New regulation from the Government of Indonesia

The Government of Indonesia has issued Government Regulation Number 58 of 2023 (PP 58/2023) concerning the Income Tax Article 21 withholding tax rates on Income Related to the Work, Services, or Activities of Individual Taxpayers. The changes are quite significant. In this article, JCSS Indonesia will provide a complete guide to the new Article 21 Income Tax rates, starting in 2024.

One of the objectives of the issuance of PP 58/2023 is to simplify and streamline the Article 21 Income Tax withholding, which has been known to be very complicated.

Income Tax Article 21 Rates Starting January 2024

Based on Article 2 paragraph (1) of PP 58/2023, the Article 21 Income Tax withholding rates, the new effective rates of Article 21 Income tax withholding tax consist of:

- Monthly effective tax rate, or

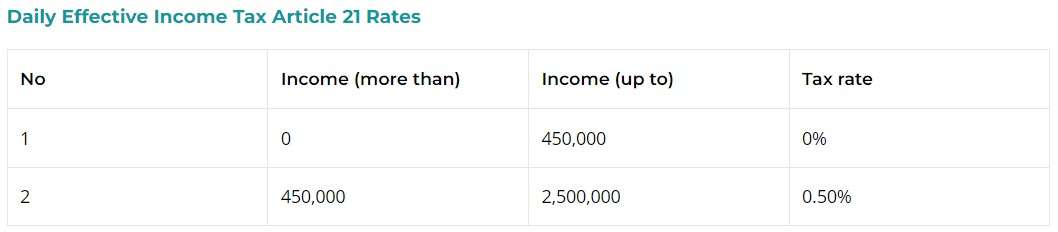

- Daily effective rate

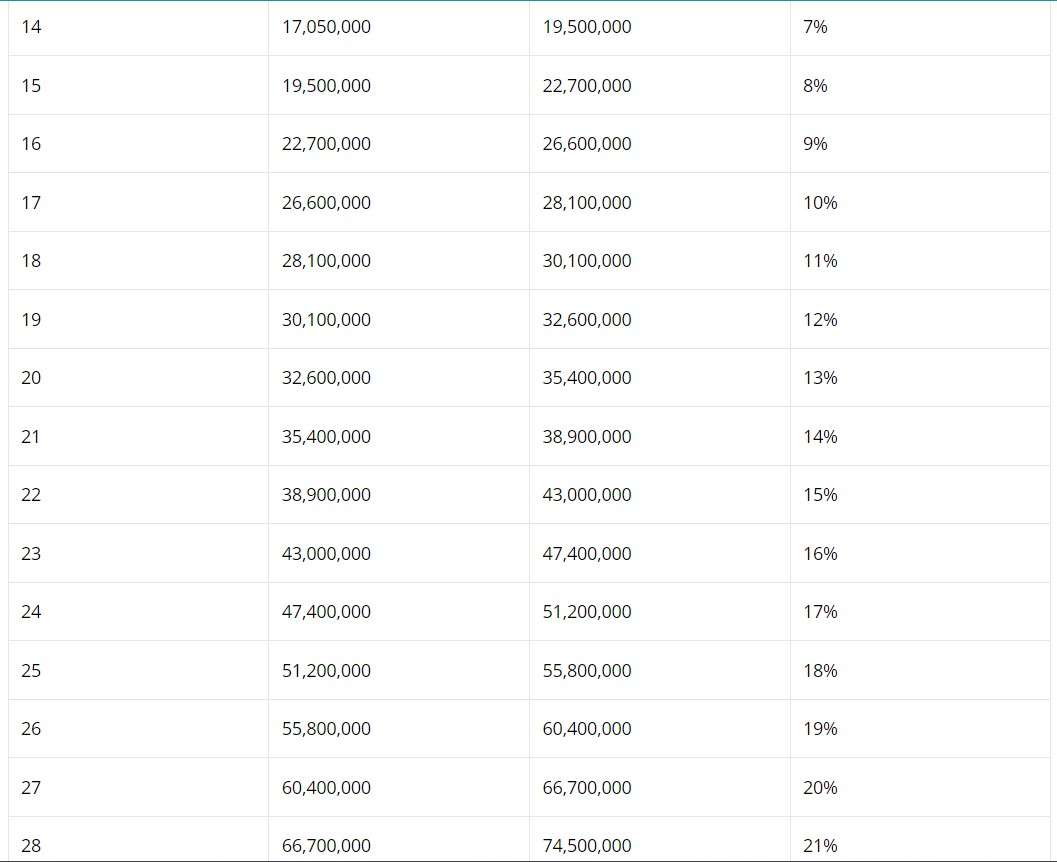

Monthly effective rates tax rates are categorized based on the non-taxable income (PTKP) status of the individual taxpayer. PTKP status is determined based on the marital status and the number of dependants at the beginning of the tax year.

