Indonesia continues to solidify its position as Southeast Asia’s premier investment destination, with over $50 billion in foreign direct investment realized in 2023 alone. For businesses looking to tap into this dynamic market of 270 million consumers, securing a Company Registration Number—known locally as the Nomor Induk Berusaha (NIB)—represents the critical first step toward legal operations and sustained growth. The Indonesian government has significantly streamlined the registration process through digital innovations and regulatory reforms, most notably with the implementation of Government Regulation No. 28 of 2025, which enhances the Online Single Submission Risk-Based Approach (OSS-RBA) system.

This comprehensive transformation has reduced bureaucratic complexity while maintaining rigorous compliance standards, making it both more accessible for legitimate investors and more secure against fraudulent activities.

To set up a company in Indonesia, you must first obtain an Indonesian business registration number.

Indonesia’s business registration system has undergone remarkable transformation in recent years, evolving from a fragmented, time-intensive bureaucratic process to a streamlined digital ecosystem. The cornerstone of this modern framework is the Business Identification Number (NIB), which replaced multiple separate permits and licenses that previously created administrative bottlenecks for entrepreneurs and foreign investors.

The NIB serves as a comprehensive business identity that simultaneously functions as an import license, customs identification number, and primary business registration certificate. This integration represents a fundamental shift toward Indonesia’s “one data” policy, aimed at eliminating redundancies and creating seamless administrative processes across government agencies.

Government Regulation No. 28 of 2025, which became effective on June 5, 2025, represents the latest evolution in this regulatory framework. This regulation replaces the previous Government Regulation No. 5 of 2021 and introduces enhanced features including Service Level Agreements (SLAs) with guaranteed processing timelines, deemed approval mechanisms (fiktif positif), and expanded integration across government systems

The legal framework governing business registration in Indonesia operates under multiple interconnected regulations and institutions.

The primary regulatory foundation includes the Job Creation Law (Law No. 11/2020), which mandated the risk-based licensing approach, and various implementing regulations issued by the Indonesia Investment Coordinating Board (BKPM).

The Ministry of Law and Human Rights plays a crucial role in the registration process, particularly in validating company establishment deeds and granting legal entity status. Meanwhile, BKPM oversees foreign investment coordination and ensures compliance with sectoral regulations and investment requirements.

The integration of the Online Single Submission (OSS) system with other government databases, including the Ministry of Law and Human Rights’ SIMBA system and the Directorate General of Taxes’ core systems, has created unprecedented transparency and efficiency in business registration processes.

Indonesia’s risk-based licensing system categorizes businesses into three primary risk levels, each with distinct registration requirements and operational permissions.

This classification system, based on the Indonesia Standard Business Classification (KBLI) codes, determines the complexity and timeline for obtaining necessary permits.

Low-Risk Business Activities require only the basic NIB for operations. These typically include wholesale trading, certain consulting services, and digital businesses that pose minimal regulatory or environmental risks. Companies in this category can commence operations immediately upon receiving their NIB, which typically takes 2-3 business days.

Medium-Risk Business Activities must obtain both an NIB and a Standard Certificate. This category includes manufacturing activities with moderate environmental impact, retail operations in regulated sectors, and businesses requiring technical compliance verification. The additional certification process typically extends the approval timeline to 1-2 weeks.

High-Risk Business Activities require comprehensive licensing documentation beyond the NIB. This includes sectors such as mining, large-scale manufacturing, financial services, and businesses with significant environmental or safety implications. Foreign-owned companies (PT PMA) generally fall into this category due to their scale and investment requirements, with approval processes potentially taking 2-8 weeks.

Foreign-owned companies, known as PT PMA (Penanaman Modal Asing), face specific capital and structural requirements that distinguish them from local businesses. The minimum total investment plan must reach IDR 10 billion (approximately USD 650,000), representing Indonesia’s commitment to attracting substantial foreign investment while ensuring serious commitment from international investors.

