There is rapid evolution in the governance, risk, and regulatory (GRC Automation) landscape worldwide. Businesses are under scrutiny from regulators insisting on GRC disclosures and institutional investors who incorporate ESG into their investment criteria.

With this, boards and leadership teams have started acknowledging the need for better governance, risk, and compliance (GRC) strategies to not just counter risk, but ensure business continuity. The past two years’ events have also highlighted the need for better rapid response capability to risk. As per OCEG, a global, non-profit think tank on GRC, 70% of organizations in a recent survey reported experiencing GRC challenges from employees working remotely.

Read More: A Complete Guide To GRC Automation And Enterprise Risk Management

Also, 60% of organizations reported that increased data privacy and cybersecurity regulations drove significant changes to their GRC approach.

Business leaders know that to thrive in an accelerating digital economy, they need to change their approach to GRC. This is to become more resilient, risk-aware, and better-governed enterprises.

Businesses mostly follow a traditional approach when it comes to grc automation. That is, by addressing them as separate silos. For example, each department may have its own risk reporting structure with no contact with other departments within the organization.

However, as risks become more intertwined, the processes used to manage them often contradict each other. This leads to duplication of work, increased costs, and business risk. An Artificial Intelligence (AI)-enabled integrated approach to business GRC Automation is the key to bringing everything together.

Table of Contents

ToggleHow AI is transforming the GRC landscape

With the GRC landscape rapidly evolving, the amount of data collected by organizations is humongous. To convert this data into actionable intelligence, technical teams must first sieve through vast complex sets of structured and unstructured data.

They must separate useful information from ‘white noise’ before analyzing further. While organizations may use automation to process risk assessments, the outcome still needs to be evaluated by risk professionals.

This is not viable in the long run because the data will keep growing as the world becomes more connected, leading to more errors.

Business decisions today span continents, jurisdictions, and customer preferences, yet must be taken in a matter of minutes and even seconds.

Business GRC models must be agile. Technology and processes must evolve to keep up with expanding data sets without getting overwhelmed with volume.

As the fourth industrial revolution unfolds and AI develops at a phenomenal pace, the fifth is already on the horizon.

The advantages of machine learning and AI over manual processes to take in information, analyze it and make calculated decisions are of obvious benefit to the enterprise.

Even now, businesses are looking at AI systems to speed up investment decisions. Having systems that analyze and suggest GRC-related changes is a natural extension of the technology to other areas rather than a monumental leap forward.

AI-enabled systems will collect data from various data streams and sources automatically. These include regulatory and trade bodies’ feeds, social media, news sites, and customer and competitor websites.

It will analyze and compare this data with the organization’s existing data sets and operations. The system will also suggest process or strategic changes.

As technology evolves and machine learning and predictive algorithms improve, the potential margin for error will diminish.

Businesses will be able to manage the entire GRC function with minimal resources. When powered by AI, integrated GRC automation software will provide an overarching framework for companies to work within.

As a result of AI, companies will be able to protect themselves more effectively in compliance, IT security, legal functions, insights, and audits. These integrated programs will foster the collaboration of sharp insights, and intelligence gained both from machine learning and human observations.

When utilizing AI correctly, leadership teams can see the bigger picture, connecting the dots through large data sets that were previously considered near impossible to manage.

Leveraging next-generation technologies like AI and machine learning cut down on manual processes without compromising all the data a business needs.

For example, instead of waiting for a human analyst to interpret and evaluate relationships and trends, AI-enabled GRC solutions could utilize cognitive computing to continuously analyze data points for any changes that could lead to increasing risk or control failures.

Only in the event of any threat to the business objective, the system automatically alerts human analysts to investigation. This way, the leadership team can focus more on strategic tasks while leaving AI to do all the heavy lifting on GRC workflow processes

GRC Automation: 4 Trends for 2023 and Beyond

With the specter of COVID-19 receding, businesses are looking beyond recovery to growth. New opportunities for success abound. But so do new challenges and risks. Chief among them is Russia’s invasion of Ukraine, coupled with the cost-of-living crisis and tightening financial conditions – all of which are projected to slow down global economic growth from an estimated 6% in 2021 to 3.2% in 2022 and 2.7% in 2023.

1. Enterprise Risk Management (ERM) – The New Competitive Advantage

Currently, firms aim to have a more comprehensive understanding of risk through an ERM program in order to be better prepared for upcoming challenges.

ERM is not a new idea, but its use is still in its infancy. Only 39% of businesses say their ERM procedures are systematic, reliable, and repeatable, and they regularly report the biggest risks to the board.

Silos are broken down by a strong ERM program, allowing risks to be discussed more freely at all levels. It gives risk analysis, monitoring, and reporting better structure.

