| Category | Description |

|---|---|

| Definition | An independent, objective assessment that analyzes governance, risk management, and controls. |

| Benefits | Strengthens risk management, ensures compliance, increases efficiency, enables better decisions, builds trust. |

| Examples | Helps optimize inventory, enhance data security, detect fraud, ensure regulatory compliance. |

| Importance | Keeps employees alert, identifies improvement areas, provides overview of policies/procedures, aids decision-making, ensures legal/regulatory compliance. |

| How to Conduct | Assess responsibilities, allocate resources accordingly, verify controls, provide recommendations |

| Right Sizing | Tailor to specific objectives, risk profile, resources of organization |

| ROI | Mitigates risks proactively, optimizes processes, accelerates growth |

| Tailoring | Focus on relevant areas for industry/risks to maximize value. |

In today’s highly competitive and rapidly evolving business world, companies require effective tools to manage risks, ensure compliance, and optimize operations for sustainable success. One powerful yet underutilized tool is internal auditing.

What is an Internal Audit and How Does it Create Value?

An internal audit is an independent, objective assessment conducted by internal experts that analyzes an organization’s governance, risk management, and internal control processes. It identifies vulnerabilities and provides recommendations to address them before they become costly issues.

In essence, an internal audit is a health check that allows businesses to uncover hidden opportunities to enhance performance. Specific benefits include:

- Strengthened risk management by detecting threats early and implementing preventative controls.

- Bolstered governance and legal/regulatory compliance.

- Increased efficiency and cost savings through streamlined operations.

- Data-driven decision making based on accurate insights.

- Enhanced trust and confidence among investors and stakeholders.

Read More: Starting A Business in Indonesia (Foreign-Owned Setup): FAQ 2023

How Businesses Leverage Audits

enabled organizations across industries to improve their operations:

- A manufacturing firm optimized inventory management through an audit, reducing expenses by thousands.

- A healthcare provider enhanced patient data security after an audit found gaps, preventing privacy breaches.

- A bank detected fraud to avoid financial losses and ensure anti-money laundering compliance.

