The OECD (Organization for Economic Co-operation and Development) initiative has formed the Inclusive Framework (IF) on Base Erosion and Profit Shifting (BEPS) aimed at reducing tax avoidance practices by implementing the concept of Global Minimum Taxation. Despite discussions on the delay in the implementation of this policy by the OECD, the formation of the Inclusive Framework remains a strategic step in addressing global taxation issues.

Recently, world economic leaders in the G20 group have approved the implementation of a global minimum tax at their meeting in Paris. This decision sets the minimum tax rate at 15 percent.

In response, the Indonesian Ministry of Finance, through the Expert Staff on Tax Compliance, Yon Arsal, revealed that the agreement on global minimum tax would impact multinational companies and could affect aspects such as tax incentives or tax holidays for businesses. But what exactly is meant by Global Minimum Tax? Let’s delve into the information!

Understanding the Concept of Global Minimum Tax

Global Minimum Tax refers to the amount of tax that every multinational company, including domestic multinational companies earning income abroad, must pay. The implementation of this tax aims to ensure that every multinational company, as a taxpayer, fulfills its obligation to pay taxes, at least at the minimum rate, in the headquarters and jurisdictions where they operate.

Through the authority of global minimum tax, an effective minimum rate is applied to the income generated by multinational companies with the Income Inclusion Rule (IIR) scheme regulated by secondary rules known as the Under Taxed Payments Rule (UTPR).

In this framework, every company involved is required to calculate the proportion of its income not subject to tax at the minimum rate. Alternatively, UTPR will be the applicable secondary rule if constituent entities do not adopt the IIR scheme.

In this context, global minimum tax is an integral part of the digital tax initiative developed by the OECD, with the support of global economic leaders in the G20.

This tax is based on two pillars, where pillar 1 aims to reduce tax competition, especially in Corporate Income Tax (CIT). Meanwhile, pillar 2 serves as a supportive solution to address the challenges of the current digitalization era.

The OECD and G20 note that discussions on taxation in the digital era focus on efforts to find new solutions that can guarantee tax rights and a fairer way to allocate company income.

These efforts were realized in the Action 1 Project of the BEPS in 2015, where at that time, global consensus on taxation was set as a target and scheduled for implementation in 2021.

The concept of implementing this tax emerged in 2019 when the OECD felt that the implementation of pillar 1 still had risks of tax avoidance. Therefore, the concept of a global minimum tax was proposed as pillar 2 to ensure the existence of a fair global tax system.

Support from the International Monetary Fund (IMF) ensures that this implementation will impose a rate of 15 percent. The IMF officially published this concept in 2019 through a document titled “Corporate Taxation in the Global Economy.”

Reasons for Implementing Global Minimum Tax

The OECD emphasizes that corporate or company taxes are a vital element in a country’s income for public facility development and the welfare of the people, especially for countries still in the development stage.

With the implementation of global minimum tax, the OECD highlights the inconsistency of data related to reported income locations with effective income locations. This potential inconsistency could lead to negative impacts, such as tax avoidance practices and profit shifting by multinational companies.

Several Finance Ministers from various countries, including Arturo Herrera Gutierrez (Mexico), Sri Mulyani Indrawati (Indonesia), Tito Mboweni (South Africa), Olaf Scholz (Germany), and Janet Yellen (United States), have presented some reasons for supporting the implementation of global minimum tax, including:

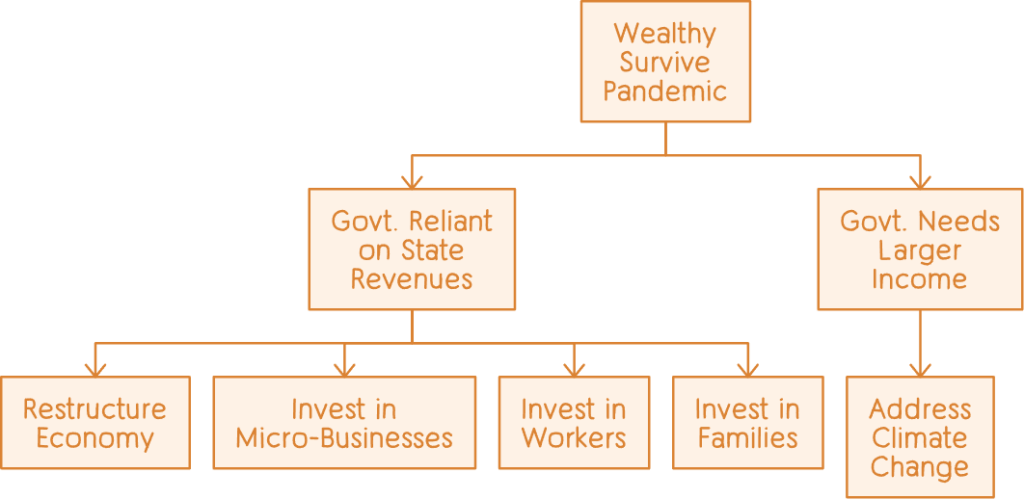

- Wealthy individuals and companies have been more successful in surviving the pandemic compared to those in lower economic strata.

