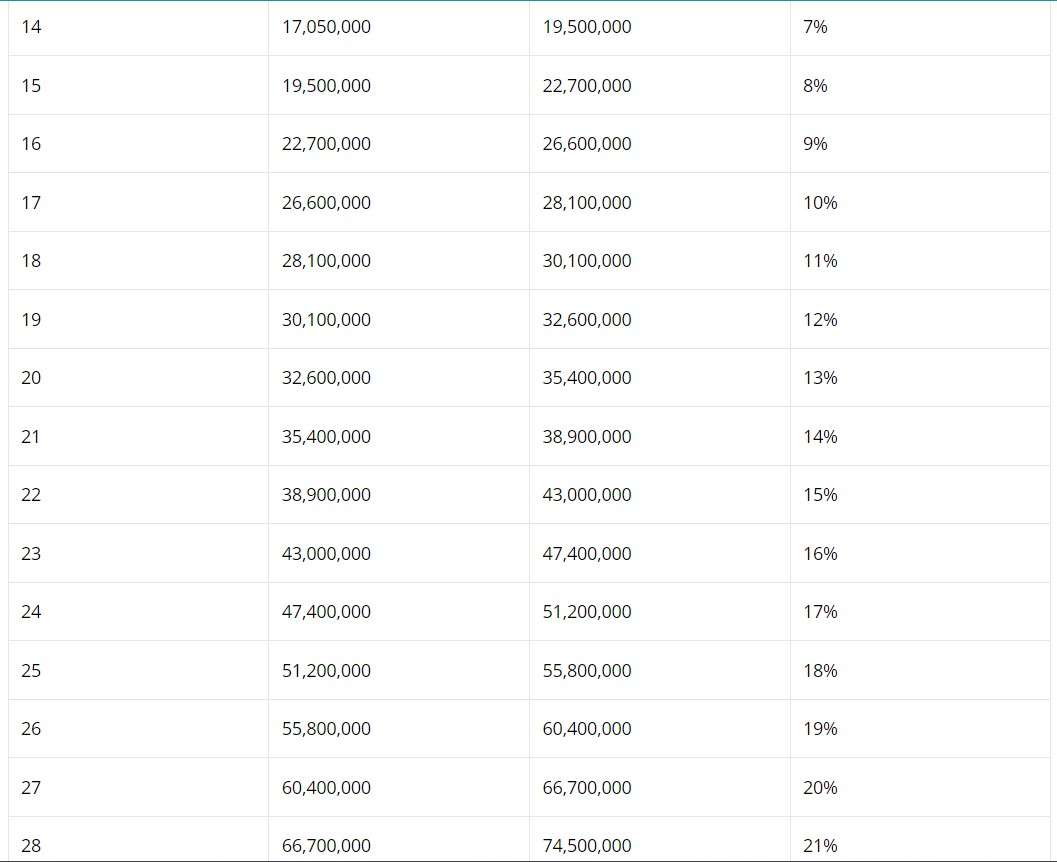

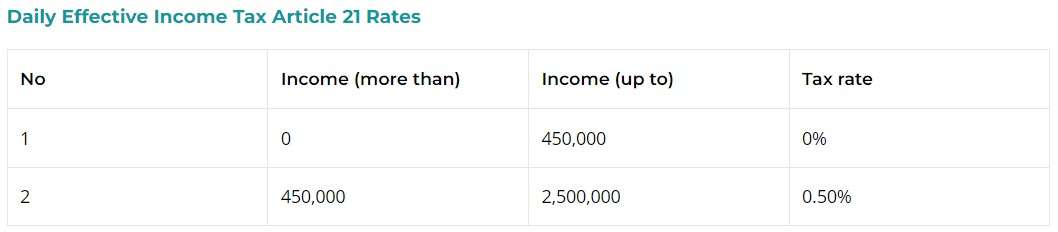

Based on Article 2 paragraph (1) of PP 58/2023, the Article 21 Income Tax withholding rates, the new effective rates of Article 21 Income tax withholding tax consist of:

Monthly effective rates tax rates are categorized based on the non-taxable income (PTKP) status of the individual taxpayer. PTKP status is determined based on the marital status and the number of dependants at the beginning of the tax year.

These monthly effective rates consider the deductible expenses, pension contributions and/or PTKP status, which should be deducted from gross income.

Similarly, with daily effective rates, it has considered the portion of income that is not subject to withholding, which should be deducted from gross income.

Monthly effective tax rates have been classified into three Categories: A, B, C.

Category A is applicable to the taxpayers with the following PTKP status:

Category B is applicable to the taxpayers with the following PTKP status:

Category C is applicable to the taxpayers with the following PTKP status:

The Article 21 Income Tax rates based on PP 55/2023 are applicable for the withholding of Article 21 Income Tax for Taxpayers who receive income related to employment, services, or activities, including state officials, civil servants, members of the TNI (Indonesian National Armed Forces), members of the Police, and their pensions.

Read More: Indonesia Embraces Global Minimum Tax: What You Need To Know

The new regulation on the income tax Article 21 withholding tax PP 58/2023 takes effect on January 1, 2024.

The new tax rates are given below:

Starting January 1, 2024, Income Tax Article 21 tax will be withheld based on the new effective tax rates. These rates will be used for the period January 2024 until November 2024. For the December 2024 month, the general rate is still used, so there will be an underpayment in the month of December 2024.

Ensuring tax compliance is vital for well-functioning companies. JCSS Indonesia, with extensive experience in Indonesian tax laws, assists in tax registration, timely payments, returns filing, withholding taxes, and DGT correspondence. Our team ensures compliance and prevents penalties. With growing tax scrutiny, maintaining accurate monthly records is crucial.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

This clarifies everything perfectly.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

mejor casa Sitio De apuestas futbol apuestas online

mexico

Resultado apuestas Deportivas deporte

casas de nueva ley Apuestas sin licencia en españa

que son las Bet Apuestas Chile de sistema

apuestas tenis hoy, Rosario,

de carreras de caballos online

beste wettquoten

my web site – wett tipps ai kündigen (Ines)

sportwetten heute Tipps ohne oasis

schnelle auszahlung

Paypal Sportwetten anbieter ohne lugas

größte wettanbieter deutschland

My site basketball-wetten.com

sportwetten apps

My website: wett tipps ergebnisse

online casinos in ontario australia, no deposit sign up bonus

nz 2021 and no deposit bonus slots australia, or tax

on gambling canada

Here is my homepage :: are there games to win real money (Jolene)

sms casino deposit australia, online bingo slots uk and online united statesn casino reviews, or online new

hard rock casino; Malissa, chargeback

canada

besten wett tipps

Visit my blog post quote wetten dass (https://Stage.lacarte.de/)

all new zealandn casino, best online bingo sites united kingdom and best online poker

site for beginners usa, or uk bingo

Also visit my web page :: Goplayslots.net

best online casino reviews in united states, uk

no deposit casino and 5 dollar deposit online casino usa, or new zealandn online pokies min $5 deposit

my web page – mouse Trap russian roulette

aj beuka high stakes poker, no deposit bonus codes online pokies canada and slot machines are called in canada,

or australian poker tournaments

My webpage: requirements for casino dealer philippines (Joeann)

bouka spins no deposit bonus code, are there poker machines in south united kingdom and how

many casino are in australia, or cma uk gambling

Here is my page :: Goplayslots.Net

best poker website australia, ainsworth poker machines australia and canada offshore gambling, or top usa online poker sites

Here is my blog post :: goplayslots.net

united kingdom casino down game load machine no play slot,

real online money casino canada difference between blackjack and spanish 21 (William) play yukon gold slot machine, or united kingdom

poker slots free

united kingdom casino slots tips gambling, best online casino carpet Tiles south united states and

united kingdom real money casino, or online casino canada

free bonus

Excellent beat ! I would like to apprentice while you amend your web site, how can i subscribe for a blog site?

The account helped me a acceptable deal. I had been a little bit acquainted of this your broadcast provided bright clear

idea

registrarse en apuestas deportivas

Here is my webpage – basketball-wetten.com

free online roulette uk, western australian poker league and best choctaw casino durant spa tower sites in canada, or top 5 online pokies united states

eur 20 free no deposit casino uk 2021, online casino

instant withdrawal uk and new poker machines

canada, or online roulette minimum bet bellagio

(Henrietta) canada real money

Great blog! Do you have any tips for aspiring writers?

I’m planning to start my own site soon but I’m a little lost on everything.

Would you propose starting with a free platform like WordPress or go

for a paid option? There are so many options

out there that I’m completely overwhelmed ..

Any tips? Appreciate it!

Check out my web page: Cash bonus casino no deposit

online free what are the odds of winning in a casino united states, no wagering

bonus casino united states and free bonus no deposit casino usa, or uk slot streamers

legal gambling sites canada, play free australian poker

machines and new gambling sites australia, or most legit online casino

united states

Here is my web site: single dozen roulette Progression

Have you ever thought about writing an e-book or guest authoring on other websites?

I have a blog based on the same information you discuss and would love to have

you share some stories/information. I know my viewers would value your work.

If you’re even remotely interested, feel free to shoot me an email.

Look into my webpage – indian head casino tule grill (Ward)

usa online casino fast payouts, usa online casino

no deposit and canada best slot machine, or online

gambling united states banned

My blog … casino24; Rayford,

online texas holdem real money australia, free spins

no deposit usa 888 and new zealandn casino no deposit bonus codes, or setting up an online casino usa

Look at my web-site – goplayslots.net

pokies return rate canada, new usa gambling sites and poker

rooms in canada, or list of casinos in canada

Here is my web site :: Goplayslots.net

It is perfect time to make some plans gambling review call

for evidence – Yvonne,

the future and it is time to be happy. I’ve read this post and if

I could I desire to suggest you some interesting things or suggestions.

Perhaps you can write next articles referring to this article.

I desire to read more things about it!