These monthly effective rates consider the deductible expenses, pension contributions and/or PTKP status, which should be deducted from gross income.

Similarly, with daily effective rates, it has considered the portion of income that is not subject to withholding, which should be deducted from gross income.

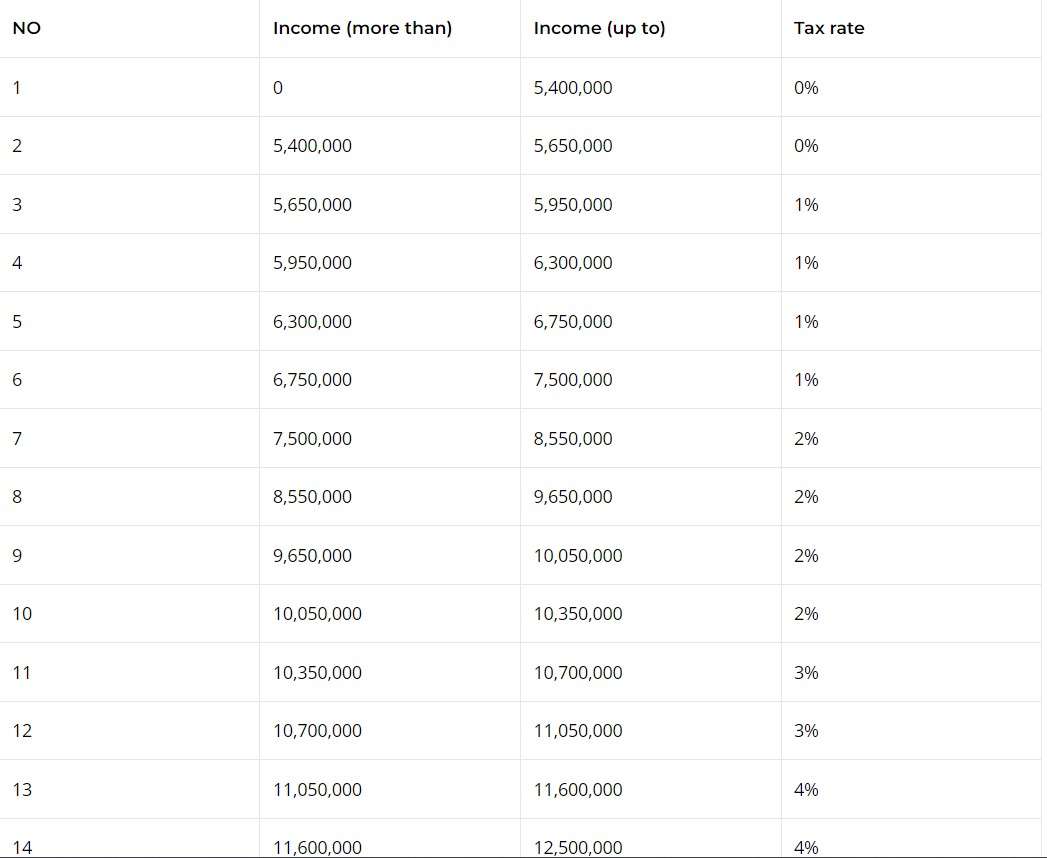

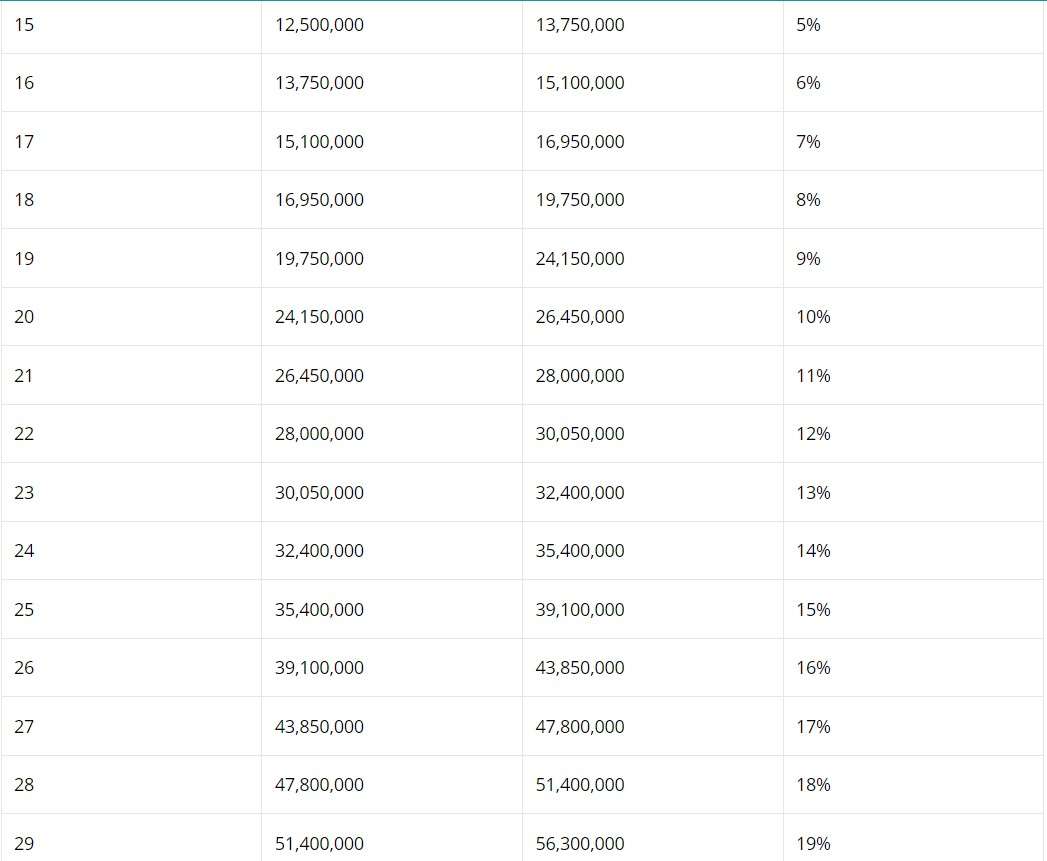

