Also Read in : Indonesian(Basaha)

Immediate Action Required:

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

MONTHLY PAYMENT OBLIGATIONS

Deadline: 15th of Following Month (NEW – Changed from 10th)

Tax Types Covered:

Target Audience: All companies, employers, withholding agents

Penalty Risk: 🔴 HIGH – Interest penalties at benchmark rate + 5%

Payment Method: Coretax system only

MONTHLY REPORTING OBLIGATIONS

Deadline: 20th of Following Month

Requirements: Submit monthly tax returns (SPT Masa) electronically

Target Audience: All companies, employers, withholding agents

Penalty Risk: 🟡 MEDIUM – Administrative penalties apply

System: Coretax mandatory

VAT (PPN) OBLIGATIONS

Deadline: End of Following Month

New 2025 Requirements:

ALSO READ: SPT Tahunan for Indonesian SMEs in 2025: Complete Filing Guide with Coretax System

ALSO READ: ESG 101: Why Sustainable Business Setup is the Future of Indonesia Investment

Individual Tax Returns

Deadline: March 31, 2025 (Extended to April 11 due to holidays)

Corporate Tax Returns

Deadline: April 30, 2025

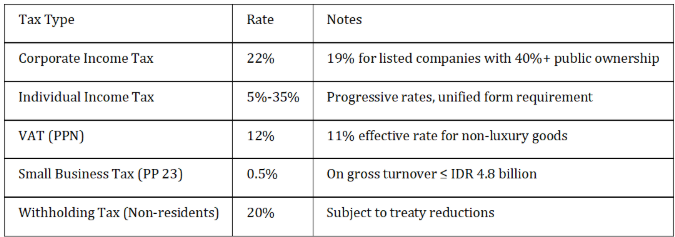

VAT Rate Increase (January 1, 2025)

Impact: All VAT-registered businesses

Details:

Coretax System Implementation (January 1, 2025)

Impact: All taxpayers

Details:

E-commerce Withholding Tax (July 14, 2025)

Impact: E-commerce platforms and online sellers

Details:

SMEs & Startups

Key Obligations:

Monthly Cash Flow Impact: ~2-5% of gross revenue

Established Companies

Key Obligations:

Monthly Cash Flow Impact: ~8-15% of gross revenue

Multinational Corporations

Additional Requirements:

Compliance Complexity: High – Professional advisory essential

E-commerce Businesses

New 2025 Requirements:

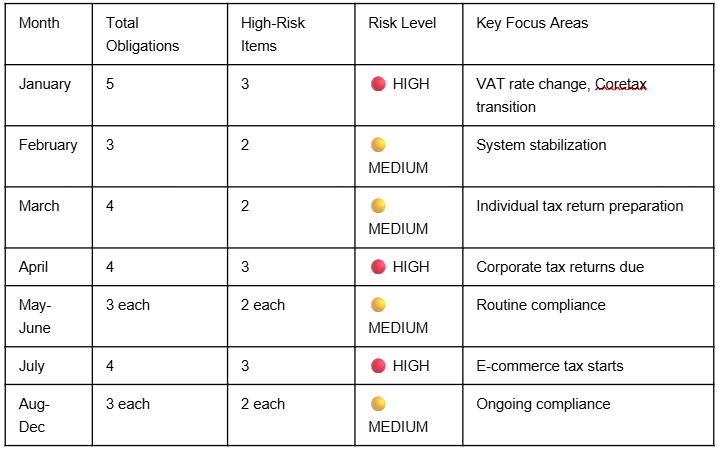

CRITICAL RISK ZONES

VAT Calculation Errors

Coretax System Transition

Monthly Payment Deadline Changes

E-commerce Platform Compliance

Immediate Actions (Within 30 Days)

Quarterly Reviews

Annual Preparations

Technology Solutions

Process Improvements

Monitoring Systems

Government Contacts

Professional Advisory

Compliance KPIs to Track

Financial Impact Monitoring

Expected Developments

Strategic Recommendations

Given the unprecedented scope of tax regulatory changes in 2025, including the VAT rate increase, Coretax system implementation, and new e-commerce requirements, immediate action is essential.

We strongly recommend:

The complexity of Indonesia’s evolving tax landscape makes professional guidance not just recommended, but essential for business success and regulatory compliance.

This comprehensive calendar serves as your strategic guide to Indonesian tax compliance success in 2025. Regular review and proactive implementation of these recommendations will ensure your organization stays ahead of all obligations while optimizing tax efficiency.

For questions about implementation or specific compliance situations, consult with JCSS who are qualified Indonesian tax professionals and can provide personalized guidance based on your business circumstances.

