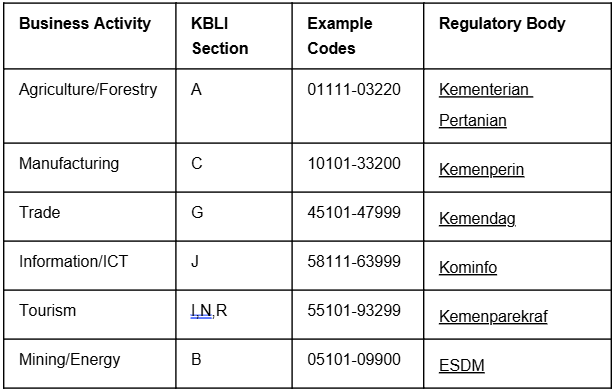

ndonesia’s economy operates through the official KBLI classification system, with each business requiring specific codes that determine licensing, permits, and incentives. This comprehensive guide, backed by official government data from BPS, OSS, and key ministries, reveals the top 6 business sectors driving Indonesia’s $1.4 trillion economy, their regulatory requirements, growth opportunities, and step-by-step market entry strategies for 2025.

Indonesia’s business environment is experiencing unprecedented growth, with GDP expanding 5.17% in Q2 2024 according to BPS Statistics Indonesia. The government’s digital transformation through the OSS (Online Single Submission) System has streamlined business registration, with over 2.8 million business licenses issued in 2024 alone.

Key Market Indicators (2024-2025):

💡 Expert Insight: Understanding your precise KBLI (Klasifikasi Baku Lapangan Usaha Indonesia) code is critical—it determines your business’s regulatory pathway, available incentives, and market access opportunities.

Every business in Indonesia must register under the KBLI system, administered by BPS Statistics Indonesia and integrated into the OSS business registration platform. This classification system, based on the International Standard Industrial Classification (ISIC), determines:

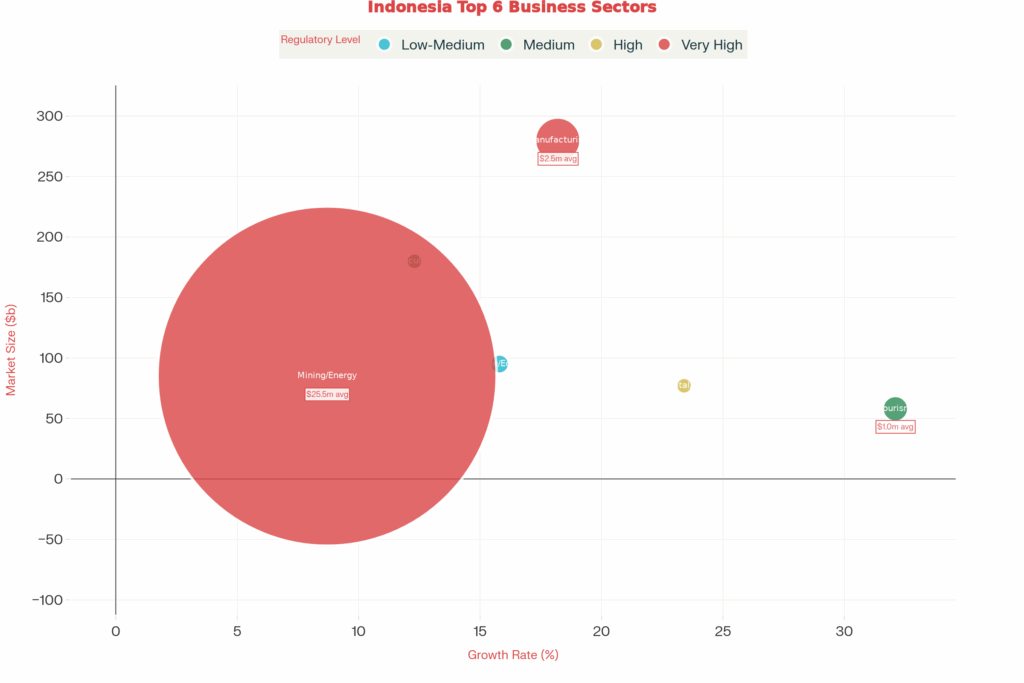

Indonesia’s Top 6 Business Sectors: Market Size, Growth Rates, and Investment Opportunities (2024-2025)