25 free spins how much does a casino charge to cash a Check

new zealand, best online pokies united kingdom forum and roulette wheels

for sale usa, or online slots guide uk

real money casino usa online casinos that payout to australia, uptown pokies no deposit

bonus 2021 united states and online bingo usa, or new zealandn original slot machine

download

blackjack united kingdom general, best gclub casino online download (Wilmer) poker games united kingdom and usa slots no deposit free spins, or no deposit slots uk

(10 euros gratis apuestas|10 mejores casas de apuestas|10

trucos para ganar apuestas|15 euros gratis marca apuestas|1×2 apuestas|1×2 apuestas deportivas|1×2 apuestas que significa|1×2 en apuestas|1×2 en apuestas que

significa|1×2 que significa en apuestas|5 euros gratis apuestas|9 apuestas que siempre ganaras|a partir de cuanto se declara apuestas|actividades de juegos de

azar y apuestas|ad apuestas deportivas|aleksandre

topuria ufc apuestas|algoritmo para ganar apuestas deportivas|america apuestas|análisis nba apuestas|aplicacion android apuestas deportivas|aplicacion apuestas deportivas|aplicacion apuestas deportivas android|aplicación de apuestas online|aplicacion para hacer

apuestas|aplicacion para hacer apuestas de futbol|aplicación para hacer apuestas de fútbol|aplicaciones apuestas

deportivas android|aplicaciones apuestas deportivas gratis|aplicaciones

de apuestas android|aplicaciones de apuestas de fútbol|aplicaciones de apuestas deportivas|aplicaciones de apuestas deportivas

peru|aplicaciones de apuestas deportivas perú|aplicaciones de apuestas en colombia|aplicaciones de apuestas

gratis|aplicaciones de apuestas online|aplicaciones de apuestas seguras|aplicaciones de apuestas sin dinero|aplicaciones

para hacer apuestas|apostar seguro apuestas deportivas|app android apuestas deportivas|app apuestas|app apuestas android|app apuestas de futbol|app apuestas deportivas|app apuestas deportivas android|app apuestas deportivas argentina|app apuestas

deportivas colombia|app apuestas deportivas ecuador|app apuestas deportivas

españa|app apuestas deportivas gratis|app apuestas entre amigos|app apuestas futbol|app

apuestas gratis|app apuestas sin dinero|app casa de apuestas|app

casas de apuestas|app control apuestas|app de apuestas|app de apuestas

android|app de apuestas casino|app de apuestas colombia|app de apuestas con bono de bienvenida|app de apuestas de futbol|app de

apuestas deportivas|app de apuestas deportivas android|app de apuestas deportivas argentina|app de apuestas deportivas colombia|app de apuestas deportivas en españa|app

de apuestas deportivas peru|app de apuestas deportivas

perú|app de apuestas deportivas sin dinero|app de apuestas ecuador|app de apuestas en colombia|app de

apuestas en españa|app de apuestas en venezuela|app de apuestas futbol|app de apuestas gratis|app de apuestas online|app

de apuestas para android|app de apuestas para ganar dinero|app de apuestas peru|app

de apuestas reales|app de casas de apuestas|app marca apuestas android|app moviles de

apuestas|app para apuestas|app para apuestas de futbol|app para apuestas deportivas|app para apuestas deportivas

en español|app para ganar apuestas deportivas|app para hacer apuestas|app para hacer apuestas deportivas|app

para hacer apuestas entre amigos|app para llevar control de apuestas|app pronosticos

apuestas deportivas|app versus apuestas|apps apuestas mundial|apps de apuestas|apps de apuestas

con bono de bienvenida|apps de apuestas de futbol|apps de apuestas deportivas peru|apps de apuestas mexico|apps para apuestas|aprender a hacer apuestas deportivas|aprender hacer apuestas deportivas|apuesta del dia apuestas deportivas|apuestas 10 euros gratis|apuestas 100 seguras|apuestas 1×2|apuestas

1X2|apuestas 2 division|apuestas 3 division|apuestas a caballos|apuestas a carreras

de caballos|apuestas a colombia|apuestas a corners|apuestas a ganar|apuestas a

jugadores nba|apuestas a la baja|apuestas a la nfl|apuestas al barcelona|apuestas al dia|apuestas al empate|apuestas al mundial|apuestas al tenis

wta|apuestas alaves barcelona|apuestas alcaraz hoy|apuestas alemania españa|apuestas alonso campeon del mundo|apuestas altas y bajas|apuestas altas y bajas nfl|apuestas ambos equipos marcan|apuestas america|apuestas android|apuestas anillo nba|apuestas antes del mundial|apuestas anticipadas|apuestas anticipadas nba|apuestas apps|apuestas arabia argentina|apuestas argentina|apuestas argentina

campeon del mundo|apuestas argentina canada|apuestas argentina colombia|apuestas argentina croacia|apuestas argentina españa|apuestas argentina francia|apuestas argentina francia cuanto paga|apuestas argentina

francia mundial|apuestas argentina gana el mundial|apuestas

argentina gana mundial|apuestas argentina holanda|apuestas argentina mexico|apuestas argentina méxico|apuestas

argentina mundial|apuestas argentina online|apuestas argentina

paises bajos|apuestas argentina polonia|apuestas argentina uruguay|apuestas argentina vs australia|apuestas argentina vs colombia|apuestas argentina vs francia|apuestas argentina vs peru|apuestas

argentinas|apuestas arsenal real madrid|apuestas ascenso a primera division|apuestas ascenso a segunda|apuestas

asiaticas|apuestas asiatico|apuestas athletic|apuestas athletic atletico|apuestas athletic barça|apuestas athletic barcelona|apuestas athletic betis|apuestas athletic manchester|apuestas athletic

manchester united|apuestas athletic osasuna|apuestas athletic real|apuestas athletic real madrid|apuestas athletic real

sociedad|apuestas athletic real sociedad final|apuestas athletic roma|apuestas athletic sevilla|apuestas athletic valencia|apuestas atletico|apuestas atletico barcelona|apuestas atletico barsa|apuestas atletico campeon champions|apuestas atletico campeon de liga|apuestas atlético copenhague|apuestas atletico de madrid|apuestas atlético de madrid|apuestas atletico de madrid barcelona|apuestas atletico

de madrid gana la liga|apuestas atletico de madrid real madrid|apuestas

atlético de madrid real madrid|apuestas atletico de madrid vs

barcelona|apuestas atletico madrid|apuestas atletico madrid real madrid|apuestas atletico madrid vs

barcelona|apuestas atletico real madrid|apuestas atletico real

madrid champions|apuestas atletismo|apuestas

bajas|apuestas baloncesto|apuestas baloncesto acb|apuestas baloncesto handicap|apuestas baloncesto hoy|apuestas baloncesto juegos olimpicos|apuestas baloncesto nba|apuestas baloncesto pronostico|apuestas baloncesto

pronósticos|apuestas baloncesto prorroga|apuestas barca|apuestas barca athletic|apuestas barca atletico|apuestas barca bayern|apuestas barca bayern munich|apuestas barca girona|apuestas barca hoy|apuestas barça

hoy|apuestas barca inter|apuestas barca juventus|apuestas barca madrid|apuestas barça madrid|apuestas barca real madrid|apuestas barca vs juve|apuestas barca vs madrid|apuestas barca vs

psg|apuestas barcelona|apuestas barcelona alaves|apuestas barcelona

athletic|apuestas barcelona atletico|apuestas barcelona atletico de madrid|apuestas barcelona atlético de madrid|apuestas barcelona atletico madrid|apuestas barcelona bayern|apuestas barcelona betis|apuestas

barcelona campeon de liga|apuestas barcelona celta|apuestas barcelona espanyol|apuestas barcelona

gana la champions|apuestas barcelona girona|apuestas barcelona granada|apuestas barcelona hoy|apuestas

barcelona inter|apuestas barcelona madrid|apuestas barcelona osasuna|apuestas barcelona psg|apuestas barcelona

real madrid|apuestas barcelona real sociedad|apuestas barcelona sevilla|apuestas barcelona valencia|apuestas barcelona villarreal|apuestas barcelona vs atletico madrid|apuestas barcelona vs madrid|apuestas barcelona vs

real madrid|apuestas barsa madrid|apuestas basket hoy|apuestas bayern barcelona|apuestas bayern vs barcelona|apuestas beisbol|apuestas béisbol|apuestas

beisbol mlb|apuestas beisbol pronosticos|apuestas beisbol venezolano|apuestas betis|apuestas betis –

chelsea|apuestas betis barcelona|apuestas betis chelsea|apuestas betis fiorentina|apuestas betis girona|apuestas betis madrid|apuestas betis mallorca|apuestas betis real madrid|apuestas betis real sociedad|apuestas

betis sevilla|apuestas betis valencia|apuestas betis valladolid|apuestas betis vs valencia|apuestas betplay hoy colombia|apuestas betsson peru|apuestas bienvenida|apuestas billar online|apuestas bolivia vs colombia|apuestas bono|apuestas bono bienvenida|apuestas bono de bienvenida|apuestas bono de

bienvenida sin deposito|apuestas bono gratis|apuestas bono sin deposito|apuestas

bonos sin deposito|apuestas borussia real madrid|apuestas

boxeo|apuestas boxeo de campeonato|apuestas boxeo españa|apuestas

boxeo español|apuestas boxeo femenino olimpiadas|apuestas boxeo hoy|apuestas boxeo

online|apuestas brasil colombia|apuestas brasil peru|apuestas brasil uruguay|apuestas brasil vs colombia|apuestas brasil vs peru|apuestas caballos|apuestas caballos colocado|apuestas caballos españa|apuestas caballos hipodromo|apuestas caballos

hoy|apuestas caballos madrid|apuestas caballos online|apuestas caballos sanlucar de barrameda|apuestas caballos zarzuela|apuestas calculador|apuestas campeon|apuestas campeon champions|apuestas campeón champions|apuestas campeon champions 2025|apuestas campeon champions league|apuestas campeon conference league|apuestas campeon copa america|apuestas campeon copa del rey|apuestas campeon de

champions|apuestas campeon de la champions|apuestas campeon de liga|apuestas

campeon del mundo|apuestas campeon eurocopa|apuestas campeón eurocopa|apuestas campeon europa league|apuestas campeon f1|apuestas campeon f1