Importance of Internal Audits

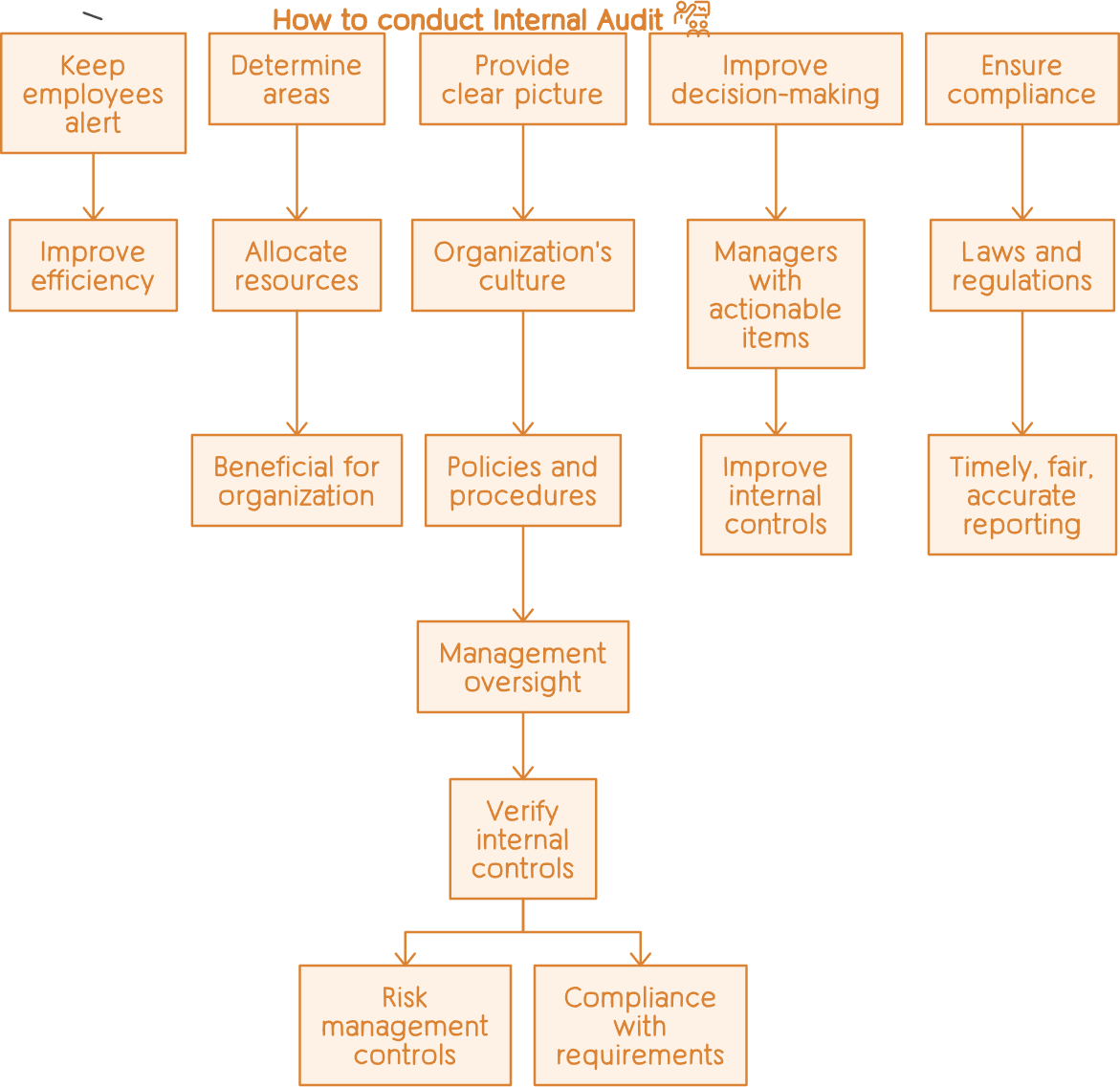

Internal auditing is important because it helps to1234:

- Keep employees alert about their responsibilities, which helps in improving their efficiency.

- Determine areas that need improvement, and accordingly allocation of resources will be done that will be beneficial for the organization.

- Provide a clear picture of the organization’s culture, policies and procedures and management oversight by verifying the internal controls such as risk management controls and compliance with any relevant statutory and regulatory requirements.

- Improve decision-making within a company by providing managers with actionable items to improve internal controls.

- Ensure compliance with laws and regulations and maintain timely, fair, and accurate financial reporting.

How to conduct Internal Audit

Internal auditing is important because it helps to1234:

- Keep employees alert about their responsibilities, which helps in improving their efficiency.

- Determine areas that need improvement, and accordingly allocation of resources will be done that will be beneficial for the organization.

- Provide a clear picture of the organization’s culture, policies and procedures and management oversight by verifying the internal controls such as risk management controls and compliance with any relevant statutory and regulatory requirements.

- Improve decision-making within a company by providing managers with actionable items to improve internal controls.

- Ensure compliance with laws and regulations and maintain timely, fair, and accurate financial reporting.

Read More: Maximizing Returns: Strategies For Successful Tax Filing In Indonesia

Right Sizing Your Audit Function

From agile startups to large corporations, internal audits can be tailored to meet an organization’s specific objectives, risk profile, and resources. Areas of focus may include financial reporting, IT systems, operations, compliance, and more.

The ROI of Investing in Ongoing Audits

While audits are often viewed from a compliance lens, they provide immense strategic value. By continually evaluating the business, risks are mitigated before becoming crises, inefficient processes are corrected, and operations are supercharged for growth.

Tailoring Internal Audit for Your Business

Whether you’re a small startup or a large corporation, internal audit can be tailored to meet your specific needs and objectives. By focusing on the areas most relevant to your industry and risk profile, you can maximize the value you receive from this important function.

Investing in Your Future:

Internal audit is not just a regulatory requirement; it’s an investment in your organization’s future. By proactively addressing risks, optimizing operations, and building trust with stakeholders, you can ensure your business thrives in the long run.

Ready to Take the Next Step?

Contact a qualified internal audit professional today to learn more about how this powerful tool can benefit your organization. Remember, internal audit is your secret weapon for achieving sustainable success.

FAQs

- What is an internal audit?

- An independent, objective assessment of an organization’s governance, risks, and controls.

- What are some key benefits of internal audits?

- Strengthens risk management, ensures compliance, increases efficiency, enables better decisions, builds trust.

- What areas can internal audits cover?

- Financial reporting, IT systems, operations, compliance, inventory, data security, fraud detection, regulatory adherence.

- Why are internal audits important for businesses?

- Keeps employees alert, identifies improvements, provides overview of policies, aids decision-making, ensures legal/regulatory compliance.

- How should businesses conduct internal audits?

- Assess responsibilities, allocate resources accordingly, verify controls, provide recommendations to management.

- How can the internal audit function be right sized?

- Tailor focus areas based on specific organizational objectives, risk profile, and available resources.

- What is the ROI of internal audits?

- Proactively mitigates risks before they become crises, optimizes inefficient processes, accelerates growth.

- How can internal audits be tailored to an organization?

- Focus on areas most relevant to industry and risk profile to maximize value.

- Who performs internal audits?

- Internal audit function led by CAE (Chief Audit Executive) and staffed by independent experts.

- Are internal audits required for businesses?

- Some industries require by regulations, otherwise optional but considered best practice.