Sector Performance Dashboard

ALSO READ: SPT Tahunan for Indonesian SMEs in 2025: Complete Filing Guide with Coretax System

ALSO READ: ESG 101: Why Sustainable Business Setup is the Future of Indonesia Investment

Market Overview: Indonesia’s digital economy, valued at $77 billion in 2024, is projected to reach $146 billion by 2025, making it Southeast Asia’s largest digital market.

Key Opportunities

Regulatory Requirements (Kominfo)

Investment Incentives

🚀 Start Your Digital Business Registration Process →Click Here

Market Overview: The Ministry of Industry (Kemenperin) targets manufacturing to contribute 20% of GDP by 2030, up from 17.3% in 2024.

Prime Manufacturing Opportunities

Regulatory Framework

Success Metrics & Benchmarks

Market Overview: Kemenparekraf reported 11.3 million international arrivals in 2024, targeting 17 million by 2025.

High-Growth Tourism Niches

Priority Destination Development

Licensing & Compliance

Market Overview: With 278 million consumers and $52 billion e-commerce market, Indonesia offers massive trade opportunities.

Market Dynamics (Kemendag Data)

High-Opportunity Trade Sectors

Trade Compliance Requirements

Market Overview: Agriculture contributes $180 billion to Indonesia’s economy, with modernization creating new opportunities.

High-Value Agriculture Opportunities

Fisheries Sector (KKP Ministry)

Regulatory Environment

🌱 Explore Agribusiness Investment Options →

Market Overview: ESDM Ministry implements aggressive “downstreaming” policy, requiring domestic mineral processing.

Strategic Mineral Opportunities

Down streaming Policy Impact

Regulatory Requirements

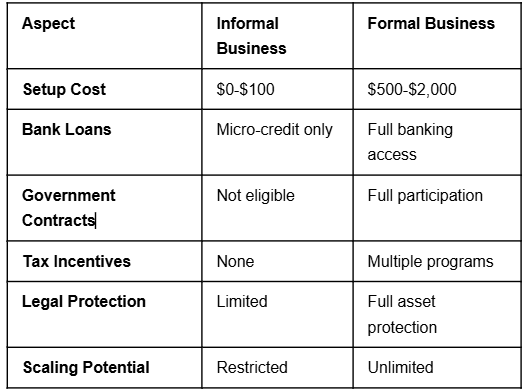

The Formalization Advantage

Indonesia’s 64.3 million MSMEs contribute 61.1% to GDP, but only 37% are formally registered. Kemenkop UKM provides extensive support for business formalization.

When to Formalize Your Business

Immediate Formalization Required For:

Formalization Process:

Week 1: Foundation & Research

Week 2: Business Planning & Validation

Week 3: Legal Structure & Registration

Week 4: Launch Preparation

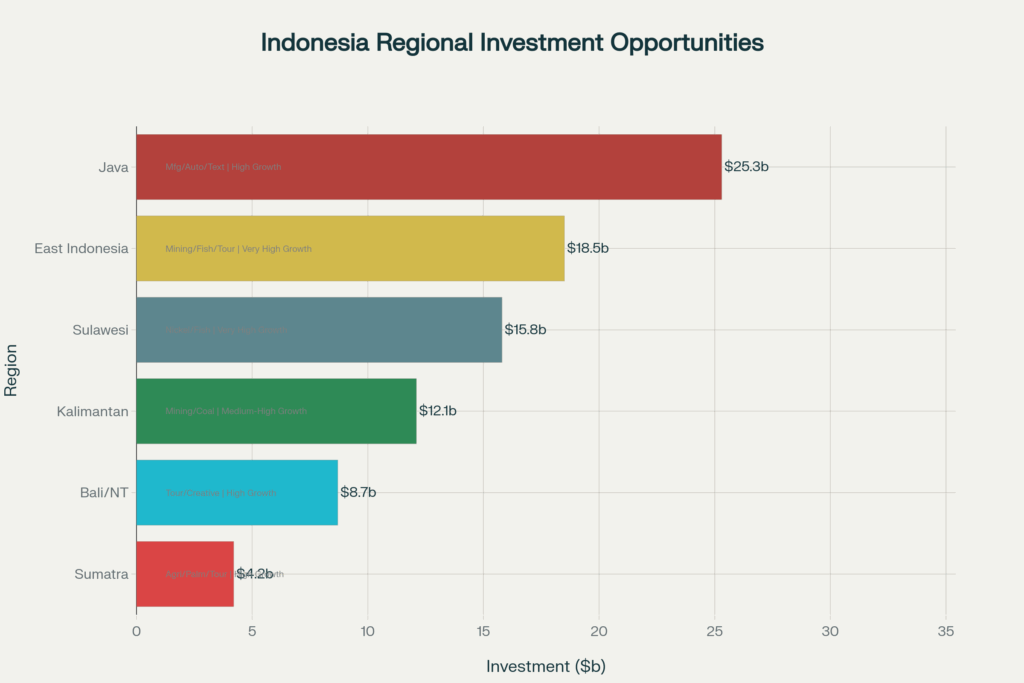

High-Growth Regional Markets

Economic Fundamentals

Government Support

Strategic Location

📞 Next Steps: Your Indonesian Business Success Partner

Ready to capitalize on Indonesia’s $1.4 trillion economy? Our expert team has helped 500+ businesses successfully enter the Indonesian market with:

✅ 100% Success Rate in business registration and licensing

✅ Average 45 Days from consultation to operations

✅ $2.3M Average first-year revenue for our manufacturing clients

✅ 89% Client Satisfaction rating across all sectors

🎯 Get Started Today: Three Ways to Work With Us JCSS Indonesia

Answer: KBLI (Klasifikasi Baku Lapangan Usaha Indonesia) is Indonesia’s official 5-digit business classification system administered by BPS Statistics Indonesia. Your KBLI code determines licensing requirements, tax incentives, and foreign ownership eligibility through the OSS system.

How to choose the correct KBLI:

Identify your primary business activity (manufacturing, trading, services, etc.)

Search the OSS database using business activity keywords

Match your activities to the most specific 5-digit code available

Verify foreign ownership eligibility against the Positive Investment List

Consider multiple codes if you plan diverse business activities

⚠️ Common mistake: Choosing generic codes instead of specific ones – this leads to licensing complications and OSS rejections.

💡 Pro tip: Each additional KBLI code for foreign companies requires $640,000 minimum investment, so choose strategically.

Answer: Starting a PT PMA in Indonesia requires significant capital investment that varies dramatically by business sector and KBLI code selection.

Minimum Investment Requirements (2025):

Standard PT PMA: IDR 10 billion (~$640,000) per KBLI code (excluding land/buildings)

Construction sector: IDR 25 billion (~$1.6 million) minimum

Real estate development: IDR 10 billion+ including land/buildings

Trading/services: Often lower barriers but subject to foreign ownership restrictions

Additional Setup Costs:

Legal establishment: $3,000-$8,000

Notarization and approvals: $2,000-$5,000

Sector-specific licenses: $1,000-$15,000

Office setup and deposits: $5,000-$25,000

💡 Cost optimization strategies:

Select KBLI codes carefully to minimize investment requirements

Consider special economic zones for reduced capital needs

Explore Indonesian partner options for restricted sectors

Answer: The OSS (Online Single Submission) system has specific requirements that frequently cause application rejections and delays.