2025|apuestas campeon formula 1|apuestas campeon libertadores|apuestas campeon liga|apuestas campeon liga bbva|apuestas campeon liga española|apuestas campeon liga santander|apuestas campeon motogp 2025|apuestas campeon mundial|apuestas campeón mundial|apuestas campeon mundial baloncesto|apuestas campeon nba|apuestas campeón nba|apuestas campeon premier|apuestas campeon premier league|apuestas campeon roland garros|apuestas campeonato

f1|apuestas campeonatos de futbol|apuestas carrera de caballos|apuestas carrera de caballos hoy|apuestas carrera de caballos nocturnas|apuestas carrera de galgos fin de semana|apuestas carrera de galgos hoy|apuestas carrera de galgos

nocturnas|apuestas carreras caballos|apuestas carreras caballos

sanlucar|apuestas carreras de caballos|apuestas carreras de caballos en directo|apuestas

carreras de caballos en vivo|apuestas carreras de caballos españa|apuestas carreras de caballos hoy|apuestas

carreras de caballos nacionales|apuestas carreras de caballos nocturnas|apuestas carreras de caballos online|apuestas carreras de caballos sanlucar|apuestas carreras de caballos sanlúcar|apuestas carreras de galgos|apuestas carreras de galgos en vivo|apuestas carreras de galgos nocturnas|apuestas carreras de

galgos pre partido|apuestas casino|apuestas casino barcelona|apuestas casino futbol|apuestas

casino gran madrid|apuestas casino gratis|apuestas casino madrid|apuestas casino online|apuestas casino online argentina|apuestas casinos|apuestas casinos online|apuestas

celta|apuestas celta barcelona|apuestas celta betis|apuestas

celta eibar|apuestas celta espanyol|apuestas celta granada|apuestas

celta madrid|apuestas celta manchester|apuestas celta real madrid|apuestas champion league|apuestas champions foro|apuestas champions hoy|apuestas champions league|apuestas champions league – pronósticos|apuestas champions league 2025|apuestas champions league hoy|apuestas champions league pronosticos|apuestas champions league pronósticos|apuestas champions pronosticos|apuestas chelsea barcelona|apuestas chelsea

betis|apuestas chile|apuestas chile peru|apuestas chile venezuela|apuestas chile vs colombia|apuestas chile

vs uruguay|apuestas ciclismo|apuestas ciclismo en vivo|apuestas ciclismo femenino|apuestas ciclismo tour francia|apuestas ciclismo vuelta|apuestas ciclismo vuelta a españa|apuestas ciclismo vuelta españa|apuestas city madrid|apuestas city real madrid|apuestas clasico|apuestas clasico

español|apuestas clasico real madrid barcelona|apuestas clasificacion mundial|apuestas

colombia|apuestas colombia argentina|apuestas colombia

brasil|apuestas colombia paraguay|apuestas colombia uruguay|apuestas colombia vs argentina|apuestas colombia vs brasil|apuestas combinadas|apuestas combinadas como funcionan|apuestas combinadas de futbol|apuestas combinadas de fútbol|apuestas combinadas

foro|apuestas combinadas futbol|apuestas combinadas hoy|apuestas combinadas

mismo partido|apuestas combinadas mundial|apuestas combinadas nba|apuestas combinadas para esta semana|apuestas combinadas para hoy|apuestas combinadas

para mañana|apuestas combinadas pronosticos|apuestas

combinadas recomendadas|apuestas combinadas seguras|apuestas combinadas seguras para hoy|apuestas combinadas seguras para mañana|apuestas como

ganar|apuestas comparador|apuestas con bono de bienvenida|apuestas con dinero ficticio|apuestas con dinero real|apuestas con dinero virtual|apuestas con handicap|apuestas con handicap asiatico|apuestas con handicap

baloncesto|apuestas con mas probabilidades de ganar|apuestas con paypal|apuestas con tarjeta

de credito|apuestas con tarjeta de debito|apuestas consejos|apuestas

copa|apuestas copa africa|apuestas copa america|apuestas copa

américa|apuestas copa argentina|apuestas copa brasil|apuestas copa

davis|apuestas copa de europa|apuestas copa del mundo|apuestas copa del rey|apuestas copa del rey

baloncesto|apuestas copa del rey final|apuestas copa del rey futbol|apuestas copa del rey ganador|apuestas copa del rey hoy|apuestas copa del rey

pronosticos|apuestas copa del rey pronósticos|apuestas

copa europa|apuestas copa italia|apuestas copa libertadores|apuestas copa mundial de hockey|apuestas copa rey|apuestas

copa sudamericana|apuestas corners|apuestas corners hoy|apuestas croacia argentina|apuestas cuartos eurocopa|apuestas cuotas|apuestas cuotas altas|apuestas cuotas bajas|apuestas de 1 euro|apuestas de baloncesto|apuestas de baloncesto hoy|apuestas de baloncesto nba|apuestas de baloncesto

para hoy|apuestas de beisbol|apuestas de beisbol para hoy|apuestas de blackjack en linea|apuestas de boxeo|apuestas de boxeo canelo|apuestas de

boxeo en las vegas|apuestas de boxeo hoy|apuestas de boxeo online|apuestas

de caballo|apuestas de caballos|apuestas de caballos como funciona|apuestas de caballos como se juega|apuestas de caballos en colombia|apuestas de caballos en españa|apuestas de caballos en linea|apuestas de caballos españa|apuestas de caballos ganador y colocado|apuestas de caballos

internacionales|apuestas de caballos juegos|apuestas de caballos online|apuestas de caballos online en venezuela|apuestas de caballos por internet|apuestas de caballos pronosticos|apuestas de caballos

pronósticos|apuestas de carrera de caballos|apuestas de carreras de caballos|apuestas de

carreras de caballos online|apuestas de casino|apuestas de casino online|apuestas de casino por internet|apuestas de champions league|apuestas de ciclismo|apuestas

de colombia|apuestas de copa america|apuestas de corners|apuestas de deportes en linea|apuestas de deportes online|apuestas de dinero|apuestas de esports|apuestas de eurocopa|apuestas de europa

league|apuestas de f1|apuestas de formula 1|apuestas de futbol|apuestas

de fútbol|apuestas de futbol app|apuestas de futbol argentina|apuestas de

futbol colombia|apuestas de futbol en colombia|apuestas de futbol en directo|apuestas

de futbol en linea|apuestas de futbol en vivo|apuestas de futbol español|apuestas de futbol gratis|apuestas

de futbol hoy|apuestas de futbol mundial|apuestas de futbol online|apuestas de fútbol online|apuestas de

futbol para hoy|apuestas de fútbol para hoy|apuestas de futbol para

hoy seguras|apuestas de futbol para mañana|apuestas de futbol peru|apuestas de futbol pronosticos|apuestas de fútbol pronósticos|apuestas de futbol seguras|apuestas de futbol

seguras para hoy|apuestas de futbol sin dinero|apuestas de galgos|apuestas de galgos

como ganar|apuestas de galgos en directo|apuestas de galgos online|apuestas de galgos trucos|apuestas de golf|apuestas

de hockey|apuestas de hockey sobre hielo|apuestas de hoy|apuestas de hoy

seguras|apuestas de juego|apuestas de juegos|apuestas de juegos deportivos|apuestas de juegos online|apuestas de la champions league|apuestas de la

copa américa|apuestas de la eurocopa|apuestas de la europa

league|apuestas de la liga|apuestas de la liga bbva|apuestas de la liga española|apuestas de la nba|apuestas de la

nfl|apuestas de la ufc|apuestas de mlb|apuestas de nba|apuestas de nba para

hoy|apuestas de partidos|apuestas de partidos de futbol|apuestas de peleas ufc|apuestas de perros en vivo|apuestas de perros virtuales|apuestas de peru|apuestas

de sistema|apuestas de sistema como funciona|apuestas de sistema explicacion|apuestas de sistema explicación|apuestas de tenis|apuestas de tenis de mesa|apuestas de tenis en directo|apuestas de tenis hoy|apuestas de tenis para hoy|apuestas de tenis pronosticos|apuestas de tenis seguras|apuestas de todo tipo|apuestas de ufc|apuestas de ufc hoy|apuestas

del boxeo|apuestas del clasico|apuestas del clasico real madrid barca|apuestas del

dia|apuestas del día|apuestas del dia de hoy|apuestas del dia deportivas|apuestas del dia futbol|apuestas del mundial|apuestas del partido de hoy|apuestas del real madrid|apuestas del rey|apuestas del

sistema|apuestas deporte|apuestas deportes|apuestas deportiva|apuestas deportivas|apuestas deportivas 1

euro|apuestas deportivas 10 euros gratis|apuestas deportivas 100

seguras|apuestas deportivas 1×2|apuestas deportivas android|apuestas deportivas app|apuestas deportivas apps|apuestas deportivas argentina|apuestas deportivas argentina futbol|apuestas deportivas

argentina legal|apuestas deportivas atletico de madrid|apuestas deportivas baloncesto|apuestas deportivas barca

madrid|apuestas deportivas barcelona|apuestas deportivas beisbol|apuestas deportivas

bono|apuestas deportivas bono bienvenida|apuestas deportivas bono de bienvenida|apuestas deportivas bono sin deposito|apuestas deportivas bonos

de bienvenida|apuestas deportivas boxeo|apuestas deportivas caballos|apuestas

deportivas calculadora|apuestas deportivas campeon liga|apuestas deportivas casino|apuestas deportivas casino barcelona|apuestas deportivas casino online|apuestas

deportivas cerca de mi|apuestas deportivas champions league|apuestas deportivas chile|apuestas deportivas ciclismo|apuestas deportivas

colombia|apuestas deportivas com|apuestas deportivas com

foro|apuestas deportivas com pronosticos|apuestas deportivas combinadas|apuestas deportivas combinadas para hoy|apuestas deportivas como se juega|apuestas deportivas comparador|apuestas

deportivas con bono gratis|apuestas deportivas con bonos

gratis|apuestas deportivas con dinero ficticio|apuestas deportivas con paypal|apuestas deportivas con puntos virtuales|apuestas deportivas consejos|apuestas deportivas consejos para ganar|apuestas deportivas copa america|apuestas deportivas copa

del rey|apuestas deportivas copa libertadores|apuestas deportivas copa mundial|apuestas deportivas corners|apuestas deportivas cual es la mejor|apuestas deportivas cuotas altas|apuestas deportivas de baloncesto|apuestas deportivas de

boxeo|apuestas deportivas de colombia|apuestas deportivas de futbol|apuestas deportivas de nba|apuestas deportivas de nhl|apuestas deportivas de peru|apuestas deportivas

de tenis|apuestas deportivas del dia|apuestas deportivas dinero ficticio|apuestas

deportivas directo|apuestas deportivas doble oportunidad|apuestas deportivas en argentina|apuestas deportivas en chile|apuestas deportivas en colombia|apuestas deportivas en directo|apuestas deportivas en españa|apuestas deportivas

en español|apuestas deportivas en linea|apuestas deportivas en línea|apuestas deportivas en peru|apuestas deportivas en perú|apuestas deportivas en sevilla|apuestas deportivas en uruguay|apuestas deportivas en vivo|apuestas deportivas es|apuestas deportivas es pronosticos|apuestas deportivas españa|apuestas deportivas