Also, it ties together different risk types, assets, controls, rules, procedures, and business strategies. Equipped with this knowledge, firms can strengthen their competitive advantage by taking bigger risks and seizing more chances rather than just anticipating and avoiding crises.

The risk teams are better equipped to respond to crises when using an integrated ERM solution that gives insight across multiple types of risks.

2. Risk Appetite and Tolerance – The Missing Pieces in Non-Financial Risk Management Programs

Only 33% of firms have stated their risk appetite and tolerance levels “mainly” or “extensively” as part of their strategic planning processes.

This shows that most businesses manage risk exposure haphazardly, without first determining how much risk they can handle, necessitating ongoing reevaluation and goal-setting.

It’s comparable to driving without guardrails or putting the horse before the cart.

Risk tolerance and hunger both assist in limiting risk-taking behavior. They help you express the activities and alterations you’re willing to put up with in order to achieve your strategic goals.

Also, they aid in the definition of organizational thresholds, such as when defensive or offensive actions must be taken and when judgements about changing important organizational strategies must be made.

So, what is a well-honed risk appetite? It strongly aligns with corporate strategy, for starters.

Together with quantitative indicators and exposure limitations, it also contains qualitative statements. Moreover, it adjusts to shifts in conditions, corporate goals, capabilities, and resources.

The more clearly you can express your risk tolerance and appetite, the more you’ll be able to maximize risk-reward outcomes and strategically profit from risks.

3. Business Continuity Management – Responding to Risk Events with Confidence

Certain risk events, such as pandemics, natural disasters, geopolitical turmoil, and societal unrest, are impossible to prevent or minimize.

But we may prepare ourselves more efficiently to deal with them and recover from them. A strong business continuity management (BCM) program is the solution.

After an interruption, BCM enables us to replace, rebuild, and restore crucial business operations.

Effective company resilience requires the use of both ERM and BCM. But while having comparable objectives and working methods, the two are frequently handled separately.

Even when companies are extremely rigorous about risk management, business continuity plans are sometimes only created for emergencies and disasters.

We anticipate better coordination between ERM and BCM in the upcoming year because this misalignment can hinder an organization’s ability to prepare for and respond to risk.

Business continuity teams can identify which potential disruptions can wreak havoc in the business, what would be their impact on the business, and develop appropriate business continuity plans with the aid of integrated enterprise-level risk assessments.

In order to reduce duplication of effort and to describe the impact of a disruption in consistent business terms, ERM and BCM teams benefit from using a unified taxonomy.

Similar to this, business impact analysis (BIA) can offer risk managers insightful information while evaluating and ranking risks.

Together, they can improve your preparedness for risk occurrences, reduce losses, and speed up your return to business following an interruption.

4. Non-Financial Risks – Quantification Is Key

Non-financial risks, often known as NFRs, can do just as much damage as financial risks, from malfeasance and compliance failures to cybersecurity attacks and operational interruptions.

For instance, cybercrime costs the global economy more than $1 trillion annually.

Just the direct financial impact is included here. Organizations must better manage these NFRs due to the potential reputational harm, system downtime, and regulatory penalties that can compound losses.

We are aware that management is based on metrics. Traditional NFR measurement methods, on the other hand, frequently include vague qualitative phrases to represent risks, such as “probably likely to occur” or “somewhat likely to damage the firm.”

While these concepts certainly assist us to some extent, they do not always offer precise solutions to all of our questions.

The best NFR to handle first and why isn’t always obvious from a high-medium-low risk ranking.

Targets

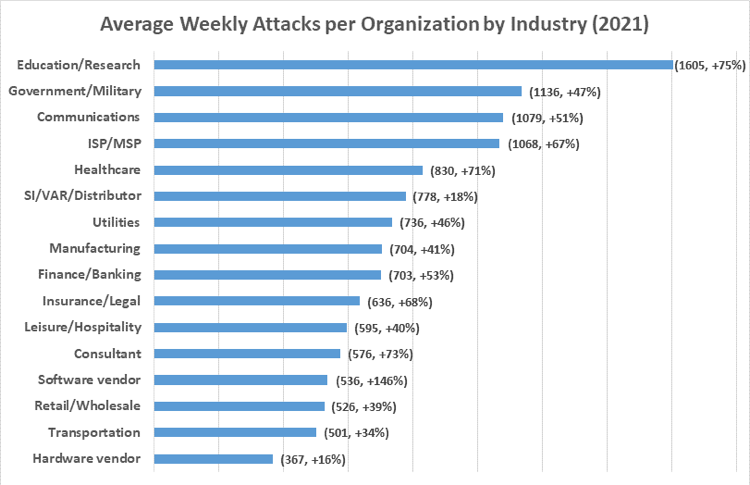

In 2021, education/research was the sector that experienced the highest volume of attacks, with an average of 1,605 attacks per organization every week. This was a 75% increase from 2020.