Monthly effective tax rates have been classified into three Categories: A, B, C.

Category A Income Tax Article 21

Category A is applicable to the taxpayers with the following PTKP status:

- Single without dependants (TK0)

- Single with one dependant (TK1)

- Married without dependants (K0)

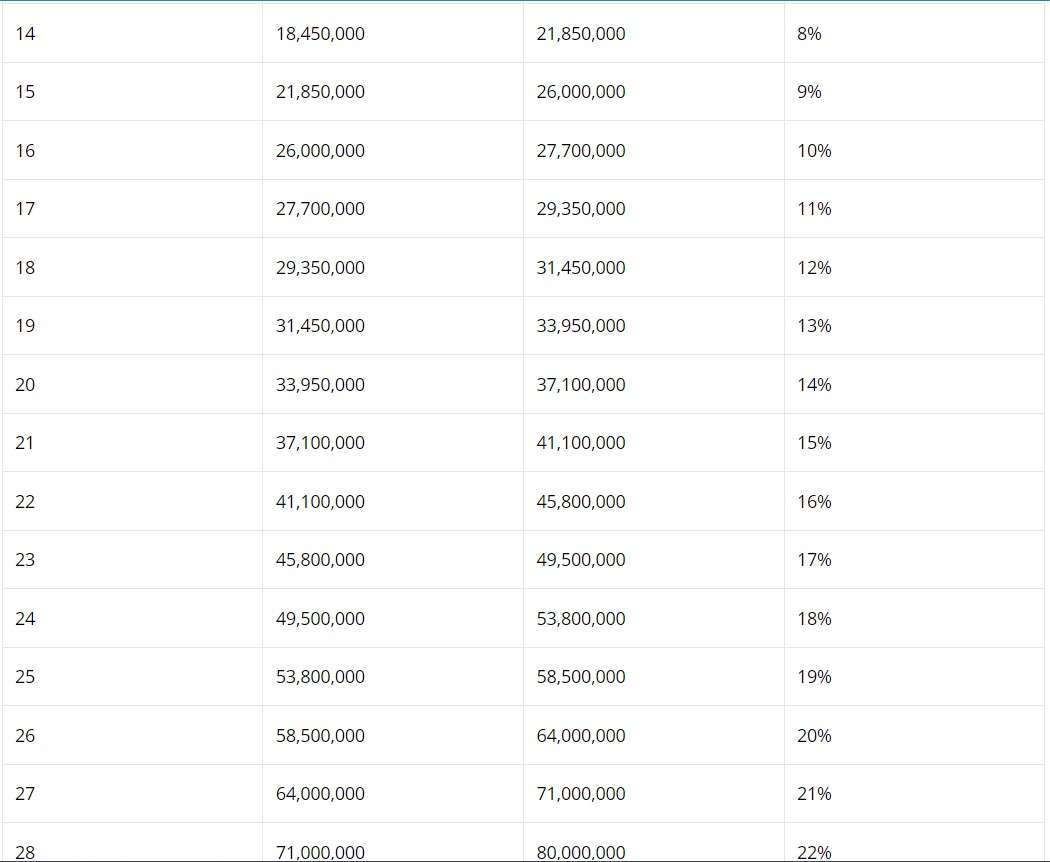

Category B Income Tax Article 21

Category B is applicable to the taxpayers with the following PTKP status:

- Single with two dependants (TK2)

- Single with three dependants (TK3)

- Married with one dependant (K1)

- Married with two dependants (K2)

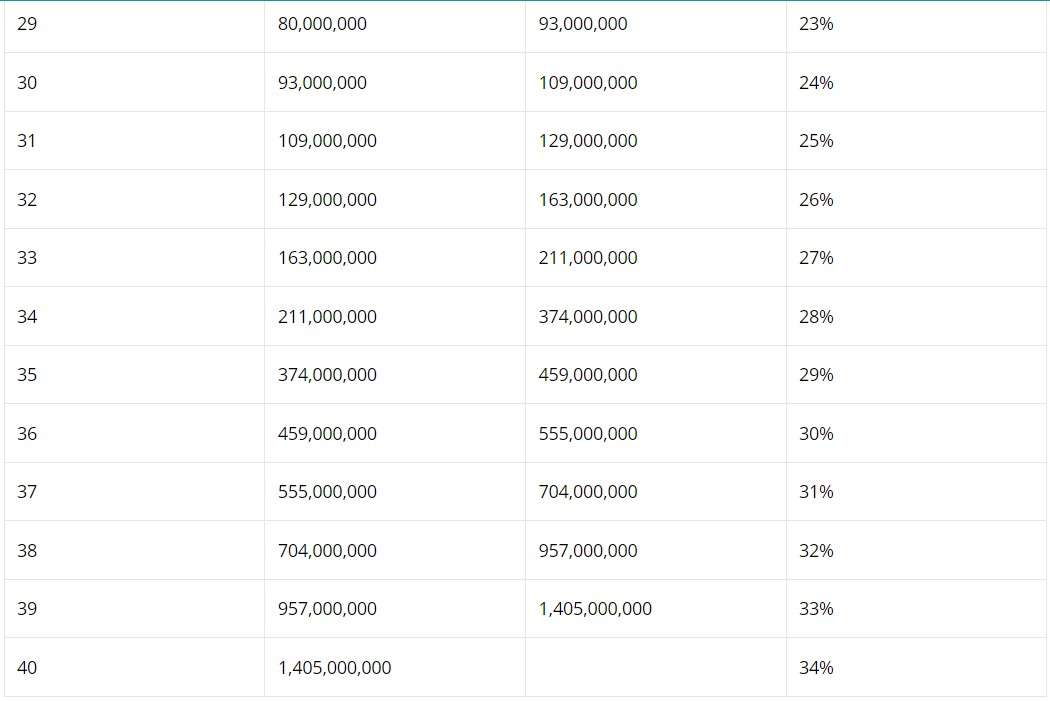

Category C Income Tax Article 21

Category C is applicable to the taxpayers with the following PTKP status:

- Married with three dependants (K3)

Who is subject to the new Income tax Article 21 rates?

The Article 21 Income Tax rates based on PP 55/2023 are applicable for the withholding of Article 21 Income Tax for Taxpayers who receive income related to employment, services, or activities, including state officials, civil servants, members of the TNI (Indonesian National Armed Forces), members of the Police, and their pensions.

Read More: Indonesia Embraces Global Minimum Tax: What You Need To Know

When does PP 58/2023 take effect?

The new regulation on the income tax Article 21 withholding tax PP 58/2023 takes effect on January 1, 2024.

The new tax rates are given below:

Monthly Effective Rates for Category A – Income Tax Article 21

Read More: Maximizing Returns: Strategies For Successful Tax Filing In Indonesia

Important note

Starting January 1, 2024, Income Tax Article 21 tax will be withheld based on the new effective tax rates. These rates will be used for the period January 2024 until November 2024. For the December 2024 month, the general rate is still used, so there will be an underpayment in the month of December 2024.

How JCSS Indonesia can assist you

Ensuring tax compliance is vital for well-functioning companies. JCSS Indonesia, with extensive experience in Indonesian tax laws, assists in tax registration, timely payments, returns filing, withholding taxes, and DGT correspondence. Our team ensures compliance and prevents penalties. With growing tax scrutiny, maintaining accurate monthly records is crucial.