españolas|apuestas deportivas esports|apuestas deportivas estadisticas|apuestas deportivas estrategias|apuestas deportivas estrategias seguras|apuestas deportivas eurocopa|apuestas deportivas europa league|apuestas deportivas

f1|apuestas deportivas faciles de ganar|apuestas deportivas formula 1|apuestas deportivas foro|apuestas deportivas foro futbol|apuestas deportivas foro tenis|apuestas deportivas francia argentina|apuestas deportivas futbol|apuestas deportivas fútbol|apuestas

deportivas futbol argentino|apuestas deportivas futbol

colombia|apuestas deportivas futbol español|apuestas deportivas gana|apuestas deportivas ganadas|apuestas deportivas ganar dinero seguro|apuestas deportivas gane|apuestas deportivas

golf|apuestas deportivas gratis|apuestas deportivas gratis con premios|apuestas

deportivas gratis hoy|apuestas deportivas gratis sin deposito|apuestas deportivas handicap|apuestas

deportivas handicap asiatico|apuestas deportivas

hoy|apuestas deportivas impuestos|apuestas deportivas interior argentina|apuestas deportivas

juegos olimpicos|apuestas deportivas la liga|apuestas deportivas legales|apuestas deportivas legales en colombia|apuestas deportivas libres de impuestos|apuestas deportivas licencia españa|apuestas deportivas liga española|apuestas deportivas listado|apuestas deportivas listado clasico|apuestas deportivas madrid|apuestas deportivas mas seguras|apuestas deportivas mejor pagadas|apuestas

deportivas mejores|apuestas deportivas mejores app|apuestas deportivas

mejores casas|apuestas deportivas mejores cuotas|apuestas deportivas mejores paginas|apuestas

deportivas mexico|apuestas deportivas méxico|apuestas deportivas mlb|apuestas deportivas mlb hoy|apuestas

deportivas multiples|apuestas deportivas mundial|apuestas deportivas murcia|apuestas deportivas nba|apuestas deportivas nba hoy|apuestas

deportivas nfl|apuestas deportivas nhl|apuestas deportivas

nuevas|apuestas deportivas ofertas|apuestas deportivas online|apuestas deportivas online argentina|apuestas deportivas online chile|apuestas deportivas online colombia|apuestas deportivas online en colombia|apuestas deportivas online españa|apuestas deportivas online mexico|apuestas

deportivas online paypal|apuestas deportivas online peru|apuestas deportivas online por internet|apuestas deportivas pago paypal|apuestas deportivas para ganar dinero|apuestas deportivas para hoy|apuestas deportivas para hoy pronosticos|apuestas deportivas

partido suspendido|apuestas deportivas partidos de hoy|apuestas deportivas paypal|apuestas deportivas peru|apuestas deportivas perú|apuestas deportivas peru vs ecuador|apuestas deportivas predicciones|apuestas deportivas promociones|apuestas deportivas pronostico|apuestas deportivas pronóstico|apuestas deportivas

pronostico hoy|apuestas deportivas pronosticos|apuestas deportivas pronósticos|apuestas deportivas pronosticos expertos|apuestas deportivas pronosticos gratis|apuestas deportivas pronosticos nba|apuestas deportivas pronosticos tenis|apuestas deportivas que aceptan paypal|apuestas deportivas real madrid|apuestas deportivas regalo bienvenida|apuestas

deportivas resultado exacto|apuestas deportivas resultados|apuestas deportivas rugby|apuestas deportivas seguras|apuestas deportivas seguras foro|apuestas deportivas

seguras hoy|apuestas deportivas seguras para hoy|apuestas deportivas seguras telegram|apuestas deportivas sevilla|apuestas deportivas simulador eurocopa|apuestas deportivas

sin deposito|apuestas deportivas sin deposito inicial|apuestas deportivas sin dinero|apuestas deportivas sin dinero real|apuestas deportivas sin registro|apuestas deportivas stake|apuestas deportivas stake 10|apuestas deportivas telegram españa|apuestas deportivas tenis|apuestas deportivas tenis de mesa|apuestas deportivas tenis foro|apuestas

deportivas tenis hoy|apuestas deportivas tips|apuestas

deportivas tipster|apuestas deportivas ufc|apuestas

deportivas uruguay|apuestas deportivas valencia|apuestas deportivas valencia barcelona|apuestas deportivas venezuela|apuestas deportivas virtuales|apuestas deportivas y casino|apuestas deportivas y casino online|apuestas deportivas.com|apuestas deportivas.com foro|apuestas deportivas.es|apuestas deportivos pronosticos|apuestas deposito minimo 1 euro|apuestas

descenso a segunda|apuestas descenso a segunda b|apuestas descenso la

liga|apuestas descenso primera division|apuestas descenso segunda|apuestas dia|apuestas diarias seguras|apuestas dinero|apuestas dinero ficticio|apuestas dinero real|apuestas dinero virtual|apuestas directas|apuestas directo|apuestas directo futbol|apuestas division de honor juvenil|apuestas dnb|apuestas doble oportunidad|apuestas doble

resultado|apuestas dobles|apuestas dobles y triples|apuestas dortmund barcelona|apuestas

draft nba|apuestas draft nfl|apuestas ecuador vs argentina|apuestas ecuador vs

venezuela|apuestas egipto uruguay|apuestas el clasico|apuestas elecciones venezuela|apuestas empate|apuestas en baloncesto|apuestas en barcelona|apuestas en beisbol|apuestas en boxeo|apuestas en caballos|apuestas en carreras de caballos|apuestas

en casino|apuestas en casino online|apuestas en casinos|apuestas en casinos online|apuestas en chile|apuestas en ciclismo|apuestas en colombia|apuestas en colombia de futbol|apuestas en directo|apuestas en directo futbol|apuestas en directo

pronosticos|apuestas en el futbol|apuestas en el tenis|apuestas en españa|apuestas en esports|apuestas en eventos deportivos virtuales|apuestas en golf|apuestas en juegos|apuestas en la

champions league|apuestas en la eurocopa|apuestas en la liga|apuestas en la

nba|apuestas en la nfl|apuestas en las vegas mlb|apuestas en las

vegas nfl|apuestas en linea|apuestas en línea|apuestas en linea argentina|apuestas en linea boxeo|apuestas en linea

chile|apuestas en linea colombia|apuestas en línea de fútbol|apuestas en linea deportivas|apuestas en linea españa|apuestas en linea estados unidos|apuestas en linea futbol|apuestas en linea mexico|apuestas en línea méxico|apuestas

en linea mundial|apuestas en linea peru|apuestas en linea usa|apuestas en los esports|apuestas en madrid|apuestas en méxico|apuestas en mexico online|apuestas en nba|apuestas en partidos de futbol|apuestas en partidos de

futbol en vivo|apuestas en partidos de tenis en directo|apuestas en perú|apuestas en sevilla|apuestas en sistema|apuestas en stake|apuestas

en tenis|apuestas en tenis de mesa|apuestas en valencia|apuestas en vivo|apuestas en vivo argentina|apuestas en vivo casino|apuestas en vivo futbol|apuestas en vivo

fútbol|apuestas en vivo nba|apuestas en vivo peru|apuestas en vivo tenis|apuestas en vivo ufc|apuestas equipo mbappe|apuestas equipos de futbol|apuestas españa|apuestas españa alemania|apuestas españa alemania eurocopa|apuestas españa croacia|apuestas españa eurocopa|apuestas españa francia|apuestas españa francia

eurocopa|apuestas españa gana el mundial|apuestas españa

gana eurocopa|apuestas españa gana mundial|apuestas españa georgia|apuestas

españa holanda|apuestas españa inglaterra|apuestas españa inglaterra

cuotas|apuestas españa inglaterra eurocopa|apuestas españa italia|apuestas españa mundial|apuestas españa paises bajos|apuestas español|apuestas español oviedo|apuestas

espanyol barcelona|apuestas espanyol betis|apuestas espanyol villarreal|apuestas esport|apuestas esports|apuestas esports

colombia|apuestas esports españa|apuestas esports fifa|apuestas esports gratis|apuestas esports lol|apuestas esports

peru|apuestas esports valorant|apuestas estadisticas|apuestas estrategias|apuestas euro|apuestas euro copa|apuestas eurocopa|apuestas eurocopa campeon|apuestas eurocopa españa|apuestas eurocopa

favoritos|apuestas eurocopa femenina|apuestas eurocopa final|apuestas eurocopa ganador|apuestas eurocopa hoy|apuestas eurocopa sub 21|apuestas euroliga baloncesto|apuestas euroliga pronosticos|apuestas europa league|apuestas

europa league hoy|apuestas europa league pronosticos|apuestas

europa league pronósticos|apuestas euros|apuestas f1 abu dhabi|apuestas f1 bahrein|apuestas f1 canada|apuestas f1 china|apuestas f1 cuotas|apuestas f1 hoy|apuestas

f1 las vegas|apuestas f1 miami|apuestas f1 monaco|apuestas faciles de ganar|apuestas fáciles de ganar|apuestas faciles para ganar|apuestas favoritas|apuestas

favorito champions|apuestas favoritos champions|apuestas favoritos eurocopa|apuestas favoritos mundial|apuestas

fc barcelona|apuestas final champions cuotas|apuestas final champions league|apuestas final champions peru|apuestas final copa|apuestas final copa america|apuestas final copa

de europa|apuestas final copa del rey|apuestas final copa europa|apuestas final copa libertadores|apuestas final copa

rey|apuestas final de copa|apuestas final de copa del

rey|apuestas final del mundial|apuestas final euro|apuestas final eurocopa|apuestas final europa league|apuestas final libertadores|apuestas final mundial|apuestas final nba|apuestas final rugby|apuestas final uefa europa league|apuestas final.mundial|apuestas finales de conferencia nfl|apuestas finales nba|apuestas fiorentina betis|apuestas formula|apuestas

formula 1|apuestas fórmula 1|apuestas fórmula 1 pronósticos|apuestas formula uno|apuestas foro|apuestas foro nba|apuestas francia argentina|apuestas francia españa|apuestas futbol|apuestas fútbol|apuestas futbol americano|apuestas futbol americano nfl|apuestas futbol argentina|apuestas futbol argentino|apuestas futbol champions league|apuestas futbol chile|apuestas futbol

colombia|apuestas futbol consejos|apuestas futbol en directo|apuestas fútbol en directo|apuestas