The paid-up capital requirement for PT PMA entities has evolved significantly since 2021. Currently, the full IDR 10 billion minimum capital must be committed, though companies can structure this as accounts receivable in their balance sheets if not immediately paid. This approach provides flexibility while maintaining regulatory compliance, though the preferred method remains full capital payment upon incorporation.

Structural requirements for PT PMA companies include a minimum of two shareholders (who can be individuals or corporations), at least one resident director, and one commissioner. The resident director requirement can be fulfilled by either an Indonesian citizen or a foreigner holding appropriate work and stay permits (KITAS).

There are several benefits that will be obtained by companies with a business registration number. These benefits are:

– You will be able to apply for a visa for any foreign employee you hire on behalf of your company

– You will be able to obtain business visa sponsorship for your clients from your company

– You can also follow and follow all business tenders in Indonesia by entering your company name

However, it should be noted that obtaining a registration number is only part of the company registration procedure in Indonesia.

Business registration number in Indonesia is a certificate of power of attorney used by entrepreneurs for licensing purposes in carrying out their respective business activities. Therefore, as an entrepreneur who wants to obtain a business identification number in Indonesia, he must follow the procedures below:

– Obtain approval on behalf of your company from the Minister of Law and Human Rights of the Republic of Indonesia. It will take 4 business days to receive approval.

– Obtaining approval from the Investment Coordinating Board (BPKM), this may take 12 business days or more to obtain.

– Provide the preparation of Articles of Association (Deed) that have been legalized by a notary. This preparation may take about 4 working days.

– You must have a domicile certificate from the local government office. This certificate can take at least 3 business days.

– You must also obtain a taxpayer identification number or NPWP for your company in Indonesia. To obtain this taxpayer identification number, it may take about 3 working days.

– After that, you need to open an account at a bank in the name of your company. It will usually take a day to open a bank account.

– You need to obtain the deed of establishment of your company from the Ministry of Law and Human Rights of the Republic of Indonesia for approximately 20 working days.

– You must obtain a certificate of company registration from the local government. To obtain this certificate, it may take approximately 20 business days.

The registration process begins with comprehensive document preparation and strategic planning. Foreign investors must first determine their business classification under the KBLI system, as this determines both the risk category and specific licensing requirements. This initial assessment is crucial because it influences minimum capital requirements, operational restrictions, and the complexity of the approval process.

Company name reservation represents the first official step in the registration process. The proposed name must comply with Indonesian naming regulations, consisting of at least three words with minimum three letters each, and cannot duplicate existing registered names. The Ministry of Law and Human Rights processes name reservations within 1-3 business days.

Simultaneously, investors must secure a registered business address in Indonesia. This address serves multiple functions: it demonstrates physical presence, satisfies domicile requirements, and provides the foundation for various compliance obligations including tax registration and regulatory inspections.

The Deed of Establishment represents the foundational legal document that officially creates the company entity. This document, prepared by an Indonesian notary public, contains comprehensive details including the company’s purpose, business activities, shareholding structure, and governance arrangements. The preparation typically requires 4-5 business days, depending on the complexity of the business structure and shareholder arrangements.

Ministry of Law and Human Rights approval follows the notarial deed preparation. This approval process involves thorough review of the company’s founding documents and issuance of a formal decree that grants legal entity status. The ministry’s review typically takes 2-3 business days for standard applications with complete documentation

Tax registration has been significantly modernized through the integration of the National Identity Number (NIK) with the Taxpayer Identification Number (NPWP). As of July 1, 2024, Indonesia implemented the Single Identity Number (SIN) system, which consolidates individual taxpayer identification with their national ID numbers. For corporate entities, this integration streamlines tax administration and ensures seamless compliance across government systems.

The NIK-NPWP integration process involves automatic synchronization between population databases and taxation systems. This integration eliminates previous duplications and inconsistencies while providing a unified foundation for tax compliance and regulatory reporting.