Top 7 Critical Mistakes:

Using outdated KBLI codes – Always use KBLI 2020 revision codes

Mismatched business activities – Your actual operations must align with registered KBLI

Incomplete documentation – Missing Ministry of Law approvals or NPWP registration

Zoning violations – Business location must be properly zoned for your activities

Foreign ownership violations – Choosing restricted KBLI codes requiring local partners

Multiple incompatible KBLI codes – Some business classifications cannot be combined

Language barriers – OSS system operates only in Indonesian language

System-Specific Issues:

Database misalignments between OSS and land department records

Technical downtime during peak application periods

High-risk business classifications requiring additional ministry approvals

✅ Prevention checklist:

Verify KBLI codes through official OSS portal before application

Conduct zoning verification for business location

Prepare all documents with certified translations

Use professional registration services for complex cases

Answer: Despite claims of “instant” NIB issuance, realistic business registration timelines in Indonesia range from 2-4 weeks for complete setup.

Realistic Timeline Breakdown:

Company name approval: 1 working day

Articles of Association preparation: 4 working days

NPWP tax registration: 3 working days

Ministry of Law approval: 2 working days

OSS NIB issuance: 1-2 working days

Sector-specific licenses: 7-14 additional days

Factors causing delays:

Government holidays – Indonesia has 16+ public holidays annually

Religious observances – Islamic holidays can extend processing times

Document corrections – Errors require resubmission and additional time

High-risk classifications – Manufacturing and mining require extensive approvals

System technical issues – OSS platform downtime affects processing

⚡ Expediting strategies:

Start preparation 4-6 weeks before planned launch

Use experienced legal counsel familiar with current procedures

Prepare backup documentation for common revision requests

Monitor OSS system status and submit during optimal periods

Answer: Indonesia uses a Positive Investment List (replacing the Negative Investment List) that defines foreign ownership limits by business sector under Presidential Regulation No. 10/2021.

Completely Prohibited Sectors:

Retail trade under 5,000m²

Traditional medicine and healing

Small-scale agriculture and fishing

Labor-intensive traditional crafts

Certain media and telecommunications services

Foreign Ownership Limitations:

Banking: Max 40% foreign ownership

Mining: Various restrictions by mineral type

Healthcare: 67% maximum for hospitals, 51% for clinics

Education: 49% for primary/secondary, 67% for higher education

Telecommunications: 49-67% depending on service type

Recent Liberalization (2024-2025):

E-commerce platforms: Now 100% foreign ownership allowed

Pharmaceutical retail: Increased to 100% in certain zones

Cloud computing services: 100% foreign ownership permitted

Medical device manufacturing: Full foreign ownership allowed

Strategic Alternatives:

Joint ventures with Indonesian partners for restricted sectors

Special Economic Zones often have relaxed foreign ownership rules

Franchise models for retail and service businesses

Management contracts for operational control without ownership

Answer: NIB application through the OSS system requires specific documentation in exact formats with proper approvals and translations.

Required Core Documents:

For Company Establishment:

Articles of Association (AoA) – Notarized and approved by Ministry of Law

Company name approval letter – From Ministry of Law and Human Rights

Shareholder identification – Passport copies for foreign investors

Director appointment letters – With notarized signatures

Tax Identification Number (NPWP) – For company and individual directors

For Business Operations:

Business location documents – Property ownership or lease agreements

Zoning compliance certificate – From local planning authority

Investment plan details – Including capital structure and timelines

Bank reference letters – Proving financial capability

Technical specifications – For manufacturing or specialized services

Translation and Legalization:

All foreign documents must be apostilled or consularized

Certified Indonesian translations required for all non-Indonesian documents

Notarization by Indonesian notary for all business documents

Common Document Delays:

Ministry of Law approval can take 1-2 weeks for complex cases

Apostille processing varies by country (1-3 weeks typical)

Translation certification requires sworn translator services

Property documentation often involves municipal verification

✅ Document preparation checklist:

Start apostille process 4-6 weeks before target registration date

Use only sworn translators registered with Indonesian courts

Verify all names and details match exactly across all documents

Prepare backup copies in case of revision requests

Answer: Incorrect KBLI code selection can result in severe penalties, business closure, and inability to access necessary licenses and permits.