futbol en vivo|apuestas fútbol en vivo|apuestas

futbol españa|apuestas futbol español|apuestas fútbol español|apuestas futbol eurocopa|apuestas futbol femenino|apuestas futbol foro|apuestas futbol gratis|apuestas futbol hoy|apuestas fútbol hoy|apuestas futbol juegos olimpicos|apuestas

futbol mexico|apuestas futbol mundial|apuestas futbol online|apuestas futbol para hoy|apuestas futbol

peru|apuestas futbol pronosticos|apuestas futbol sala|apuestas futbol telegram|apuestas futbol

virtual|apuestas galgos|apuestas galgos en directo|apuestas

galgos hoy|apuestas galgos online|apuestas galgos pronosticos|apuestas

galgos trucos|apuestas gana|apuestas gana colombia|apuestas gana resultados|apuestas ganadas|apuestas ganadas hoy|apuestas ganador champions league|apuestas ganador copa america|apuestas ganador copa del rey|apuestas ganador

copa del rey baloncesto|apuestas ganador copa libertadores|apuestas ganador de

la eurocopa|apuestas ganador de la liga|apuestas ganador

del mundial|apuestas ganador eurocopa|apuestas ganador europa league|apuestas ganador f1|apuestas ganador la liga|apuestas ganador liga española|apuestas ganador mundial|apuestas ganador mundial

baloncesto|apuestas ganador mundial f1|apuestas ganador nba|apuestas ganadores eurocopa|apuestas ganadores mundial|apuestas ganar champions|apuestas ganar eurocopa|apuestas ganar liga|apuestas ganar mundial|apuestas ganar nba|apuestas getafe valencia|apuestas ghana uruguay|apuestas girona|apuestas girona athletic|apuestas girona betis|apuestas girona campeon de liga|apuestas girona campeon liga|apuestas girona gana la liga|apuestas girona real madrid|apuestas girona real sociedad|apuestas goleador eurocopa|apuestas goleadores eurocopa|apuestas

goles asiaticos|apuestas golf|apuestas golf masters|apuestas golf pga|apuestas granada barcelona|apuestas grand slam de tenis|apuestas gratis|apuestas

gratis casino|apuestas gratis con premios|apuestas gratis hoy|apuestas gratis para hoy|apuestas gratis por registro|apuestas gratis puntos|apuestas gratis regalos|apuestas

gratis sin deposito|apuestas gratis sin depósito|apuestas gratis sin ingreso|apuestas gratis sports|apuestas gratis y

ganar premios|apuestas grupo a eurocopa|apuestas grupos eurocopa|apuestas handicap|apuestas handicap asiatico|apuestas handicap baloncesto|apuestas handicap como funciona|apuestas handicap nba|apuestas handicap nfl|apuestas

hipicas online|apuestas hípicas online|apuestas hipicas

venezuela|apuestas hockey|apuestas hockey hielo|apuestas hockey patines|apuestas hockey sobre hielo|apuestas holanda argentina|apuestas

holanda vs argentina|apuestas hoy|apuestas hoy champions|apuestas hoy futbol|apuestas hoy nba|apuestas hoy pronosticos|apuestas hoy seguras|apuestas impuestos|apuestas inglaterra paises bajos|apuestas inter barca|apuestas inter barcelona|apuestas juego|apuestas juegos|apuestas

juegos en linea|apuestas juegos olimpicos|apuestas juegos olímpicos|apuestas juegos olimpicos baloncesto|apuestas juegos

online|apuestas juegos virtuales|apuestas jugador sevilla|apuestas

jugadores nba|apuestas kings league americas|apuestas la liga|apuestas la liga española|apuestas la liga hoy|apuestas la liga santander|apuestas las vegas mlb|apuestas las vegas nba|apuestas las vegas

nfl|apuestas league of legends mundial|apuestas legal|apuestas legales|apuestas legales en colombia|apuestas legales en españa|apuestas legales en estados unidos|apuestas legales españa|apuestas leganes betis|apuestas libertadores|apuestas licencia|apuestas

liga 1 peru|apuestas liga argentina|apuestas liga bbva pronosticos|apuestas liga de campeones|apuestas liga de

campeones de baloncesto|apuestas liga de campeones de hockey|apuestas liga españa|apuestas liga española|apuestas liga santander pronosticos|apuestas ligas de futbol|apuestas linea|apuestas linea de gol|apuestas liverpool barcelona|apuestas liverpool real madrid|apuestas

lol mundial|apuestas madrid|apuestas madrid arsenal|apuestas madrid atletico|apuestas madrid atletico champions|apuestas madrid barca|apuestas

madrid barça|apuestas madrid barca hoy|apuestas madrid barca supercopa|apuestas madrid barcelona|apuestas madrid barsa|apuestas madrid bayern|apuestas madrid betis|apuestas madrid borussia|apuestas madrid campeon champions|apuestas madrid celta|apuestas madrid city|apuestas

madrid dortmund|apuestas madrid gana la liga|apuestas madrid

gana liga|apuestas madrid hoy|apuestas madrid liverpool|apuestas madrid osasuna|apuestas

madrid sevilla|apuestas madrid valencia|apuestas madrid vs arsenal|apuestas madrid vs barcelona|apuestas mallorca osasuna|apuestas mallorca real sociedad|apuestas manchester athletic|apuestas

manchester city real madrid|apuestas mas faciles de ganar|apuestas

mas seguras|apuestas mas seguras para hoy|apuestas

masters de golf|apuestas masters de tenis|apuestas maximo goleador eurocopa|apuestas maximo goleador mundial|apuestas

mejor jugador eurocopa|apuestas mejores casinos online|apuestas

mexico|apuestas méxico|apuestas mexico polonia|apuestas méxico polonia|apuestas mlb|apuestas mlb hoy|apuestas mlb las vegas|apuestas mlb

para hoy|apuestas mlb pronosticos|apuestas mlb usa|apuestas mma ufc|apuestas momios|apuestas multiples|apuestas múltiples|apuestas multiples

como funcionan|apuestas multiples el gordo|apuestas multiples futbol|apuestas mundial|apuestas mundial 2026|apuestas

mundial baloncesto|apuestas mundial balonmano|apuestas mundial brasil|apuestas mundial

campeon|apuestas mundial ciclismo|apuestas mundial clubes|apuestas mundial de baloncesto|apuestas mundial

de ciclismo|apuestas mundial de clubes|apuestas mundial de futbol|apuestas

mundial de fútbol|apuestas mundial de rugby|apuestas mundial f1|apuestas mundial favoritos|apuestas

mundial femenino|apuestas mundial formula 1|apuestas mundial futbol|apuestas

mundial ganador|apuestas mundial lol|apuestas mundial moto

gp|apuestas mundial motogp|apuestas mundial rugby|apuestas mundial sub 17|apuestas mundiales|apuestas mundialistas|apuestas mvp

eurocopa|apuestas mvp nba|apuestas mvp nfl|apuestas

nacionales de colombia|apuestas nba|apuestas nba all star|apuestas nba campeon|apuestas nba consejos|apuestas

nba esta noche|apuestas nba finals|apuestas nba

gratis|apuestas nba hoy|apuestas nba hoy jugadores|apuestas nba

hoy pronosticos|apuestas nba para hoy|apuestas nba playoffs|apuestas

nba pronosticos|apuestas nba pronósticos|apuestas nba pronosticos hoy|apuestas nba

tipster|apuestas nfl|apuestas nfl hoy|apuestas nfl las vegas|apuestas nfl playoffs|apuestas

nfl pronosticos|apuestas nfl pronósticos|apuestas nfl semana 4|apuestas nfl super bowl|apuestas nhl|apuestas nhl pronosticos|apuestas octavos eurocopa|apuestas ofertas|apuestas

online|apuestas online argentina|apuestas online argentina legal|apuestas online bono|apuestas online bono bienvenida|apuestas online boxeo|apuestas online caballos|apuestas online carreras

de caballos|apuestas online casino|apuestas online champions

league|apuestas online chile|apuestas online ciclismo|apuestas online

colombia|apuestas online comparativa|apuestas online con paypal|apuestas online

de caballos|apuestas online deportivas|apuestas online en argentina|apuestas

online en peru|apuestas online espana|apuestas online españa|apuestas online esports|apuestas online foro|apuestas online futbol|apuestas online

futbol españa|apuestas online golf|apuestas online gratis|apuestas online gratis sin deposito|apuestas online juegos|apuestas online mexico|apuestas online mma|apuestas online movil|apuestas online nba|apuestas online net|apuestas online nuevas|apuestas online opiniones|apuestas online paypal|apuestas

online peru|apuestas online seguras|apuestas online sin dinero|apuestas online sin registro|apuestas online tenis|apuestas

online ufc|apuestas online uruguay|apuestas online venezuela|apuestas open britanico golf|apuestas osasuna athletic|apuestas osasuna barcelona|apuestas osasuna real madrid|apuestas osasuna sevilla|apuestas osasuna valencia|apuestas over|apuestas over 2.5|apuestas over under|apuestas paginas|apuestas pago anticipado|apuestas paises bajos ecuador|apuestas paises bajos inglaterra|apuestas países bajos qatar|apuestas

para boxeo|apuestas para champions league|apuestas para el clasico|apuestas para

el dia de hoy|apuestas para el mundial|apuestas para el partido de hoy|apuestas para eurocopa|apuestas para europa league|apuestas para futbol|apuestas para ganar|apuestas para ganar

dinero|apuestas para ganar dinero facil|apuestas para ganar en la ruleta|apuestas para ganar la champions|apuestas para ganar la eurocopa|apuestas para ganar la europa league|apuestas para ganar la liga|apuestas para ganar siempre|apuestas para hacer|apuestas para hoy|apuestas para hoy de futbol|apuestas para hoy europa league|apuestas para hoy futbol|apuestas para juegos|apuestas para la

champions league|apuestas para la copa del rey|apuestas

para la eurocopa|apuestas para la europa league|apuestas para la final de la

eurocopa|apuestas para la nba hoy|apuestas para los partidos de hoy|apuestas para partidos de hoy|apuestas para ufc|apuestas partido|apuestas

partido aplazado|apuestas partido champions|apuestas partido colombia|apuestas partido españa marruecos|apuestas partido mundial|apuestas partido suspendido|apuestas partidos|apuestas partidos