Registration through the Online Single Submission (OSS) system represents the culmination of the formal registration process. The OSS platform has undergone significant enhancements under Government Regulation No. 28 of 2025, including improved integration with sectoral databases, automated verification for low-risk activities, and real-time monitoring dashboards.

The NIB issuance process varies by business risk classification. Low-risk businesses typically receive their NIB within 2-3 days, while high-risk activities, particularly PT PMA registrations, may require 3-5 days due to additional validation requirements. The system now includes automatic registration with health and social security systems (BPJS), customs authorities, and investment reporting mechanisms.

Companies must activate their NIB within ten working days of issuance. This activation process ensures that all integrated systems recognize the business entity and enables full operational capabilities.

Once your company is established, you can start running your business in Indonesia and carry out activities such as:

– Open an Indonesian company bank account

It is possible to open an Indonesian company bank account without having to be physically present in Indonesia.

– Rent or purchase property and other assets on behalf of your company

After obtaining a business registration number for your company in Indonesia, you will be asked to choose a location to set up your physical office in Indonesia. However, note that you will be required to refer to the Negative Investment List for your business location as some business activities are prohibited in certain areas.

– Start other preparations for your operation, such as but not limited to staff recruitment, office renovation preparation, etc.

You should have already planned how your operations will be carried out in your company. By planning and starting your operations after your company is established, you will save a lot of money and time.

– Proceed to obtain work and residence permits for foreign employees in your company

You will be asked to find out how many foreign employees you will hire in your company. This is important because you will be required to comply with regulations pertaining to obtaining a work permit for your foreign workers.