- This has significant consequences, where governments become increasingly reliant on state revenues to restructure the economy and invest in supporting vulnerable micro-businesses, workers, and families.

- As the pandemic begins to recede, governments will need larger sources of income to address the challenges of climate change and long-term structural issues.

Benefits of Global Minimum Tax

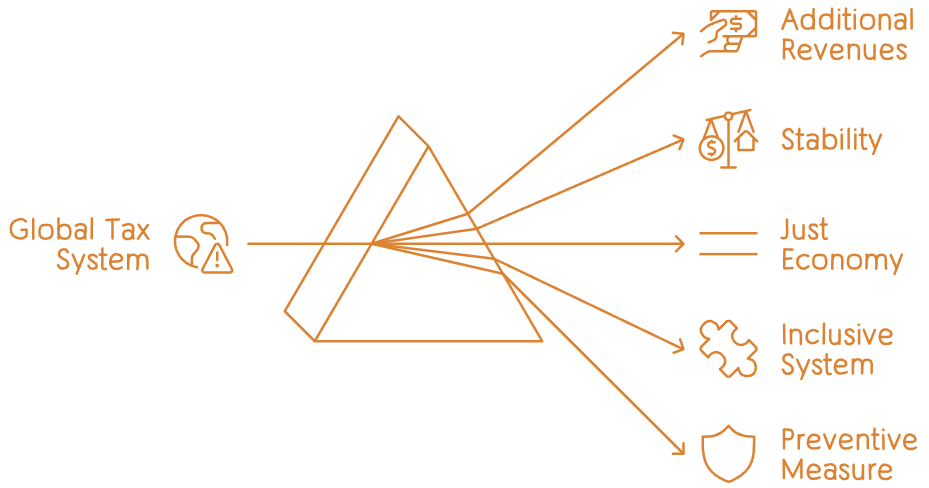

Every concept or implementation has clear goals and benefits, especially in a global context such as the implementation of a minimum tax. Here are some benefits that can be obtained through the implementation of global minimum tax:

- The implementation of pillar 2 is estimated to generate additional global revenues of around $150 billion per year.

- Ensures stability in the global tax system.

- Promotes the creation of a more just global economy.

- Forms an inclusive international tax system, especially for countries like Indonesia that are vulnerable to the risk of losing tax bases.

- Serves as a preventive measure to address tax avoidance practices, including preventing the emergence of detrimental tax losses or profit shifting by companies to avoid significant taxes in their home country.

Read More: Starting A Business in Indonesia (Foreign-Owned Setup): FAQ 2023

Global Minimum Tax in Indonesia

In Indonesia, the implementation of global minimum tax is considered an effective innovation in protecting the country’s tax base. The existence of a minimum rate is expected to reduce tax competition that often occurs and diminish the role of tax havens, minimizing opportunities for profit shifting (BEPS). Therefore, the implementation of global minimum tax is expected to effectively address ‘tax leaks’ that often arise due to globalization phenomena.

Thus, Indonesia’s support for the implementation of global minimum tax is considered the right decision. Some aspects to consider in executing agreements that align with Indonesia’s interests include:

- The implementation of pillar 2 has the potential to significantly change the pattern of global capital flows. This can make investment schemes in tax havens more transparent and direct. The prospects are clearly seen in capital flows and returns, which will flow proportionally to countries with large economies like Indonesia. Thus, this creates a more certain and positive business environment. It is crucial for Indonesia to address challenges that may arise in its implementation, with the support of legal foundations already regulated by the Job Creation Law.

- The Global Anti Base Erosion (GloBE) places more emphasis on the interests of countries that serve as the base or location of multinational companies. This raises questions about its relevance, especially since the majority of multinational companies in Indonesia come from capital-exporting countries. Nevertheless, attention should be paid to its relevance to implementation in developing countries.

- As a Subject To Tax Rule (STTR), this scheme requires special attention, especially for developing countries like Indonesia. This scheme can provide certainty about the tax base in Indonesia as the source country, in line with Indonesia’s neutral stance on competitiveness. In this regard, Indonesia is expected to help realize agreements within the framework of multilateral instruments, including the revision of Article 4 paragraph (1) of the General Allocation Fund (P3B) Law, which can be interpreted as changing the term “liable to tax” to “subject to tax.”

Overall, it can be concluded that Indonesia’s support for the implementation of global minimum tax is a prudent step in protecting the country’s interests. Especially considering the shift in focus to the digitization issue in current tax discussions, this decision is relevant in anticipating potential negative impacts that may arise.