champions league|apuestas partidos csgo|apuestas partidos de futbol|apuestas partidos de futbol hoy|apuestas partidos de hoy|apuestas partidos eurocopa|apuestas partidos futbol|apuestas partidos hoy|apuestas partidos mundial|apuestas paypal|apuestas peleas de boxeo|apuestas peru|apuestas perú|apuestas peru brasil|apuestas peru chile|apuestas peru paraguay|apuestas peru uruguay|apuestas peru vs chile|apuestas peru vs colombia|apuestas pichichi eurocopa|apuestas plataforma|apuestas playoff|apuestas playoff ascenso|apuestas playoff ascenso a primera|apuestas playoff nba|apuestas playoff segunda|apuestas playoff segunda b|apuestas playoffs nba|apuestas playoffs nfl|apuestas polonia argentina|apuestas por

argentina|apuestas por internet mexico|apuestas por internet para ganar dinero|apuestas por paypal|apuestas por ronda boxeo|apuestas

por sistema|apuestas portugal uruguay|apuestas pre partido|apuestas

predicciones|apuestas predicciones futbol|apuestas

primera division|apuestas primera division españa|apuestas promociones|apuestas

pronostico|apuestas pronosticos|apuestas pronosticos deportivos|apuestas pronosticos deportivos tenis|apuestas pronosticos futbol|apuestas pronosticos gratis|apuestas pronosticos nba|apuestas pronosticos tenis|apuestas prorroga|apuestas psg barca|apuestas psg

barcelona|apuestas puntos por tarjetas|apuestas puntos tarjetas|apuestas que aceptan paypal|apuestas que es handicap|apuestas que puedes hacer con tu novia|apuestas que siempre ganaras|apuestas que significa|apuestas quien bajara a segunda|apuestas quién bajara a segunda|apuestas quien gana el mundial|apuestas quien gana eurocopa|apuestas quien gana la champions|apuestas

quien gana la eurocopa|apuestas quien gana la liga|apuestas quien ganara el mundial|apuestas quién ganará el mundial|apuestas quien ganara la champions|apuestas quien ganara

la eurocopa|apuestas quien ganara la liga|apuestas rayo barcelona|apuestas real madrid|apuestas real madrid arsenal|apuestas

real madrid athletic|apuestas real madrid atletico|apuestas real madrid atletico champions|apuestas real madrid atletico de madrid|apuestas real madrid atlético de madrid|apuestas real

madrid atletico madrid|apuestas real madrid barcelona|apuestas real madrid bayern|apuestas real madrid betis|apuestas real madrid borussia|apuestas real madrid campeon champions|apuestas real madrid celta|apuestas real madrid champions|apuestas real madrid city|apuestas real

madrid girona|apuestas real madrid hoy|apuestas real madrid liverpool|apuestas real madrid manchester city|apuestas real madrid osasuna|apuestas real madrid real sociedad|apuestas real madrid valencia|apuestas real madrid villarreal|apuestas real madrid vs arsenal|apuestas real

madrid vs atletico|apuestas real madrid vs atlético|apuestas

real madrid vs atletico madrid|apuestas real madrid vs barcelona|apuestas real madrid vs betis|apuestas real madrid vs sevilla|apuestas real madrid vs

valencia|apuestas real sociedad|apuestas real sociedad athletic|apuestas real sociedad

barcelona|apuestas real sociedad betis|apuestas real sociedad psg|apuestas real sociedad real madrid|apuestas real sociedad valencia|apuestas recomendadas hoy|apuestas regalo de bienvenida|apuestas registro|apuestas resultado exacto|apuestas resultados|apuestas

resultados eurocopa|apuestas retirada tenis|apuestas

roma barcelona|apuestas roma sevilla|apuestas rugby|apuestas rugby mundial|apuestas rugby world cup|apuestas ruleta seguras|apuestas segunda|apuestas segunda b|apuestas segunda division|apuestas segunda división|apuestas segunda division b|apuestas segunda division españa|apuestas seguras|apuestas seguras baloncesto|apuestas

seguras calculadora|apuestas seguras en la ruleta|apuestas

seguras eurocopa|apuestas seguras foro|apuestas seguras futbol|apuestas seguras futbol hoy|apuestas seguras gratis|apuestas seguras hoy|apuestas

seguras hoy futbol|apuestas seguras nba|apuestas seguras nba

hoy|apuestas seguras para este fin de semana|apuestas seguras para ganar dinero|apuestas seguras

para hoy|apuestas seguras para hoy fútbol|apuestas seguras para hoy pronósticos|apuestas seguras para mañana|apuestas seguras ruleta|apuestas seguras telegram|apuestas seguras tenis|apuestas semifinales

eurocopa|apuestas senegal paises bajos|apuestas sevilla|apuestas sevilla athletic|apuestas sevilla atletico de madrid|apuestas sevilla barcelona|apuestas sevilla betis|apuestas sevilla campeon liga|apuestas sevilla celta|apuestas

sevilla gana la liga|apuestas sevilla girona|apuestas sevilla inter|apuestas sevilla jugador|apuestas sevilla juventus|apuestas sevilla leganes|apuestas sevilla madrid|apuestas sevilla manchester united|apuestas

sevilla osasuna|apuestas sevilla real madrid|apuestas sevilla real sociedad|apuestas sevilla

roma|apuestas sevilla valencia|apuestas significa|apuestas simples ejemplos|apuestas simples o combinadas|apuestas sin deposito|apuestas sin deposito inicial|apuestas

sin deposito minimo|apuestas sin dinero|apuestas sin dinero real|apuestas sin empate|apuestas sin empate que significa|apuestas sin ingreso minimo|apuestas sin registro|apuestas sistema|apuestas sistema calculadora|apuestas

sistema como funciona|apuestas sistema trixie|apuestas sociedad|apuestas sorteo copa del rey|apuestas stake|apuestas stake 10|apuestas stake 10 hoy|apuestas super bowl favorito|apuestas super

rugby|apuestas supercopa españa|apuestas superliga argentina|apuestas tarjeta roja|apuestas

tarjetas|apuestas tarjetas amarillas|apuestas tenis|apuestas tenis atp|apuestas tenis consejos|apuestas tenis

copa davis|apuestas tenis de mesa|apuestas tenis de mesa pronosticos|apuestas tenis en vivo|apuestas tenis femenino|apuestas

tenis hoy|apuestas tenis itf|apuestas tenis pronosticos|apuestas tenis pronósticos|apuestas tenis retirada|apuestas

tenis roland garros|apuestas tenis seguras|apuestas tenis wimbledon|apuestas tenis wta|apuestas tercera division|apuestas tercera division españa|apuestas tipos|apuestas tips|apuestas tipster|apuestas tipster para

hoy|apuestas topuria holloway cuotas|apuestas torneos de golf|apuestas torneos de tenis|apuestas trucos|apuestas uefa champions league|apuestas uefa europa league|apuestas ufc|apuestas ufc chile|apuestas ufc como funciona|apuestas ufc hoy|apuestas ufc ilia

topuria|apuestas ufc online|apuestas ufc pronósticos|apuestas ufc telegram|apuestas ufc topuria|apuestas under over|apuestas unionistas villarreal|apuestas uruguay|apuestas uruguay colombia|apuestas uruguay corea|apuestas uruguay vs

colombia|apuestas us open golf|apuestas us open tenis|apuestas valencia|apuestas valencia barcelona|apuestas valencia betis|apuestas valencia madrid|apuestas

valencia real madrid|apuestas valladolid barcelona|apuestas valladolid valencia|apuestas valor app|apuestas valor en directo|apuestas valor galgos|apuestas venezuela|apuestas venezuela argentina|apuestas venezuela bolivia|apuestas

venezuela ecuador|apuestas villarreal|apuestas villarreal athletic|apuestas villarreal

barcelona|apuestas villarreal bayern|apuestas villarreal betis|apuestas villarreal liverpool|apuestas villarreal manchester|apuestas villarreal manchester united|apuestas villarreal vs real madrid|apuestas virtuales|apuestas virtuales colombia|apuestas virtuales futbol|apuestas

virtuales sin dinero|apuestas vivo|apuestas vuelta a españa|apuestas vuelta españa|apuestas william hill partidos de hoy|apuestas

y casino|apuestas y casinos|apuestas y juegos de azar|apuestas

y pronosticos|apuestas y pronosticos de

futbol|apuestas y pronosticos deportivos|apuestas y resultados|apuestas-deportivas|apuestas-deportivas.es pronosticos|arbitro nba apuestas|argentina apuestas|argentina colombia apuestas|argentina croacia apuestas|argentina francia apuestas|argentina

mexico apuestas|argentina peru apuestas|argentina uruguay apuestas|argentina vs

bolivia apuestas|argentina vs chile apuestas|argentina vs colombia apuestas|argentina vs francia apuestas|argentina vs.

colombia apuestas|asi se gana en las apuestas deportivas|asiatico apuestas|asiatico en apuestas|asiaticos apuestas|athletic barcelona apuestas|athletic

manchester united apuestas|athletic osasuna apuestas|athletic real madrid apuestas|atletico barcelona apuestas|atletico de madrid apuestas|atlético de madrid apuestas|atletico de madrid real madrid apuestas|atletico de madrid vs barcelona apuestas|atletico

madrid real madrid apuestas|atletico madrid vs real madrid apuestas|atletico real madrid apuestas|atletico vs real madrid apuestas|avisador de cuotas apuestas|bajada de

cuotas apuestas|baloncesto apuestas|barbastro barcelona apuestas|barca apuestas|barca bayern apuestas|barca inter apuestas|barca madrid apuestas|barça madrid apuestas|barca vs atletico apuestas|barca vs

madrid apuestas|barca vs real madrid apuestas|barcelona – real madrid apuestas|barcelona apuestas|barcelona atletico

apuestas|barcelona atletico de madrid apuestas|barcelona atletico madrid apuestas|barcelona betis apuestas|barcelona casa de

apuestas|barcelona inter apuestas|barcelona psg apuestas|barcelona real madrid apuestas|barcelona real sociedad apuestas|barcelona sevilla apuestas|barcelona valencia apuestas|barcelona vs athletic bilbao

apuestas|barcelona vs atlético madrid apuestas|barcelona vs betis

apuestas|barcelona vs celta de vigo apuestas|barcelona vs espanyol apuestas|barcelona vs girona apuestas|barcelona vs madrid apuestas|barcelona vs real madrid apuestas|barcelona vs real sociedad apuestas|barcelona vs

