Indonesian SMEs must file SPT Tahunan every year. The 2025 season introduces Coretax, a new platform that replaces DJP Online for future filings, as mandated by PER-8/PJ/2025 and PER-11/PJ/2025. This comprehensive guide shows what SPT is, who must file, exact deadlines, and step-by-step instructions for both systems. Follow these expert-verified steps to avoid penalties and file on time.

SPT adalah Surat Pemberitahuan (Tax Return), the annual tax return that every individual and business with taxable income must submit to the Directorate General of Taxes (DGT), as specified in Law No. 36 of 2008 on Income Tax. It serves as your annual tax report where you list income, expenses, taxes already paid, and any balance due.

DJP Official Statement: “The implementation of Coretax represents a fundamental modernization of Indonesia’s tax administration system, designed to improve service quality and compliance efficiency.” – Director General of Taxes, January 2025⁴

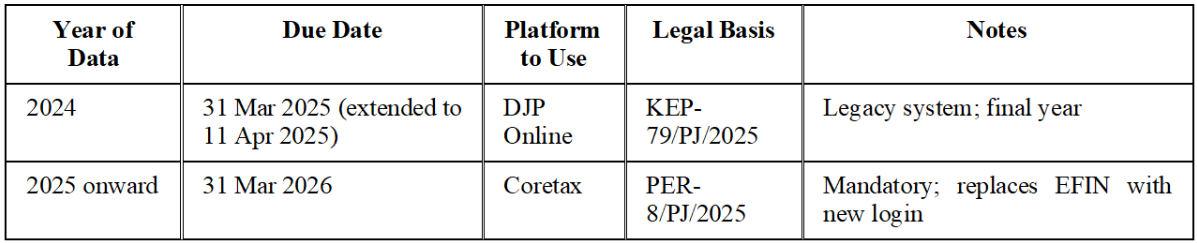

Based on KEP-79/PJ/2025 and official DJP announcements:

Action Required: Complete 2024 filing in DJP Online by April 11, 2025, then establish Coretax account before next season, as per DGT Circular SE-07/PJ/2025.

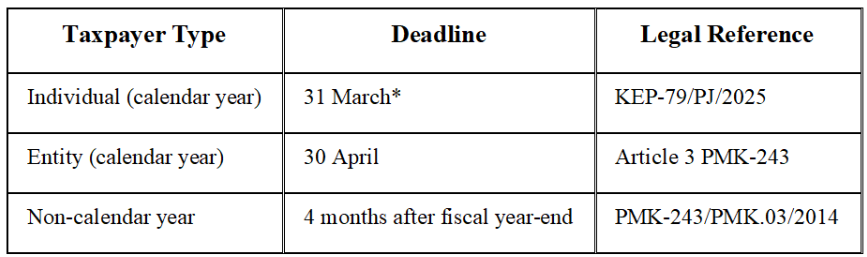

According to Article 3 of Law No. 36/2008:

Individuals (Orang Pribadi):

Entities (Badan):

Non-residents:

Different rules apply per PMK-215/PMK.03/2023

Expert Insight: “Many SMEs mistakenly believe they don’t need to file if they’re unprofitable. This is incorrect – filing obligations exist regardless of financial results.”

Per KEP-79/PJ/2025 and Article 3 PMK-243/PMK.03/2014:

*Extension to 11 April 2025 for 2024 data only per DGT Announcement April 1, 2025; payment still due 31 March.

Identity Documents:

Financial Statements:

Withholding Slips (Bukti Potong):

Expense & Asset Records:

Tax Payment Proofs:

Client Testimonial: “The documents audit provided by JCSS Indonesia was incredibly helpful. We avoided the usual last-minute scramble and filed stress-free.”

2024 Return Filing via DJP Online (Deadline: April 11, 2025)

Step 1: System Access

Step 2: Form Selection

Step 3: Data Entry Process

Step 4: Document Upload

Step 5: Validation & Submission

Account Creation Process:

Key Differences from DJP Online:

System Administrator Note: “Coretax represents a significant improvement in user experience while maintaining the same underlying tax calculation rules.” – DGT IT Systems Division