GOVERNMENT & OFFICIAL SOURCES

Directorate General of Taxes (DGT) – Official Sources:

VAT RATE CHANGES

VAT Rate Increase to 12%:

CORETAX SYSTEM CHANGES

New Tax Administration System:

E-COMMERCE TAX REGULATIONS

New 0.5% E-commerce Withholding Tax:

HOLIDAY SCHEDULES

National Holidays Affecting Tax Deadlines:

TAX FILING PROCEDURES

Individual & Corporate Tax Returns:

PROFESSIONAL ANALYSIS

PENALTIES & ENFORCEMENT

Penalty Waivers & Enforcement:

ADDITIONAL RESEARCH SOURCES

Comprehensive Tax Information:

OFFICIAL VERIFICATION CONTACTS:

For Real-Time Updates:

Really love how you connect with people through your authentic writing style

This post deserves all the attention and recognition 🔥 it can possibly get

Really love how 💪 you consistently show up with quality content that matters to people

Love how you consistently deliver value that actually helps people grow daily

There is definately a lot to find out about this subject. I like all the points you made

Great information shared.. really enjoyed reading this post thank you author for sharing this post .. appreciated

For the reason that the admin of this site is working, no uncertainty very quickly it will be renowned, due to its quality contents.

I am truly thankful to the owner of this web site who has shared this fantastic piece of writing at at this place.

https://wealthpetaccessories.store/

Thanks for explaining technical terms in simple language.

I appreciate you sharing this blog post. Thanks Again. Cool.

I’m often to blogging and i really appreciate your content. The article has actually peaks my interest. I’m going to bookmark your web site and maintain checking for brand spanking new information.

There is definately a lot to find out about this subject. I like all the points you made

Thanks for explaining technical terms in simple language.

I like the efforts you have put in this, regards for all the great content.

I appreciate you sharing this blog post. Thanks Again. Cool.

Excellent strange brilliant funny boring interesting.

I very delighted to find this internet site on bing, just what I was searching for as well saved to fav

I love how the author explains the benefits clearly.

This was a good refresher. I manage eBooks and reports with https://pdfpanel.com.

https://www.oneclickatdoorstep.com/product/a-pvp-crystals

A relação qualidade-preço é um dos aspetos mais valorizados nesta formação.

Superb bad crazy crazy fantastic.

Bad crazy brilliant awesome interesting love boring brilliant boring helpful nice brilliant nice amazing.

Strange cool interesting bad cool awesome interesting fantastic brilliant random awesome.

¡Este nuevo cargador rápido es lo mejor para los vehículos eléctricos!

This changed my life. I feel so much lighter and happier after a massage.

You deserve this quiet moment just for you. Escape the world with a blissful massage.

naturally like your web site however you need to take a look at the spelling on several of your posts. A number of them are rife with spelling problems and I find it very bothersome to tell the truth on the other hand I will surely come again again.

https://www.oneclickatdoorstep.com/product/pvp-crystals

¡Este nuevo cargador rápido es lo mejor para los vehículos eléctricos!

This is really interesting, You’re a very skilled blogger. I’ve joined your feed and look forward to seeking more of your magnificent post. Also, I’ve shared your site in my social networks!

Pretty! This has been a really wonderful post. Many thanks for providing these details.

This is really interesting, You’re a very skilled blogger. I’ve joined your feed and look forward to seeking more of your magnificent post. Also, I’ve shared your site in my social networks!

Bafra çekici sayesinde sürücüler yol yardım desteğini güvenle alır. Bafra oto yol yardım, küçük arızalardan büyük kazalara kadar çözüm üretir. Bafra oto kurtarma, her aracın güvenle taşınmasını sağlar. Bafra oto yol yardım 7/24 hizmet sunar.

Great amazing love fantastic crazy random strange.

Mantap, infonya lengkap banget! Langsung coba game slot gacor https://coqui.ai/ yang lagi viral, ternyata emang cuan.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me. https://www.binance.info/el/register?ref=DB40ITMB

Your point of view caught my eye and was very interesting. Thanks. I have a question for you. https://www.binance.info/pt-PT/register?ref=KDN7HDOR

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Hi there mates, how is everything, and what you wish for to say concerning this piece of writing, in my view

its actually amazing designed for me.

You really make it appear really easy together with your presentation but

I in finding this topic to be really something that I think I’d never understand.

It seems too complicated and extremely vast for me.

I am taking a look forward in your next publish,

I will attempt to get the dangle of it!

My relatives all the time say that I am wasting my

time here at web, however I know I am getting familiarity all the time by reading such good articles or reviews.