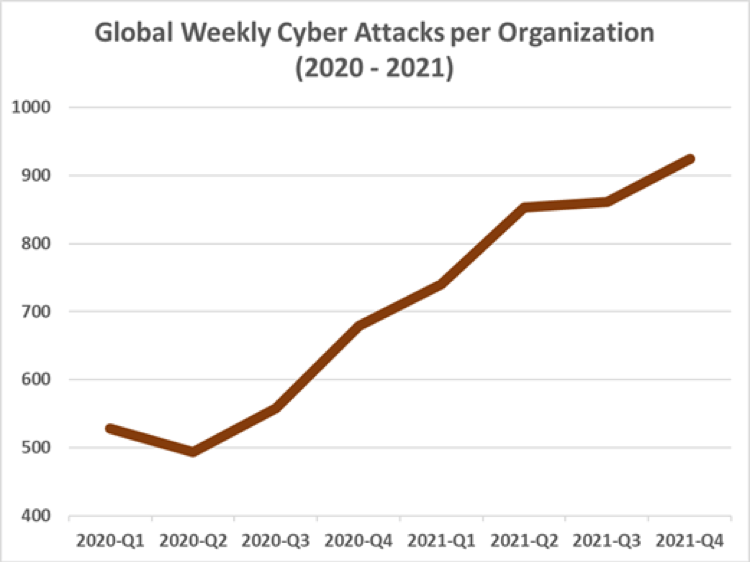

Below are the global weekly cyber-attacks per organization and its predictions.

Source:checkpoint

This was followed by the government/military sector, which had 1,136 attacks per week (47% increase), and the communications industry which had 1,079 attacks weekly per organization (51% increase). And this will increase as new technologies come in the market like ChatGPT.

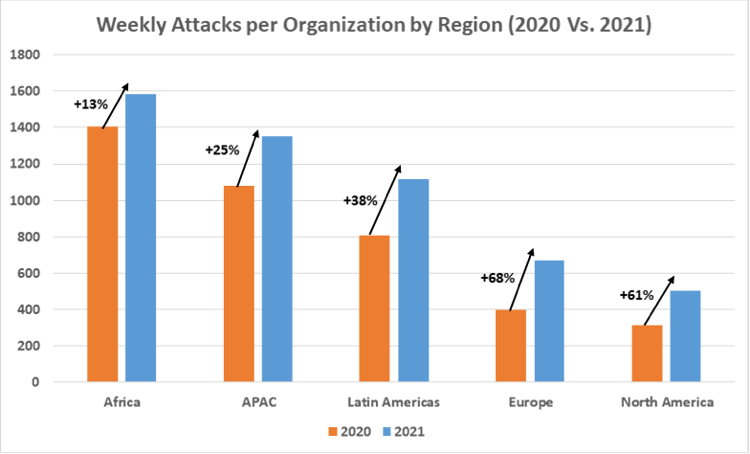

Geo data

Africa experienced the highest volume of attacks in 2021, as can be seen in the visual below, with an average of 1,582 weekly attacks per organization. This represents a 13% increase from 2020.

This was followed by APAC, which has an average of 1,353 weekly attacks per organization (25% increase); Latin America, with 1,118 attacks weekly (38% increase); Europe, with 670 attacks weekly (68% increase); and North America, with an average of 503 weekly attacks per organization (61% increase). Below you can see weekly attacks per organization by region.

You can read more about these serious threats in detail over here.

Expecting the unexpected

The GRC automation landscape is also impacted by unexpected events – like fluctuating exchange rates between the Dollar and the Indian rupee.

Or the new cyber threats that emerge now and then. Businesses are finding it more challenging to plan and have no choice but to allow for wider risk margins.

One can only expect more unpredictable events in the next few years.

As businesses face more pressure to deliver against evolving risks, GRC technology based on AI will evolve to provide a holistic view across the entire enterprise.

Technology will enable businesses to manage uncertainty apart from standard events. Organizations will become better equipped to manage unexpected risks and not be vulnerable to ongoing market changes or industry trends.

Organizations will be able to rely on AI to provide a single process and point of reference for GRC. This will ensure that they are better prepared to face the unexpected.

Read More: GRC Automation

Read More: Cyber Assurance & ISA

Conclusion

In conclusion, AI is becoming a more significant part of GRC automation, presenting firms with both opportunities and risks. Organizations can use AI to enhance their GRC processes and achieve higher efficiency, effectiveness, and compliance by understanding these advantages and difficulties and staying current with developing trends.