NOTE: The opening of a corporate bank account is required after incorporation

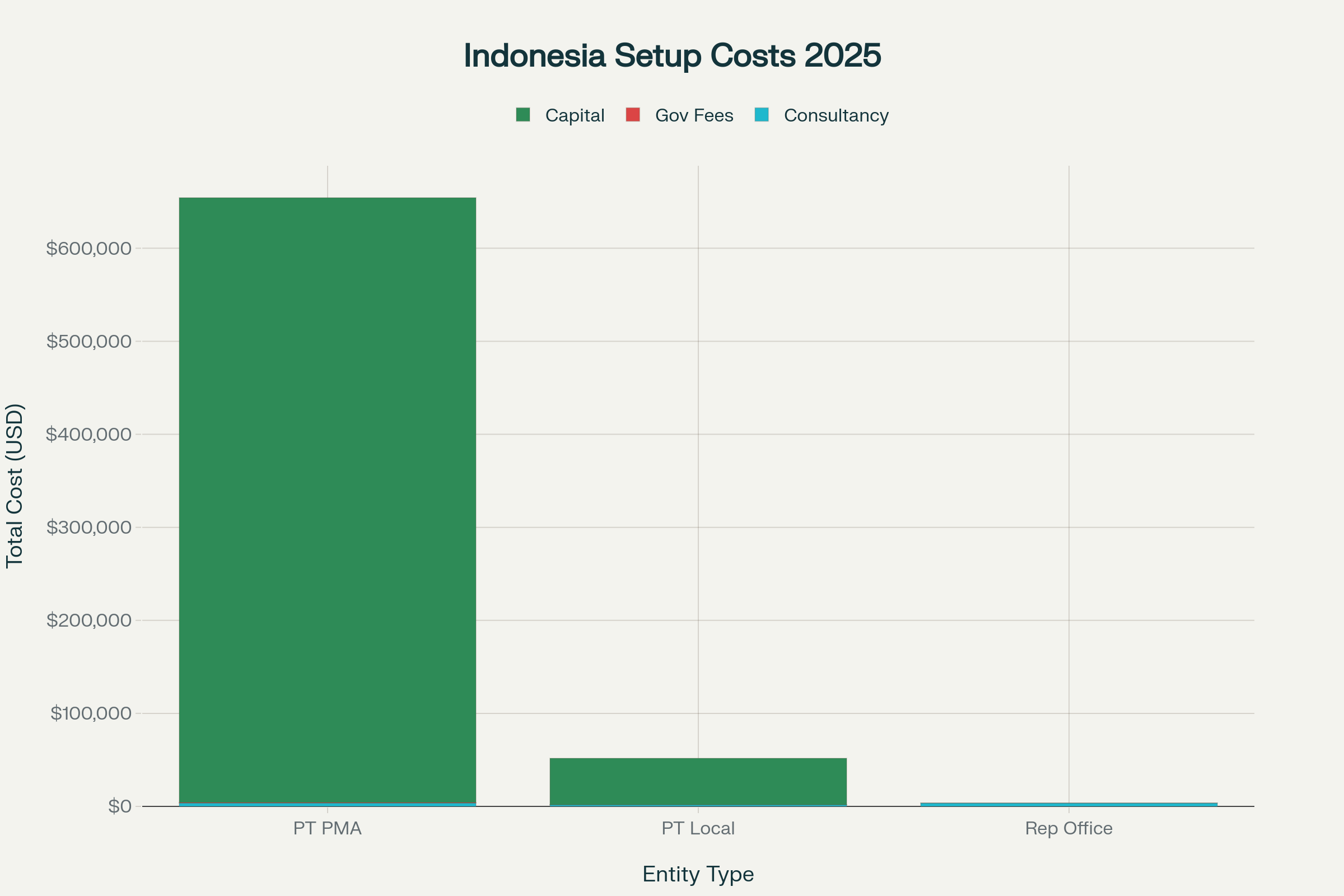

The cost structure for Indonesian company registration varies significantly based on entity type, business complexity, and service provider selection. Professional service fees for PT PMA establishment typically range from USD 2,500 to USD 5,000, reflecting the complexity of foreign investment regulations and comprehensive compliance requirements.

Government fees represent a smaller portion of total costs but vary depending on business location, selected KBLI codes, and required permits. Standard government fees for PT PMA registration typically range from USD 300 to USD 800, covering notarial services, ministry approvals, and basic licensing requirements.

Additional costs include translation services for foreign documents, bank charges for capital deposits, and potential immigration fees for foreign directors requiring work permits. These ancillary costs can add USD 500 to USD 2,000 to the total registration budget.

The IDR 10 billion minimum capital requirement for PT PMA companies represents one of the most significant financial commitments in the registration process. This requirement, equivalent to approximately USD 650,000 at current exchange rates, reflects Indonesia’s focus on attracting substantial foreign investment while ensuring investor commitment to long-term operations.

Payment structures for the minimum capital have evolved to provide greater flexibility while maintaining regulatory compliance. Companies can fulfill capital requirements through direct cash deposits, asset contributions (excluding land and buildings), or structured payment plans over three years aligned with business development milestones.

Certain business sectors require higher minimum capital due to regulatory or operational complexity. Financial services, logistics and freight forwarding, construction, and other capital-intensive industries may face significantly higher requirements, sometimes reaching IDR 25 billion or more depending on specific KBLI classifications.

Beyond initial registration expenses, companies must budget for ongoing compliance costs that ensure continued legal operations. Annual maintenance costs typically include business license renewals (USD 100-500), corporate tax filings and audits (USD 1,000-5,000), and accounting services (USD 100-500 monthly).

Companies must also consider costs associated with mandatory reporting requirements, including investment activity reports to BKPM, tax filings, and sector-specific compliance obligations. These ongoing expenses, while manageable, represent important budget considerations for sustainable operations.

The implementation of Government Regulation No. 28 of 2025 represents the most significant regulatory update to Indonesia’s business licensing framework in recent years. This comprehensive regulation expands the OSS system from five to eight integrated subsystems, incorporating principal licensing, investment facilities, and partnership obligations into a unified platform.

