Corporate Annual Tax Return, or SPT (Surat Pemberitahuan Tahunan), is a vital document that companies in Indonesia must file to report their annual tax obligations to the government. The SPT allows companies to accurately declare their taxable income, deductions, and other pertinent financial information to the tax authorities. This article aims to emphasize the significance of corporate tax reporting and provide guidance on how to report corporate annual tax returns (SPT) in Indonesia.

What is Corporate Tax?

Corporate tax is a type of tax that is imposed on the profits earned by a company. The company’s taxable income is computed by deducting COGS, G&A, marketing expenses, and other costs from the revenue earned, which is used to determine the tax amount payable.

The corporate tax rate can differ considerably depending on the country, and some countries are known for having lower tax rates than others, which has led to them being labeled as tax havens.

Corporations may also use various methods such as deductions, subsidies, and tax loopholes to reduce their tax obligations. The effective tax rate, or the actual amount of tax paid by a corporation, is generally lower than the initial statutory rate declared before applying any deductions, resulting in this outcome.

The Importance of Corporate Tax Reporting

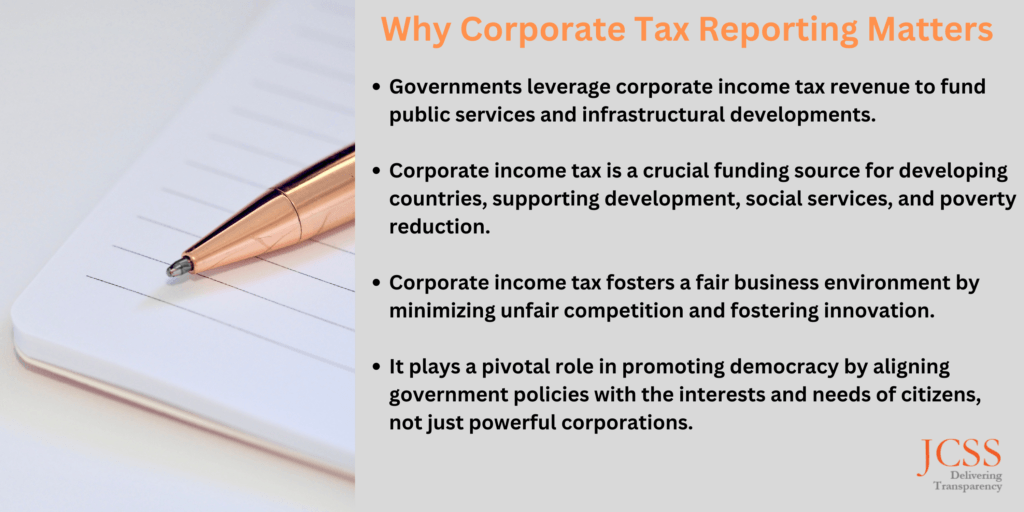

Corporate income tax is crucial to our economic and political systems. It requires corporations to pay taxes on their profits, generating significant revenue for governments to fund public services and infrastructure.

However, the importance of the corporate income tax goes far beyond simply generating revenue.

Advocates for corporate income tax argue that it is an essential tool for promoting tax fairness, reducing income inequality, encouraging responsible corporate behavior, and holding corporations accountable for their actions.

Governments can utilize the substantial revenue generated by corporate income tax to finance public services and infrastructure projects.

- The corporate income tax promotes tax fairness by requiring corporations to pay their fair share, reducing the burden on individuals and small businesses.

- Developing countries depend on corporate income tax to fund their development programs, improve social services, and reduce poverty.

- The corporate income tax creates a level playing field for businesses, reducing unfair competition and promoting innovation.

- The corporate income tax is an essential aspect of promoting democracy and ensuring that government policies reflect the interests and needs of citizens rather than just powerful corporations.

Read More: Starting A Business in Indonesia (Foreign-Owned Setup): FAQ 2023

Understanding Corporate Tax in Indonesia

The Indonesian government imposes several taxes on corporate income. These taxes are levied on a company’s taxable income, which is calculated based on the company’s revenue minus the cost of goods sold, general and administrative expenses, selling and marketing expenses, research and development expenses, depreciation, and other operating costs.

There are different types of taxes on corporate income in Indonesia, the rates at which they are levied, and the rules that apply to their payment and reporting.

Corporate Income Tax

A company’s taxable income is subject to corporate income tax.

Taxable income is calculated based on the company’s revenue minus various expenses.

Indonesia’s corporate income tax rate is 22%, although specific industries may be subject to a different rate.

Withholding Tax

Companies may be subject to withholding tax on payments such as interest, dividends, royalties, and services rendered.

Value-Added Tax (VAT)

VAT is levied on the sales of goods and services.

Companies must register and report their VAT obligations to the tax authorities.

Land and Building Tax

Land and building tax is imposed annually on owners or users of land and buildings located in Indonesia.

The tax rate varies depending on the location and value of the property.

Transfer Tax

Transfer tax may be imposed on transferring land, buildings, and other assets such as vehicles and shares.

Stamp Duty

Stamp duty is imposed on certain legal documents, such as contracts and agreements.

The rate varies depending on the type of document and its value.

Luxury Goods Sales Tax

Luxury goods sales tax is imposed on the sales of certain luxury goods, such as yachts, airplanes, and high-end cars.

The tax rate varies depending on the type and value of the goods.

Excise Tax

Excise tax is imposed on the sales of certain goods, such as tobacco products, alcoholic beverages, and vehicles.

The tax rate varies depending on the type of goods.

Customs Duty

Customs duty is imposed on the import and export of goods.

The rate varies depending on the type and value of the goods.

Companies operating in Indonesia must carefully comply with the rules and regulations surrounding these taxes to avoid any penalties or fines.

Read More: Mastering Indonesian Business Licenses: Your Ticket To Triumph!

How to File Annual Tax Return in Indonesia

If you run a business in Indonesia, it’s essential to understand how to file an annual tax return.

Filing your tax return on time and with accurate information is necessary to remain compliant with tax regulations and avoid penalties.

In Indonesia, the tax authority requires companies to file an annual tax return for corporate income tax, known as SPT Tahunan PPh Badan.

This document summarizes the company’s financial information for the year and calculates the amount of tax payable based on the taxable income. Here are the steps to do so:

1. Determine the deadline: The annual tax return filing for corporate income tax is generally April 30th of the following year.

2. Prepare the required documents: The documents needed for filing the annual tax return include financial statements, a tax registration number (NPWP), and other relevant documents, such as withholding tax receipts.

3. Calculate the taxable income: Calculate the company’s taxable income by subtracting all allowable deductions from the total revenue.

4. Calculate the tax payable: Calculate the amount of tax payable based on the applicable tax rate.

5. Fill out the SPT form: Fill out the annual tax return form, or SPT, with the calculated taxable income and tax payable.

6. Submit the SPT form: Submit the SPT form and supporting documents to the tax office by the deadline.

7. Make the payment: Pay any tax payable by the deadline.

8. Retain the receipt: Retain the receipt of payment as proof of payment.

9. Comply with post-filing requirements: After filing the SPT, the company must comply with post-filing requirements, such as responding to any inquiries or audits by the tax office.

In conclusion, filing corporate annual tax returns in Indonesia is a critical process for businesses operating in the country. Understanding the nuances of corporate tax, adhering to regulations, and adopting efficient filing practices are essential for smooth business operations. By prioritizing accurate and timely tax reporting, businesses not only ensure compliance with the law but also contribute to the overall economic development of Indonesia. Whether you’re a local entrepreneur or an international business, navigating the Indonesian tax landscape with diligence and precision is key to sustaining and growing your enterprise.