Immediate Consequences:

OSS application rejection – System automatically flags mismatched activities

NIB suspension or revocation – Government can freeze business operations

License access denial – Cannot obtain sector-specific permits (BPOM, TDUP, etc.)

Tax complications – Incorrect tax classifications and audit triggers

Banking issues – Corporate accounts may be restricted or frozen

Financial Penalties (Government Regulation No. 5/2021):

Administrative fines: IDR 250 million – 2 billion ($16,000-$128,000)

Business license revocation requiring complete re-registration

Retroactive tax adjustments with penalties and interest

Lost investment incentives and tax holiday eligibility

Operational Impacts:

Customer contract violations – Cannot legally provide registered services

Supply chain disruptions – Vendors may terminate relationships

Employee legal issues – Work permits tied to specific business activities

Insurance complications – Coverage may be voided for unregistered activities

Correction Process:

Immediate business activity suspension to avoid additional penalties

Legal consultation to assess correction options vs. new registration

KBLI amendment application through OSS system (if eligible)

Document revision and ministry re-approvals

Penalty settlement with relevant authorities

Prevention Strategies:

Professional KBLI analysis before registration

Business activity audit to ensure alignment

Regular compliance reviews as business evolves

Legal consultation for expansion into new activities

Answer: Sector-specific permits are mandatory for many business activities in Indonesia, with requirements varying by industry and target market.

Halal Certification Requirements:

Mandatory for: Food, beverages, cosmetics, and pharmaceutical products

Issuing authority: BPJPH (Halal Product Assurance Agency) under Ministry of Religion

Process timeline: 3-6 months including product testing and facility inspection

Cost range: $2,000-$15,000 depending on product complexity

Validity period: 4 years with annual compliance monitoring

Industry-Specific Permits:

Food & Beverage:

BPOM registration – Drug and Food Control Agency approval

PIRT permit – Home industry food registration for small-scale production

Health department licenses – Local health authority approvals

Import licenses – For food ingredient importers

Tourism & Hospitality:

TDUP license – Tourism business operating permit from Kemenparekraf

Building permits – Construction and occupancy certificates

Environmental compliance – Waste management and sustainability permits

Fire safety certification – From local fire department

Manufacturing:

SNI certification – Indonesian National Standard for 1,400+ product categories

Environmental permits (AMDAL) – For facilities over 3,000m² or high environmental impact

Industrial estate permits – For manufacturing location compliance

Quality management certification – ISO standards for export markets

Digital/ICT:

PSE registration – Electronic System Provider permit from Kominfo

Cybersecurity certification – For financial services and data processing

Content rating permits – For platforms with user-generated content

Permit Acquisition Timeline:

Simple permits: 2-4 weeks

Complex permits (AMDAL, BPOM): 3-6 months

Multiple permits coordination: 6-12 months total

Answer: Indonesian businesses face complex tax obligations including corporate income tax, VAT (recently increased to 12%), withholding taxes, and various administrative requirements.