The regulation introduces Service Level Agreements (SLAs) that guarantee specific processing timelines for various licensing requirements. If relevant authorities fail to process applications within prescribed timeframes, automatic approval mechanisms (deemed approval or fiktif positif) ensure that businesses can proceed without indefinite delays.

Enhanced integration features include automated connections with spatial planning databases, environmental approval systems, and building permit authorities. This integration eliminates previous jurisdictional overlaps and reduces the potential for conflicting requirements across different government agencies.

The updated OSS system requires implementation by October 5, 2025, providing a four-month transition period for system adjustments and user adaptation. During this transition, existing applications continue processing under previous regulations, ensuring continuity for businesses already in the registration pipeline.

Businesses with existing OSS accounts must manually update their profiles once the new system launches. This migration process may require re-uploading licenses, adjusting business classifications, and completing new profile fields introduced under the updated regulation.

The enhanced system includes improved monitoring capabilities, real-time status notifications, and streamlined interfaces designed to reduce user confusion and processing errors. These improvements build upon feedback from businesses and service providers who experienced challenges with previous system iterations.

The full implementation of the Single Identity Number system as of July 1, 2024, represents a fundamental shift in Indonesia’s approach to taxpayer identification. Individual taxpayers now use their NIK (National Identity Number) as their NPWP (Taxpayer Identification Number), eliminating the previous 15-digit NPWP format.

This integration supports Indonesia’s “one data” policy by creating standardized identification across government systems. The consolidation reduces administrative burden for individuals while providing government agencies with more accurate and comprehensive taxpayer information.

Corporate entities benefit from improved system integration, though they maintain separate corporate tax identification numbers. The SIN implementation enhances verification processes and reduces potential discrepancies between population and taxation databases.

Indonesia’s Negative Investment List continues to define sectors where foreign investment faces restrictions or prohibitions. The list, regularly updated to reflect economic policy priorities and national security considerations, directly impacts PT PMA registration feasibility and ownership structures.

Sectors with foreign ownership limitations include telecommunications (maximum 49% foreign ownership), certain retail activities, traditional market operations, and culturally sensitive industries. Companies planning operations in restricted sectors must carefully structure ownership to comply with these limitations while achieving operational objectives.

Some sectors require special government approvals beyond standard NIB registration. These may include environmental impact assessments for manufacturing, tourism permits for hospitality operations, or financial authority approvals for investment services. Such additional requirements can significantly extend registration timelines and increase compliance complexity.

Despite significant improvements, the OSS system occasionally experiences technical challenges that can impact registration timelines. Common issues include data synchronization problems between different government databases, unclear document requirements, and system notifications that lack specific guidance.

Recent updates have addressed many previous technical issues, including improved integration with the Ministry of Law and Human Rights’ SIMBA system and the tax authority’s databases. However, users should plan for potential technical delays and maintain regular communication with system administrators.

The introduction of real-time monitoring dashboards and improved notification systems under Government Regulation No. 28 of 2025 aims to reduce technical frustrations and provide clearer guidance on application status.

Realistic timeline expectations are crucial for successful registration planning. While low-risk businesses may complete NIB registration within days, PT PMA companies should anticipate 4-8 weeks for complete registration, including all required licenses and permits.

Factors that can extend timelines include incomplete documentation, technical issues with government systems, requests for additional information from reviewing authorities, and coordination challenges between multiple government agencies. Building buffer time into project schedules helps accommodate these potential delays.

Professional service providers with established relationships with government agencies can often expedite processes and resolve issues more efficiently than companies attempting self-registration. The additional cost of professional services often proves worthwhile given the complexity and importance of proper registration.

Certain business sectors face capital requirements substantially higher than the standard IDR 10 billion minimum. Financial services companies, for example, may require minimum capital ranging from IDR 25 billion to IDR 100 billion depending on the specific type of financial activity.

Construction companies, logistics operators, and manufacturing businesses in specific sectors also face enhanced capital requirements. These requirements reflect the Indonesian government’s assessment of operational risks, infrastructure needs, and economic impact associated with different business activities.