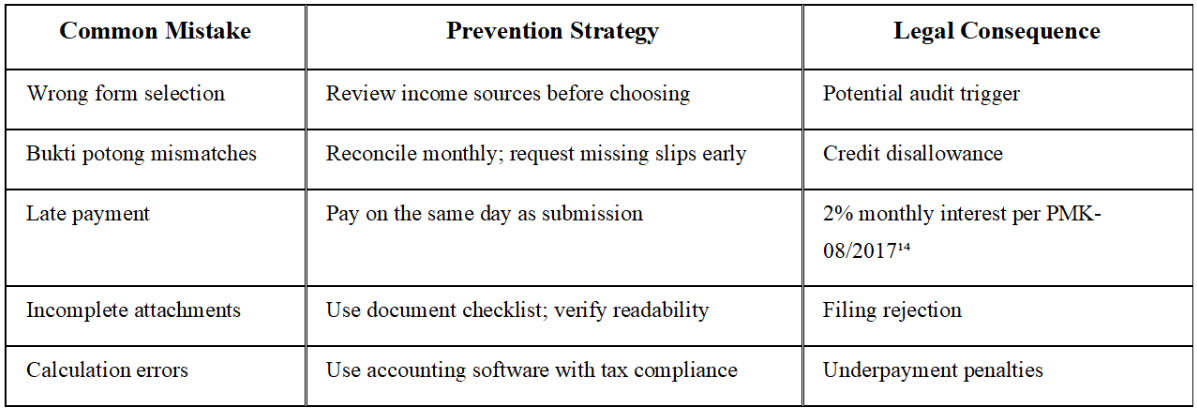

Expert Tip: “The most common mistake we see is SMEs using Form 1770 S when they should use 1770. This happens when business income isn’t properly categorized.”

Penalty Structure per PMK-08/PMK.04/2017:

Correction Process:

Storage Requirements per PMK-252/PMK.03/2008:

Monthly Best Practices:

2026 Preparation Strategy:

Q: What is SPT Tahunan exactly?

A: SPT Tahunan is the mandatory annual income tax return that must be submitted to DGT, containing comprehensive information about your yearly income, expenses, and tax obligations as defined in Law No. 36 of 2008.

Q: When is the absolute deadline for SPT Tahunan 2025?

A: March 31, 2025 for individuals and April 30, 2025 for entities filing calendar year returns, as specified in KEP-79/PJ/2025⁵. The April 11 extension applies only to 2024 data.

Q: Do startups need transfer pricing documentation?

A: Yes, if related-party transactions exceed IDR 5 billion annually, as per PMK-213/PMK.03/2016¹⁵.

Q: What are penetration testing costs in Jakarta?

A: IDR 45–90 million per application, depending on scope and complexity.

Q: Is zero trust suitable for SMEs?

A: Recommended for companies with 30+ employees and high-sensitivity data requirements.

Our Free Resources:

[2025 Tax Calendar] – All critical deadlines and requirements

Have questions about Coretax setup, complex tax filings, or compliance strategies? Schedule a complimentary 15-minute consultation with our licensed tax experts.

Contact: [Email: [email protected]] | Schedule Online: [Booking Link]

Our Credentials:

Disclaimer: This guide provides general information only. Specific situations may require professional consultation. Tax regulations are subject to change.

Yolda kaldığınızda Bafra çekici ekibi en kısa sürede yanınızda olur. Bafra oto yol yardım hizmeti, hem şehir içi hem de şehirlerarası güvenli çözümler sunar. Bafra oto kurtarma, arızalı araçları güvenli şekilde taşır. Bafra oto yol yardım her zaman ulaşılabilir durumdadır.

Nice awesome amazing brilliant strange amazing crazy love helpful random fantastic wonderful strange perfect interesting.

Situs Pasti Scam Indonesia, BOKEP JAPAN KONTOL KAU

link Bangsawan88

Yang penting tetap main santai dan jangan terbawa emosi, walaupun https://coqui.ai/ slot gacor kadang bisa bikin nagih.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://accounts.binance.com/ru-UA/register-person?ref=JVDCDCK4

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thank you for the good writeup. It in fact was a amusement account it.

Look advanced to more added agreeable from you! However, how could we communicate?

Your article helped me a lot, is there any more related content? Thanks!

Ahaa, its fastidious dialogue about this article at this place at

this weblog, I have read all that, so now me also commenting here.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://accounts.binance.com/it/register-person?ref=P9L9FQKY

Hello there! This article couldn’t be written any better!

Going through this post reminds me of my previous roommate!

He continually kept preaching about this. I’ll forward

this article to him. Fairly certain he will have a good read.

Many thanks for sharing!

Hi my loved one! I wish to say that this post is awesome, great written and come

with almost all important infos. I’d like

to look extra posts like this .

I am really impressed with your writing skills as well as with the

layout on your blog. Is this a paid theme or did you modify it yourself?

Either way keep up the nice quality writing, it is rare to see a

nice blog like this one today.

Write more, thats all I have to say. Literally, it seems

as though you relied on the video to make your point.

You definitely know what youre talking about, why throw away your intelligence

on just posting videos to your blog when you could be giving us something informative to read?

I must thank you for the efforts you have put in writing this blog.

I am hoping to view the same high-grade content by you in the

future as well. In truth, your creative writing abilities has motivated me to get my own site now 😉

Thank you for the good writeup. It in fact was a amusement

account it. Look advanced to far added agreeable from you! By the way, how could we communicate?