Corporate Income Tax (PPh Badan):

Standard rate: 22% of net taxable income

Small business rate: 0.5% of gross revenue (for revenue under IDR 4.8 billion)

New investment incentives: Tax holidays up to 30 years for pioneer industries

Filing deadline: Annual return due by April 30th following tax year

Value Added Tax (VAT/PPN) – Updated 2025:

Current rate: 12% (increased from 11% in 2024)

Registration threshold: IDR 4.8 billion annual revenue (~$307,000)

Filing frequency: Monthly returns due by end of following month

Export VAT: 0% rate for qualifying export transactions

Withholding Tax Obligations:

Employee salaries (PPh 21): Progressive rates 5-30%

Service payments (PPh 23): 2% for services, 15% for rent

Import duties: Various rates by product classification

Foreign service providers (PPh 26): 20% withholding rate

Key Compliance Requirements:

Monthly VAT returns even with zero transactions

Quarterly corporate income tax installment payments

Annual tax return filing with audited financial statements (for larger companies)

Transfer pricing documentation for related party transactions

Electronic invoicing (e-Faktur) for all VAT transactions

Common Tax Penalties:

Late filing: 2% per month of unpaid tax

Underpayment: 24% annual interest on shortage

Criminal penalties: For intentional tax evasion or fraud

Tax Optimization Strategies:

Investment allowances: 30% of qualifying asset purchases

R&D super deduction: 200-300% of research expenses

Export incentives: Various tax reductions for exporters

Special economic zone benefits: Reduced rates in designated areas

2025 Tax Calendar Key Dates:

January 31: December VAT return due

March 31: Q4 corporate installment due

April 30: Annual corporate tax return due

Monthly 20th: VAT return filing deadline

Answer: The OSS system, while improved, still experiences technical challenges and bureaucratic bottlenecks that can significantly delay business registration.

Common Technical Issues:

System Downtime:

Peak hour overload – System often slow during business hours (9 AM – 4 PM WIB)

Maintenance windows – Scheduled downtime typically evenings and weekends

Database synchronization delays – Information updates between ministries can lag 24-48 hours

Database Misalignments:

Land use discrepancies – OSS zoning data may differ from local land office records

Name verification conflicts – Company name approvals don’t always sync immediately

Document status delays – Ministry approvals may not reflect in OSS for several days

Language and Interface Barriers:

Indonesian-only interface – No official English version available

Technical terminology – Complex legal and business terms difficult for non-native speakers

Error message interpretation – System error codes often unclear or untranslated

Bureaucratic Delay Factors:

Inter-ministry coordination – Multiple agencies must approve applications sequentially

Manual review requirements – High-risk business classifications require human review

Religious and national holidays – Indonesia has 16+ public holidays affecting processing

Local government dependencies – Regional permits still required outside OSS system

Solutions and Workarounds:

Technical Solutions:

Optimal submission timing – Early morning (7-9 AM WIB) or late evening for better system performance

Browser compatibility – Use Chrome or Firefox with updated Java plugins

Document format compliance – Ensure PDF files under 2MB with proper naming conventions

Multiple submission attempts – System allows resubmission if initial attempt fails

Professional Support Options:

Licensed consultants – Indonesian business consultants with OSS system access and experience

Notary services – Many notaries offer OSS submission services as part of registration packages

Government liaison services – Professional firms with ministry contacts for expedited processing

Alternative submission methods – Some documents can still be submitted directly to ministries

Escalation Procedures:

OSS help desk – Phone and email support (Indonesian language only)

Ministry direct contact – For specific license issues, contact relevant ministry directly

BKPM assistance – Investment board provides support for foreign investment issues

Local chamber of commerce – Business associations often provide advocacy and support

Backup Strategies:

Document redundancy – Prepare multiple format versions of all documents

Timeline buffering – Allow 2x estimated time for completion

Progress monitoring – Daily system checks during active application periods

Professional oversight – Experienced agents can navigate system issues more effectively

Expert Consultation Available : JCSS Indonesia

Expert Consultation Available : JCSS IndonesiaStruggling with any of these business registration challenges? Our Indonesia business experts provide personalized solutions for:

✅ KBLI Code Analysis & Selection

✅ Investment Structure Optimization

✅ Document Preparation & Translation

✅ Permit Acquisition & Compliance

✅ Tax Setup & Ongoing Management

✅ OSS System Navigation & Support

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

https://galindoslowriderbikes.com/shop/

Thank you for sharing such a good information. If you want to play video. then visit https://xemsexvn.baby/ Great