Companies should conduct thorough due diligence on sector-specific requirements before committing to registration, as these requirements can significantly impact both initial investment needs and ongoing operational obligations.

Foreign investors frequently encounter challenges related to document authentication and translation requirements. All foreign documents must be legalized through Indonesian consular offices and translated by certified translators, a process that can add significant time and cost to registration.

Apostille certification, where available between countries, can streamline the authentication process. However, countries without apostille agreements with Indonesia must complete full consular legalization, involving multiple government offices and potentially extended processing times.

Engaging experienced Indonesian legal counsel early in the process helps identify document requirements and ensures proper preparation. Professional service providers can coordinate translation and authentication services, reducing the risk of delays due to improper documentation.

Despite significant improvements, the OSS system occasionally experiences technical challenges that can impact registration timelines. Common issues include data synchronization problems between different government databases, unclear document requirements, and system notifications that lack specific guidance.

Recent updates have addressed many previous technical issues, including improved integration with the Ministry of Law and Human Rights’ SIMBA system and the tax authority’s databases. However, users should plan for potential technical delays and maintain regular communication with system administrators.

The introduction of real-time monitoring dashboards and improved notification systems under Government Regulation No. 28 of 2025 aims to reduce technical frustrations and provide clearer guidance on application status.

Realistic timeline expectations are crucial for successful registration planning. While low-risk businesses may complete NIB registration within days, PT PMA companies should anticipate 4-8 weeks for complete registration, including all required licenses and permits.

Factors that can extend timelines include incomplete documentation, technical issues with government systems, requests for additional information from reviewing authorities, and coordination challenges between multiple government agencies. Building buffer time into project schedules helps accommodate these potential delays.

Professional service providers with established relationships with government agencies can often expedite processes and resolve issues more efficiently than companies attempting self-registration. The additional cost of professional services often proves worthwhile given the complexity and importance of proper registration.

Obtaining a proper business registration number provides comprehensive legal protection under Indonesian law. Registered companies benefit from limited liability protection, intellectual property rights enforcement, and access to Indonesian court systems for dispute resolution.

The NIB also serves as proof of legal business operations, protecting companies from potential government enforcement actions against unlicensed businesses. Unregistered businesses face significant risks including asset freezing, operational shutdowns, and potential criminal liability for directors.

Market access benefits include eligibility for government tenders, ability to enter into contracts with Indonesian entities, and qualification for various business incentives and support programs. These advantages often justify the investment in proper registration even for businesses considering alternative market entry strategies.

Properly registered companies can sponsor work visas for foreign employees, enabling access to international talent and expertise. This capability is particularly valuable for companies requiring specialized skills or maintaining global operational consistency.

The NIB enables companies to open Indonesian bank accounts, essential for efficient local operations and customer service. Local banking relationships also facilitate currency management, trade finance access, and integration with Indonesian payment systems.

Companies with proper registration can participate in Indonesia’s growing digital economy, including e-commerce platforms, digital payment systems, and government digitalization initiatives. These opportunities represent significant growth potential as Indonesia continues its digital transformation.

Registered foreign investment companies may qualify for various fiscal incentives, including tax holidays, customs duty exemptions, and accelerated depreciation allowances. The updated OSS system under Government Regulation No. 28 of 2025 includes dedicated modules for investment facility applications, streamlining access to these benefits.

Government support programs for registered businesses include export promotion assistance, technology transfer facilitation, and access to industrial estate facilities. These programs represent valuable resources for companies seeking to scale operations or enhance competitive positioning.

The Indonesian government’s commitment to improving the business environment continues through regular regulatory updates and system enhancements, providing registered companies with increasingly efficient operational frameworks.

If you are a foreign entrepreneur who is serious about starting your business in Indonesia, having a local service provider who is heavily involved and supports your operation will be a definite advantage. Contact us for a free consultation today.