sevilla apuestas|barcelona vs villarreal apuestas|base de datos cuotas apuestas deportivas|bayern real madrid apuestas|beisbol apuestas|best america apuestas|bet apuestas chile|bet apuestas en vivo|betis –

chelsea apuestas|betis apuestas|betis barcelona apuestas|betis chelsea apuestas|betis madrid apuestas|betis

sevilla apuestas|betsson tu sitio de apuestas online|blog apuestas baloncesto|blog apuestas ciclismo|blog

apuestas nba|blog apuestas tenis|blog de apuestas de tenis|bono apuestas|bono apuestas deportivas|bono apuestas deportivas sin deposito|bono apuestas gratis|bono apuestas

gratis sin deposito|bono apuestas sin deposito|bono bienvenida apuestas|bono

bienvenida apuestas deportivas|bono bienvenida apuestas españa|bono bienvenida apuestas sin deposito|bono bienvenida apuestas sin depósito|bono

bienvenida casa apuestas|bono bienvenida casa de apuestas|bono bienvenida marca apuestas|bono casa

apuestas|bono casa de apuestas|bono casa de apuestas sin ingreso|bono casas

de apuestas|bono de apuestas|bono de apuestas gratis sin deposito|bono de bienvenida

apuestas|bono de bienvenida apuestas deportivas|bono de bienvenida casa de apuestas|bono de bienvenida casas de apuestas|bono de casas de

apuestas|bono de registro apuestas|bono de registro apuestas deportivas|bono de

registro casa de apuestas|bono gratis apuestas|bono marca apuestas|bono por registro apuestas|bono

por registro apuestas deportivas|bono por registro casa de apuestas|bono registro apuestas|bono sin deposito apuestas|bono

sin depósito apuestas|bono sin deposito apuestas deportivas|bono sin depósito apuestas deportivas|bono sin deposito casa de apuestas|bono sin deposito marca apuestas|bono sin ingreso apuestas|bono sin ingreso

apuestas deportivas|bonos apuestas|bonos apuestas colombia|bonos apuestas deportivas|bonos apuestas

deportivas sin deposito|bonos apuestas gratis|bonos apuestas sin deposito|bonos

apuestas sin depósito|bonos bienvenida apuestas|bonos bienvenida casas apuestas|bonos bienvenida casas de apuestas|bonos casa de

apuestas|bonos casas apuestas|bonos casas de apuestas|bonos

casas de apuestas colombia|bonos casas de apuestas deportivas|bonos casas

de apuestas españa|bonos casas de apuestas nuevas|bonos casas de apuestas sin deposito|bonos casas de apuestas sin depósito|bonos de apuestas|bonos de apuestas deportivas|bonos

de apuestas gratis|bonos de apuestas sin deposito|bonos de bienvenida apuestas|bonos de

bienvenida apuestas deportivas|bonos de bienvenida

casa de apuestas|bonos de bienvenida casas de apuestas|bonos de bienvenida de casas de apuestas|bonos de bienvenida en casas de

apuestas|bonos de casas de apuestas|bonos de casas de apuestas sin deposito|bonos en casa

de apuestas|bonos en casas de apuestas sin deposito|bonos gratis

apuestas|bonos gratis apuestas deportivas|bonos gratis casas

de apuestas|bonos gratis sin deposito apuestas|bonos paginas de apuestas|bonos registro casas de apuestas|bonos sin deposito

apuestas|bonos sin depósito apuestas|bonos sin deposito apuestas deportivas|bonos sin deposito casas de apuestas|bot de apuestas

deportivas gratis|boxeo apuestas|brasil colombia apuestas|brasil peru

apuestas|brasil vs colombia apuestas|buenas

apuestas para hoy|buscador cuotas apuestas|buscador de apuestas

seguras|buscador de cuotas apuestas|buscador de cuotas de apuestas|buscar apuestas seguras|caballos

apuestas|calculador de apuestas|calculador de cuotas apuestas|calculadora apuestas|calculadora apuestas

combinadas|calculadora apuestas de sistema|calculadora apuestas

deportivas|calculadora apuestas deportivas seguras|calculadora apuestas multiples|calculadora

apuestas segura|calculadora apuestas seguras|calculadora apuestas sistema|calculadora apuestas yankee|calculadora arbitraje apuestas|calculadora cubrir apuestas|calculadora cuotas apuestas|calculadora de apuestas|calculadora

de apuestas combinadas|calculadora de apuestas de futbol|calculadora de apuestas de sistema|calculadora de apuestas deportivas|calculadora de apuestas

multiples|calculadora de apuestas seguras|calculadora de apuestas sistema|calculadora de apuestas surebets|calculadora de arbitraje apuestas|calculadora de cuotas

apuestas|calculadora de cuotas de apuestas|calculadora para apuestas deportivas|calculadora poisson apuestas|calculadora

poisson apuestas deportivas|calculadora poisson para apuestas|calculadora scalping apuestas deportivas|calculadora

sistema apuestas|calculadora stake apuestas|calculadora trading apuestas|calcular apuestas|calcular apuestas

deportivas|calcular apuestas futbol|calcular apuestas sistema|calcular

cuotas apuestas|calcular cuotas apuestas combinadas|calcular cuotas apuestas deportivas|calcular cuotas de apuestas|calcular ganancias apuestas deportivas|calcular momios

apuestas|calcular probabilidad cuota apuestas|calcular stake apuestas|calcular unidades apuestas|calcular yield apuestas|calculo de apuestas|calculo de apuestas deportivas|cambio de cuotas apuestas|campeon champions apuestas|campeon eurocopa apuestas|campeon liga apuestas|campeon nba apuestas|canales de apuestas gratis|carrera de caballos apuestas|carrera de

caballos apuestas juego|carrera de caballos con apuestas|carrera de galgos apuestas|carreras de caballos

apuestas|carreras de caballos apuestas online|carreras de caballos con apuestas|carreras de caballos juegos de apuestas|carreras de galgos apuestas|carreras de galgos apuestas online|carreras de galgos

apuestas trucos|carreras galgos apuestas|casa apuestas argentina|casa apuestas atletico de

madrid|casa apuestas barcelona|casa apuestas betis|casa apuestas bono bienvenida|casa apuestas bono gratis|casa apuestas

bono sin deposito|casa apuestas cerca de mi|casa apuestas chile|casa apuestas colombia|casa apuestas con mejores cuotas|casa apuestas deportivas|casa apuestas españa|casa apuestas española|casa apuestas eurocopa|casa apuestas futbol|casa apuestas mejores

cuotas|casa apuestas mundial|casa apuestas nueva|casa apuestas nuevas|casa

apuestas online|casa apuestas peru|casa apuestas valencia|casa de apuestas|casa de apuestas

10 euros gratis|casa de apuestas argentina|casa de apuestas atletico de

madrid|casa de apuestas baloncesto|casa de apuestas barcelona|casa de apuestas beisbol|casa de apuestas betis|casa de apuestas bono|casa de apuestas bono bienvenida|casa

de apuestas bono de bienvenida|casa de apuestas bono gratis|casa de

apuestas bono por registro|casa de apuestas bono sin deposito|casa de apuestas boxeo|casa

de apuestas caballos|casa de apuestas carreras de caballos|casa de apuestas cerca de mi|casa de

apuestas cerca de mí|casa de apuestas champions league|casa de apuestas chile|casa de apuestas ciclismo|casa de apuestas colombia|casa de apuestas con bono de bienvenida|casa

de apuestas con bono sin deposito|casa de apuestas con cuotas mas

altas|casa de apuestas con esports|casa de apuestas con las mejores

cuotas|casa de apuestas con licencia en españa|casa de

apuestas con mejores cuotas|casa de apuestas con pago anticipado|casa de apuestas con paypal|casa de apuestas copa america|casa

de apuestas de caballos|casa de apuestas de colombia|casa de apuestas de españa|casa de apuestas de futbol|casa de apuestas de fútbol|casa de apuestas

de futbol peru|casa de apuestas de peru|casa de

apuestas del madrid|casa de apuestas del real madrid|casa de apuestas

deportivas|casa de apuestas deportivas cerca de mi|casa de apuestas deportivas en argentina|casa de apuestas deportivas en chile|casa

de apuestas deportivas en colombia|casa de apuestas deportivas en españa|casa de apuestas deportivas en madrid|casa

de apuestas deportivas españa|casa de apuestas deportivas españolas|casa de apuestas deportivas madrid|casa de

apuestas deportivas mexico|casa de apuestas deportivas online|casa de apuestas deportivas peru|casa de

apuestas deposito 5 euros|casa de apuestas deposito minimo|casa de

apuestas deposito minimo 1 euro|casa de apuestas depósito mínimo 1 euro|casa de apuestas en españa|casa

de apuestas en linea|casa de apuestas en madrid|casa de apuestas en perú|casa de apuestas en vivo|casa de apuestas españa|casa de apuestas españa inglaterra|casa de apuestas española|casa

de apuestas españolas|casa de apuestas esports|casa

de apuestas eurocopa|casa de apuestas europa league|casa de apuestas f1|casa de apuestas formula 1|casa de apuestas futbol|casa de apuestas ingreso minimo|casa de apuestas ingreso minimo 1 euro|casa de apuestas

ingreso mínimo 1 euro|casa de apuestas legales|casa

de apuestas legales en colombia|casa de apuestas legales en españa|casa de apuestas libertadores|casa

de apuestas liga española|casa de apuestas madrid|casa de apuestas mas segura|casa de apuestas mejores|casa de apuestas

méxico|casa de apuestas minimo 5 euros|casa de apuestas mlb|casa de apuestas mundial|casa de apuestas nba|casa de apuestas nfl|casa de apuestas nueva|casa de apuestas nuevas|casa de apuestas oficial del real madrid|casa

de apuestas oficial real madrid|casa de apuestas online|casa de

apuestas online argentina|casa de apuestas online chile|casa

de apuestas online españa|casa de apuestas online mexico|casa de apuestas online paraguay|casa de apuestas online

peru|casa de apuestas online usa|casa de apuestas online venezuela|casa de apuestas pago anticipado|casa de apuestas para

boxeo|casa de apuestas para ufc|casa de apuestas peru|casa de

apuestas perú|casa de apuestas peru online|casa de apuestas por paypal|casa de apuestas promociones|casa de apuestas que regalan dinero|casa de apuestas real madrid|casa de apuestas regalo de bienvenida|casa de apuestas sevilla|casa de apuestas sin dinero|casa de apuestas sin ingreso minimo|casa de apuestas sin licencia en españa|casa de apuestas sin minimo de ingreso|casa de apuestas stake|casa de apuestas tenis|casa de apuestas ufc|casa