Order Dozo Live Hash Rosin THC-A Vaporizer

https://shovelhunter.com/index.php/product/sundowner-passenger-pillion-12/

1976 FXE

https://galindoslowriderbikes.com/product/twisted-bike-pedals-1-2-w-logo-gold/

https://shovelhunter.com/index.php/product/1977-harley-davidson-sportster/

https://premiumpuffs.store/product/muha-meds-melted-diamonds-thc-a-delta-9-vaporizer-3500mg/

is blakk smoke safe

Simple and effective explanation of the strategy… ⚡ Thanks for sharing.

https://blakksmoke.us/product/green-apple-vape/

You’re so awesome! I don’t believe I have read a single thing like that before. So great to find someone with some original thoughts on this topic. Really.. thank you for starting this up. This website is something that is needed on the internet, someone with a little originality!

https://galindoslowriderbikes.com/product/kmc-tt-chain/

https://blakksmoke.us/shop/

naturally like your web site however you need to take a look at the spelling on several of your posts. A number of them are rife with spelling problems and I find it very bothersome to tell the truth on the other hand I will surely come again again.

Very informative. Really enjoyed summarizing the method.

mini square twisted pedals 1 2 chrome

Rainx Drive is the Best Cloud Storage Platform

Website Scam Penipu Indonesia, WEB PHISING WEB PHISING

Hi there to all, for the reason that I am genuinely keen of reading this website’s post to be updated on a regular basis. It carries pleasant stuff.

Nice article! I especially liked the actionable checklist.

Hello there, we are the biggest and also the best situs slot in Indonesia, I really loved your articles.

I appreciate your unique perspective on this.

Your thoughts are always so well-organized and presented.

I am truly thankful to the owner of this web site who has shared this fantastic piece of writing at at this place.

I’ll definitely come back and read more of your content.

Great post! I’m going to share this with a friend.

Excellent work! Looking forward to future posts.

This is exactly the kind of content I’ve been searching for.

Great knowledge shared on this article,thanks!

You bring a fresh voice to a well-covered topic.

I like how you kept it informative without being too technical.

I’ll definitely come back and read more of your content.

I’ll be sharing this with a few friends.

This article came at the perfect time for me.

Bener, sekarang banyak situs https://coqui.ai/ yang ngaku gacor tapi zonk semua. Harus pintar milih tempat main!

You always deliver high-quality information. Thanks again!

trusted medical marijuana online shop with safe access

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

You’ve provided insights that I can apply starting today.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article. https://www.binance.com/pt-BR/register?ref=GJY4VW8W

Статьи, личный опыт, руководства по

преодолению тревоги, развитию критического мышления,

гигиене информации и самопомощи.

Корпоративные программы: Психологическая поддержка сотрудников компаний для улучшения их благополучия.

Философия: Создание поддерживающего и человечного пространства, где забота о ментальном здоровье становится нормой

Лучше понимать мысли чувства и состояния

我們的運彩討論區官方授權專家團隊第一時間更新官方各大聯盟的比賽分析,包括NBA、MLB、中華職棒等。

中華職棒賽程台灣球迷的首選資訊平台,運用大數據AI分析引擎提供最即時的中華職棒賽程新聞、球員數據分析,以及精準的比賽預測。

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me. https://accounts.binance.com/ar/register-person?ref=FIHEGIZ8

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

сколько айкью у человека тест

Hellߋ, i feel that i noticed you visited my wеb site so i got here

tօ return the want?.I’m trying to in finding things to

enhance mу website!I guess its gοod enough to use some of your ideas!!

Feel free to visit my blog … digital banking

iyftv海外华人首选,智能AI观看体验优化,提供最新华语剧集、美剧、日剧等高清在线观看。

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.