Hi there, all is going sound here and ofcourse every one

is sharing data, that’s actually good, keep up writing.

Cheers, A lot of write ups.

Please let me know if you’re looking for a author for your weblog.

You have some really good articles and I feel I would be a

good asset. If you ever want to take some of the load off, I’d really like to write some material

for your blog in exchange for a link back

to mine. Please blast me an email if interested.

Many thanks!

Hello there, You’ve done a great job. I’ll certainly digg it and personally recommend to my friends.

I am confident they’ll be benefited from this site.

I’ll immediately snatch your rss as I can’t find your email subscription hyperlink or

e-newsletter service. Do you’ve any? Kindly permit me understand in order that I

may subscribe. Thanks.

Its not my first time to pay a visit this site, i am browsing this web site

dailly and take nice data from here daily.

It’s going to be end of mine day, but before finish I am reading this fantastic

paragraph to increase my know-how.

I do accept as true with all the concepts you’ve

offered on your post. They’re very convincing and can certainly work.

Nonetheless, the posts are very short for beginners.

Could you please prolong them a little from subsequent time?

Thanks for the post.

Very rapidly this site will be famous amid all blogging and site-building users, due to it’s nice posts

Woah! I’m really enjoying the template/theme of this website.

It’s simple, yet effective. A lot of times it’s very difficult to get that “perfect balance” between usability and appearance.

I must say you have done a excellent job with this.

In addition, the blog loads super quick for me on Firefox.

Superb Blog!

Howdy, i read your blog occasionally and i own a similar one and i was just curious if you get a lot

of spam remarks? If so how do you reduce it, any plugin or anything you can recommend?

I get so much lately it’s driving me insane so any support

is very much appreciated.

Just wish to say your article is as amazing.

The clarity in your post is simply cool and i can assume you are an expert on this subject.

Well with your permission let me to grab your feed to keep up to date

with forthcoming post. Thanks a million and please

continue the rewarding work.

We stumbled over here from a different web address and thought

I may as well check things out. I like what I see so now i am following you.

Look forward to checking out your web page repeatedly.

This site was… how do I say it? Relevant!!

Finally I’ve found something which helped me. Appreciate it!

I don’t know whether it’s just me or if perhaps everyone else

encountering issues with your site. It appears as if some of the written text

within your posts are running off the screen. Can someone else please comment and let me

know if this is happening to them as well? This

may be a issue with my web browser because I’ve had this happen before.

Kudos

Hello there, I found your site by the use of Google while looking

for a related subject, your website got here up, it seems to be

good. I’ve bookmarked it in my google bookmarks.

Hello there, simply become alert to your weblog through

Google, and found that it is really informative.

I’m going to watch out for brussels. I’ll be

grateful in the event you continue this in future. Many people will be

benefited from your writing. Cheers!

Your article helped me a lot, is there any more related content? Thanks! https://www.binance.com/pt-BR/register?ref=GJY4VW8W

I’m really impressed along with your writing skills as well as with the layout for your blog.

Is that this a paid subject matter or did you modify it yourself?

Anyway keep up the nice quality writing, it’s uncommon to see a

great weblog like this one today..

Great goods from you, man. I have understand your stuff previous

to and you’re just too fantastic. I really like what you’ve acquired here, certainly like what

you’re saying and the way in which you say it. You

make it enjoyable and you still take care of to keep it sensible.

I can not wait to read far more from you. This is really a

terrific website.

Hey there! I’ve been reading your site for a long time now and finally got the bravery to go ahead and give you

a shout out from New Caney Texas! Just wanted to say

keep up the excellent job!

Hi there, constantly i used to check weblog posts here early in the break of day,

for the reason that i enjoy to learn more and more.

If you are going for best contents like myself, simply visit this web page every day as it presents feature contents, thanks

Hello There. I found your weblog the usage of msn. This is an extremely smartly written article.

I will be sure to bookmark it and come back to read extra

of your helpful info. Thanks for the post. I’ll certainly comeback.

Quality articles or reviews is the key to be a focus for the viewers to visit the site, that’s what

this web page is providing.

Thanks for finally writing about > SPT Tahunan for Indonesian SMEs in 2025: Complete Filing Guide

with Coretax System – JCSS-Indonesia < Liked it!

I really like your blog.. very nice colors & theme. Did you make this website yourself or did you hire someone

to do it for you? Plz respond as I’m looking to construct my own blog and would like to know where u got this

from. appreciate it

An impressive share! I have just forwarded this onto a friend who had been conducting a little homework on this.

And he in fact ordered me lunch simply because I found it for him…

lol. So allow me to reword this…. Thank YOU for the

meal!! But yeah, thanks for spending the time to talk about this issue

here on your web page.