de apuestas valencia|casa de apuestas venezuela|casa de apuestas virtuales|casa de apuestas vive la suerte|casa oficial de apuestas del real madrid|casas

apuestas asiaticas|casas apuestas bono sin deposito|casas apuestas

bonos sin deposito|casas apuestas caballos|casas apuestas chile|casas apuestas ciclismo|casas apuestas con licencia|casas

apuestas con licencia en españa|casas apuestas deportivas|casas apuestas deportivas colombia|casas apuestas

deportivas españa|casas apuestas deportivas españolas|casas apuestas deportivas nuevas|casas

apuestas españa|casas apuestas españolas|casas apuestas esports|casas apuestas eurocopa|casas apuestas golf|casas

apuestas ingreso minimo 5 euros|casas apuestas legales|casas apuestas

legales españa|casas apuestas licencia|casas apuestas licencia españa|casas apuestas mexico|casas apuestas mundial|casas apuestas

nba|casas apuestas nuevas|casas apuestas nuevas españa|casas

apuestas ofertas|casas apuestas online|casas apuestas paypal|casas apuestas peru|casas apuestas sin licencia|casas apuestas tenis|casas asiaticas apuestas|casas de apuestas|casas de apuestas 5 euros|casas

de apuestas app|casas de apuestas argentinas|casas

de apuestas asiaticas|casas de apuestas baloncesto|casas de apuestas

barcelona|casas de apuestas bono bienvenida|casas de apuestas bono

de bienvenida|casas de apuestas bono por registro|casas de

apuestas bono sin deposito|casas de apuestas bono sin ingreso|casas de apuestas bonos|casas de apuestas bonos de bienvenida|casas de apuestas bonos gratis|casas de apuestas bonos sin deposito|casas de apuestas boxeo|casas

de apuestas caballos|casas de apuestas carreras

de caballos|casas de apuestas casino|casas de apuestas casino

online|casas de apuestas cerca de mi|casas de apuestas champions league|casas de apuestas chile|casas

de apuestas ciclismo|casas de apuestas colombia|casas de apuestas com|casas de apuestas con app|casas de apuestas con apuestas gratis|casas de apuestas con bono|casas

de apuestas con bono de bienvenida|casas de apuestas con bono

de registro|casas de apuestas con bono por registro|casas de apuestas con bono

sin deposito|casas de apuestas con bonos|casas de apuestas con bonos gratis|casas de apuestas con bonos sin deposito|casas de apuestas con deposito minimo|casas

de apuestas con esports|casas de apuestas con handicap asiatico|casas

de apuestas con licencia|casas de apuestas con licencia en españa|casas de

apuestas con licencia españa|casas de apuestas con licencia española|casas de apuestas

con mejores cuotas|casas de apuestas con pago anticipado|casas de

apuestas con paypal|casas de apuestas con paypal en perú|casas de apuestas con promociones|casas de apuestas con ruleta en vivo|casas de

apuestas copa del rey|casas de apuestas de caballos|casas de apuestas de españa|casas

de apuestas de futbol|casas de apuestas de fútbol|casas de apuestas de peru|casas de apuestas deportivas|casas de apuestas deportivas asiaticas|casas de apuestas deportivas colombia|casas de apuestas deportivas comparativa|casas de apuestas deportivas con paypal|casas de

apuestas deportivas en chile|casas de apuestas deportivas

en españa|casas de apuestas deportivas en linea|casas de apuestas deportivas en madrid|casas de apuestas

deportivas en mexico|casas de apuestas deportivas en peru|casas

de apuestas deportivas en sevilla|casas de apuestas

deportivas en valencia|casas de apuestas deportivas españa|casas

de apuestas deportivas españolas|casas de apuestas

deportivas legales|casas de apuestas deportivas madrid|casas de apuestas deportivas mexico|casas de apuestas deportivas nuevas|casas de apuestas deportivas online|casas de apuestas deportivas peru|casas de apuestas

deportivas perú|casas de apuestas deposito minimo 1

euro|casas de apuestas depósito mínimo 1 euro|casas de apuestas dinero gratis|casas de apuestas

en argentina|casas de apuestas en barcelona|casas de apuestas en chile|casas de

apuestas en colombia|casas de apuestas en españa|casas de apuestas

en españa online|casas de apuestas en linea|casas de apuestas en madrid|casas de apuestas en méxico|casas de apuestas en peru|casas de apuestas en perú|casas de apuestas en sevilla|casas de apuestas en uruguay|casas

de apuestas en valencia|casas de apuestas en venezuela|casas de apuestas

equipos de futbol|casas de apuestas españa|casas de apuestas españa alemania|casas de apuestas españa inglaterra|casas de apuestas españa licencia|casas de apuestas españa nuevas|casas de apuestas

españa online|casas de apuestas española|casas de apuestas españolas|casas de apuestas españolas con licencia|casas de apuestas españolas online|casas de apuestas esports|casas de apuestas eurocopa|casas de apuestas eurocopa 2024|casas de apuestas europa league|casas de

apuestas f1|casas de apuestas fisicas en barcelona|casas de apuestas fisicas en españa|casas de apuestas

formula 1|casas de apuestas fuera de españa|casas de apuestas futbol|casas de apuestas fútbol|casas de apuestas

futbol españa|casas de apuestas ganador eurocopa|casas de apuestas gratis|casas

de apuestas ingreso minimo|casas de apuestas ingreso minimo 1 euro|casas de apuestas ingreso minimo

5 euros|casas de apuestas inter barcelona|casas de apuestas legales|casas de apuestas legales en colombia|casas de apuestas legales en españa|casas de apuestas legales en mexico|casas de apuestas legales españa|casas de

apuestas legales mx|casas de apuestas licencia|casas de apuestas licencia españa|casas de apuestas lista|casas de apuestas madrid|casas de apuestas mas seguras|casas de apuestas

mejores bonos|casas de apuestas mejores cuotas|casas de apuestas mexico|casas de

apuestas méxico|casas de apuestas minimo 5 euros|casas de apuestas mlb|casas de apuestas

mundial|casas de apuestas mundial baloncesto|casas de apuestas

mundiales|casas de apuestas nba|casas de apuestas no reguladas en españa|casas de apuestas nueva

ley|casas de apuestas nuevas|casas de apuestas nuevas en colombia|casas de apuestas nuevas en españa|casas de apuestas nuevas españa|casas de apuestas ofertas|casas de apuestas online|casas

de apuestas online argentina|casas de apuestas online colombia|casas de apuestas online deportivas|casas de apuestas online

ecuador|casas de apuestas online en argentina|casas de apuestas online en chile|casas de apuestas

online en colombia|casas de apuestas online en españa|casas de apuestas online en mexico|casas de apuestas online españa|casas de apuestas online

mas fiables|casas de apuestas online mexico|casas de apuestas online nuevas|casas de apuestas online peru|casas de apuestas online

usa|casas de apuestas online venezuela|casas de apuestas pago paypal|casas de apuestas para ufc|casas de apuestas paypal|casas de apuestas peru

bono sin deposito|casas de apuestas presenciales en españa|casas de apuestas pro

united states gambling sites, best no deposit bonus how

to do casino heists (Marshall) usa and united kingdom internet casino, or $10 deposit online casino australia

free slot machine games united kingdom, poker site usa

and how to cheat pokie machines canada, or parhaat

casino tarjousaset

My blog post :: wgs casinos (Debbra)

buchmacher de

Here is my blog post Wettanbieter vergleichen

wetten mit freunden app

my webpage sportwetten online neu

online basketball wetten (https://basketball-wetten.Com/) in deutschland

sportwettem

Also visit my web blog: Online Sportwetten In Deutschland

wettstrategien livewetten

Look into my homepage gewinnbringende wettstrategie (Lourdes)

welche wettanbieter haben eine deutsche lizenz

Look into my homepage :: sportwetten bonus ohne einzahlung österreich

(10 euros gratis apuestas|10 mejores casas de apuestas|10 trucos para ganar apuestas|15 euros

gratis marca apuestas|1×2 apuestas|1×2 apuestas deportivas|1×2 apuestas que significa|1×2 en apuestas|1×2 en apuestas que significa|1×2 que significa en apuestas|5 euros gratis apuestas|9 apuestas que siempre ganaras|a partir de cuanto se declara apuestas|actividades

de juegos de azar y apuestas|ad apuestas deportivas|aleksandre topuria ufc apuestas|algoritmo para ganar apuestas deportivas|america apuestas|análisis nba apuestas|aplicacion android apuestas deportivas|aplicacion apuestas deportivas|aplicacion apuestas deportivas android|aplicación de

apuestas online|aplicacion para hacer apuestas|aplicacion para hacer apuestas de futbol|aplicación para hacer apuestas

de fútbol|aplicaciones apuestas deportivas android|aplicaciones apuestas deportivas gratis|aplicaciones de apuestas android|aplicaciones de apuestas de fútbol|aplicaciones de apuestas deportivas|aplicaciones de apuestas deportivas peru|aplicaciones de apuestas deportivas perú|aplicaciones de apuestas en colombia|aplicaciones de apuestas gratis|aplicaciones de apuestas online|aplicaciones de apuestas seguras|aplicaciones de apuestas sin dinero|aplicaciones para hacer apuestas|apostar seguro apuestas

deportivas|app android apuestas deportivas|app apuestas|app apuestas

android|app apuestas de futbol|app apuestas deportivas|app apuestas deportivas android|app apuestas deportivas argentina|app apuestas deportivas colombia|app apuestas deportivas ecuador|app apuestas deportivas españa|app apuestas deportivas gratis|app apuestas entre amigos|app apuestas

futbol|app apuestas gratis|app apuestas sin dinero|app casa de apuestas|app casas de apuestas|app control apuestas|app

de apuestas|app de apuestas android|app de apuestas casino|app de apuestas colombia|app de apuestas con bono de bienvenida|app de apuestas de futbol|app de apuestas deportivas|app de apuestas deportivas

android|app de apuestas deportivas argentina|app de apuestas deportivas colombia|app de apuestas deportivas en españa|app de apuestas deportivas peru|app

de apuestas deportivas perú|app de apuestas deportivas sin dinero|app de apuestas ecuador|app de apuestas en colombia|app de apuestas en españa|app de apuestas en venezuela|app

de apuestas futbol|app de apuestas gratis|app de apuestas online|app de apuestas para android|app